Possible SMIC ban another US war against China's tech rise

Possible SMIC ban another US war against China’s tech rise

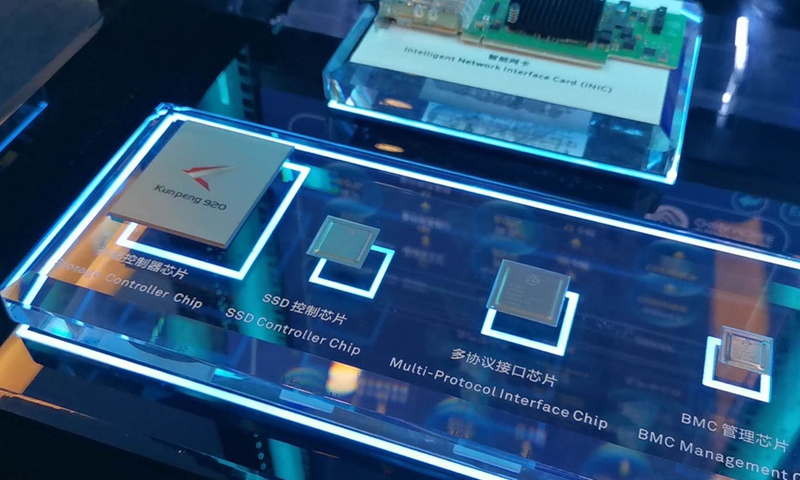

The Kunpeng 920 chip, among other server chips, showcased at Huawei Beijing research center.Photo:CGTN

The US government is apparently seeking to further escalate its tech war against China by reportedly considering adding China's leading chipmaker to a trade blacklist, threatening to further disrupt a massive $300 billion-worth annual chip trade between China and other countries, including the US, whose companies sold about $70 billion worth of chips to China in 2019 alone.

Building on a series of restrictions on chip supplies to Chinese telecom giant Huawei that already has the global semiconductor industry on edge over potential profound ramifications, reports of the US considering to add China's SMIC on its Entity List also sent chilling waves across the industry over the weekend, as many players from the US, Europe and elsewhere are likely to be impacted, industry experts said on Sunday.

The reported move, which is likely aimed at putting a stranglehold on China's semiconductor industry - a crucial sector for the development of almost all advanced technologies such as 5G, could bring serious challenges to Chinese companies and push China to accelerate investment and development in its domestic industry, which lags behind in many areas but is also on a rapid rise, analysts noted.

Escalating war

Citing an official from the US Department of Defense, several media outlets reported on Saturday that the US government was considering adding SMIC to its entity list, which would require US suppliers to obtain licenses before selling products to the Chinese firm.

The US official did not provide any reason behind the move, but some officials have indicated that the company's ties with the Chinese military were under scrutiny, according to Reuters.

In a statement on Saturday night, SMIC said it was "in complete shock" over the media reports and pushed back against accusations of ties with the Chinese military. "The Company manufactures semiconductors and provides services solely for civilian and commercial end-users and end-uses. We have no relationship with the Chinese military," the statement said.

Chinese experts criticized that the US does not have or needs any concrete ground to target SMIC and it was just the latest escalation in the US' ill-intentioned tech war to contain China's rapid rise in the realm of technology. Using the tech war, the US has already sanctioned about 300 Chinese companies on various vague and elusive reasons regarding national security and human rights, among others.

"The semiconductor sector is currently the biggest focus of the US tech war on China, because there are no other areas where the US can put a stranglehold on China as in chips," Fang Xingdong, founder of Beijing-based technology think tank ChinaLabs, told the Global Times on Sunday.

Before the reported move on SMIC, the US government had already moved to essentially cut off foreign chip supplies to Huawei, with the latest expanded ban expected to go into effect on September 15.

SMIC, which is also a supplier to Huawei, had reportedly indicated that it would observe the US ban and stop chip supplies to Huawei, drawing backlash from some among the Chinese public who criticized the firm for abiding by "unreasonable US rules." It was unclear how and if the US move will change SMIC's stance. SMIC is also being criticized by some on Chinese social media for not standing up to the US crackdown more fiercely, after its statement on Saturday noted that it was open to communicate with the US government to address "misunderstandings."

Xiang Ligang, a Beijing-based independent telecom analyst, said that a potential US ban on SMIC could actually push the two Chinese firms to work jointly on chips.

"With the blacklist, I think SMIC can now openly work with Huawei. And if these two companies can work together, they will come up with something, though some time might be needed," Xiang told the Global Times on Sunday.

Chinese officials have repeatedly criticized what they call politically-motivated US crackdowns on Chinese companies and have vowed to take necessary countermeasures. Officials have also said that they are working on an "Unreliable Entity List" as a move in response to the US' Entity List. However, that list has not been released and it appears that the country is taking a long-term approach that seeks to boost the domestic semiconductor industry to cut reliance on foreign supplies, experts noted.

SMIC Photo: Xinhua

"There is no other way around it. We just need to build up our own industry and technologies," Fang said.

In the wake of the US' escalating tech war against China that has formed sobering realizations among Chinese officials and industry leaders that the country cannot completely count on foreign supplies for such a critical component, China has already rolled out a flurry of policies and plans to focus on boosting the domestic industry.

In July, the State Council, China's cabinet, issued supportive policies for the integrate circuit and software sector, including massive tax cuts, financial and other supports to help companies develop technologies and attract talent.

The development of a third-generation semiconductor sector will reportedly also be included in the upcoming 14th Five-Year Plan, which will guide China's economic and social policies in the five years through to 2025.

Meanwhile, Chinese officials continue to push forward opening up and global cooperation in advanced technology, in stark contrast to the US' isolation.

"There is no doubt that blacklisting SMIC will deal some blows to the company as well as China's semiconductor industry, but I don't think it's the end of world for the domestic sector. There are areas where we are lagging behind, but there are also areas where we are picking up fast. Given the time, the industry will come up with something," Xiang said.

Global disruption

While the US move is aimed at cracking down on the Chinese company as well as the industry, the potential damage and disruption it will bring will be global, as SMIC works closely with companies around the world, including in the US, experts noted, adding the massive chip trade between China and other countries could be at risk.

A potential SMIC blacklist could directly impact the Chinese company's suppliers, including US firms Lam Research, KLA Corp and Applied Materials, according to experts and media reports. Amid US sanctions, shares of some of those firms have dropped sharply recently. Lam Research's shares have lost 11.83 percent between August 6 and Friday, while KLA Corp's stock dropped 5.02 percent during the period.

"I honestly don't understand the US. It aims to contain China's technology rise, but barring its companies from such a market actually works toward the opposite of what it intends to - retreating from such a huge market is not helping the US in any way," Xiang said.

China is one of the world's biggest importers of chips, with annual import value expected to remain above $300 billion for a third consecutive year in 2020, Wei Shaojun, vice chairman of the China Semiconductor Industry Association, said in a recent forum, noting that China contributes to "the vast majority" of global growth in the semiconductor sector.

Apart from US suppliers, SMIC, which is valued at 250 billion yuan and saw its revenue hitting a record 13.16 billion yuan in the first half of 2020, also has suppliers and partners in Europe and Asia.

The US' increasing bans will also push these global players to find alternatives to avoid US sanctions while continuing doing business with Chinese companies, which in turn could chip away at the US' dominance in the global industry chain, said Jiang Junmu, chief writer at telecom industry news website c114.com.cn.

"With the US doing all this, other countries will also be fearful and might want to develop their own industry chain. That would make it hard for the US to wield its leadership in the global supply chain," Jiang told the Global Times on Sunday.