SOURCE / MARKETS

China poised to build unified national trading system

Carbon exchange boosts green business

Shanghai carbon-market emissions trading scheme pilot launches trial at the Shanghai Environment and Energy Exchange on November 26, 2013. Around 191 companies from industries including steel, chemical production, service and aviation took part in the trials between 2013 to 2015. File photo: Xinhua

With a handful of pilot carbon markets beginning to take shape, China is poised to build a unified national market for emissions trading, a pivotal step in reaching the nation's carbon-neutral goal before 2060.

Throughout the evolution toward a national carbon market, local trading exchanges are aiming to strengthen their global influence boosting the economic transition toward greener growth while businesses participating in emission trading are hoping for the inclusion of more portfolios into emissions trading, according to interviews with multiple carbon trading participants conducted by the Global Times.

Draft rules for national carbon emissions trading management were unveiled in early November, calling for public comment. The final version will be published in the near future, Liu Youbin, a spokesman for the Ministry of Ecology and Environment (MEE), told a media briefing at the end of November.

Nine years after the approval of pilot carbon trading systems in seven designated areas, carbon trading is set to become normalized.

Carbon trading enables the purchase and sale of permits and credits of carbon dioxide emissions, aiding efforts to slow climate change.

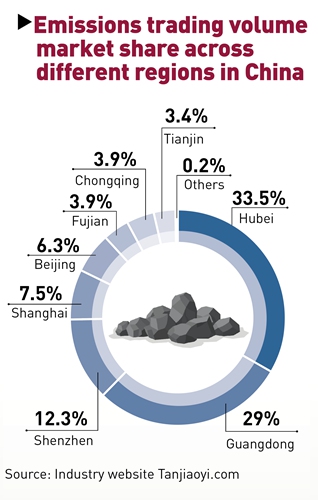

The nation's first pilot carbon trading program was launched in Shenzhen in June 2013. Thereafter, the experimental trading schemes were rolled out in six other designated areas - Beijing, Tianjin, Shanghai, Guangdong, Hubei and Chongqing. Fujian also launched its emissions trading system in 2016.

As of August, the pilot trading systems have covered nearly 3,000 major industrial emitters, with cumulative trade totaling 406 million tons of carbon-dioxide with the equivalent greenhouse gas and transaction cost amounting to 9.28 billion yuan ($1.41 billion) in turnover, Li Gao, head of the climate change department at the MEE, disclosed in October.

The trial of emissions in Shanghai is arguably among the most high-profile. Since its launch in November 2013, the city's secondary spot goods carbon trading has totaled 151 million tons with cumulative transactions hitting 1.72 billion yuan, Lai Xiaoming, chairman of Shanghai Environment and Energy Exchange Corporation, the operator of the Shanghai carbon emissions trading exchange, told the Global Times.

Among them, the cumulative trade of China Certified Emission Reductions (CCER) reached approximately 108 million tons with accumulative transactions totaling 745 million yuan. The Shanghai market accounts for 40 percent of the country's total carbon trading when measured by CCER trading volume.

Nearly 310 major emitters from 27 industrial and non-industrial sectors including steel, electricity, chemical, aviation and commercial hotel are currently included in the local emissions trading system, or about half of the city's entire carbon emissions.

Largest carbon trading hub

The forthcoming 14th Five-Year Plan (2021-25) underpins China's landmark carbon market push. As the chairman of the Shanghai market operator put it, the local exchange will be built into a carbon trading hub with global reach.

The national carbon market, when up and running, will cover more than 2,000 firms in the power generation sector across the country and involve tradable quotas of about 4 billion tons, higher than the combined quotas in the EU - 2.8 billon tons, according to Lai, the national carbon market will be the world's largest by quota size and Shanghai is slated to become the largest carbon spot goods trading hub in the world.

Global emissions trading turnover reached a record high of $214 billion in 2019, Reuters reported in January. Trading levels increased 34 percent year-on-year and marked the third year in a row of growth.

The EU's Emissions Trading System is currently the world's No.1 carbon market, representing roughly 80 percent of trading volumes.

Corporate participants in the would-be global carbon trading hub have over the years benefited tremendously from the system and are looking to the availability of more innovative and effective emissions trading as a means to become greener businesses.

Sinopec Shanghai Petrochemical Company Limited, a subsidiary of Chinese oil refining giant Sinopec, is an active participating firm in the local carbon market. The company has actively implemented energy-saving measures, which has resulted in sales of surplus emissions credits and swapping of the quotas, a company spokesperson told the Global Times, noting that its participation injects liquidity into the carbon market, maintains and increases the value of the company's carbon assets.

Carbon trading is an important green financing vehicle allowing for the company to commit to energy-saving and emissions projects. Between 2017 and 2019, the company saw a continued decline in energy consumption per unit of output.

Another example is Shenergy Carbon Technology, the carbon asset management and carbon finance arm created in 2018 by Shenergy Group, a major natural gas supplier and power generator in Shanghai.

Local carbon trading exchange has played a significant role in carving out a domestic approach to carbon trading, a company spokesperson said, revealing that Shenergy Carbon Technology is now working with the local exchange and commercial banks to consider using Shanghai emission allowance for pledge financing in addition to exploring the feasibility of carbon emissions rights as a pledge option for credit enhancement.