A fully automated wharf at the Qingdao Port in the Free Trade Zone (FTZ) in East China's Shandong Province is bustling. The FTZ, open for one year, focuses on the development of modern trade, logistics, finance and advanced manufacturing. Over the past year, more than 5,000 enterprises have been established there, with investment of more than 60 billion yuan ($9.13 billion). Photo: cnsphoto

China's actual use of foreign capital hit 98.7 billion yuan ($14.38 billion) in November, up 5.5 percent year-on-year, maintaining steady growth for an eighth consecutive month, the Ministry of Commerce (MOFCOM) said on Tuesday.

From January to November, the actual use of foreign capital reached 899 billion yuan, up 6.3 percent year-on-year, according to an official from the Foreign Investment Department of the MOFCOM.

The actual use of foreign capital in the services industry hit 704 billion yuan from January to November, up 16.1 percent year-on-year, accounting for 78.3 percent of the total. The utilization of foreign capital in the high-tech services industry was up 31.6 percent year-on-year.

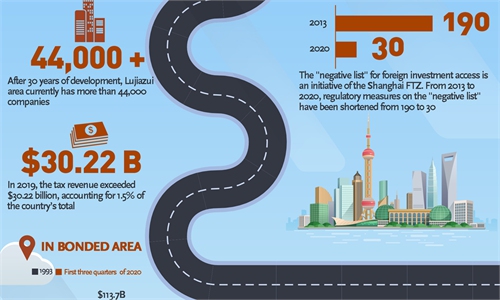

A reflection of China's reform and opening-up drive, pilot free trade zones (FTZs) have played an increasingly important role in facilitating foreign trade and investment.

In 2019, 18 FTZs handled 4.6 trillion yuan in trade. They utilized 143.55 billion yuan of foreign capital in 2019, led by the FTZs in Shanghai and South China's Guangdong Province, according to a report released by Chinese Academy of International Trade and Economic Cooperation on Monday.

Between the establishment of the China (Shanghai) Pilot Free Trade Zone in 2013 and the end of 2019, 18 FTZs were set up. The negative list of the FTZs has been reduced by more than 80 percent in the past six years, according to data from the ministry.

Global Times