COMMENTS / COLUMNISTS

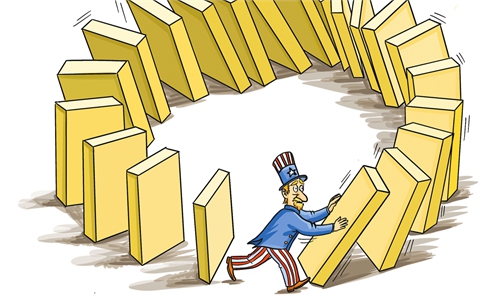

US economy to teeter on virus fight, federal stimulus, dollar stability

Illustration: Chen Xia/GT

Celebrating one of the darkest Christmases in recent memory, shrouded in a murky presidential power transition and the elevating deaths and hospitalizations caused by COVID-19's onslaught, Americans are somber about a future which remains uncertain despite the growing availability of the vaccines.Millions of jobless Americans continue to struggle to make ends meet by tapping into their dwindling saving accounts and many are now desperate for new hand-outs from the second-round $900 billion coronavirus stimulus bill.

Although a good number of economists and financial market analysts are projecting a rosy picture of the US economy in 2021, with some forecasting a real GDP growth of more than 5.5 percent, the dormant economy is unlikely to improve in the first 4-5 months of the new year, if the outgoing Trump administration refuses to provide a smooth transition for Biden and Harris, and American politicians on Capitol Hill refuse to stop partisan posturing and instead focus on containing the virus and its new mutations, and cooperate on rescuing a broken economy.

Based on calculations of broad metrics, the world's largest economy, which is forecasted to contract some 4 percent this year, will likely pose a moderate growth rate of around 3.5 percent in 2021, primarily relying on an estimated boost in the second half of the year. The unemployment rate is expected to hover at approximately 5.5 percent by the end of 2021.

The first quarter looks increasingly bleak, and some American economists are fearing a "double-dip" contraction for the first three months of 2021, as US restaurants, pubs, hotels, travel services, theaters, schools and sports leagues are confronting a new wave of cancellations and closures as rising cases overwhelm hospital ICU wards across the nation.

The new surge in COVID-19 cases and the renewal of restrictions ordered by governors in many states is almost certain to produce lingering negative effects on economic growth in 2021. The economy had appeared to be on a downward trajectory, with poor retail sales and rising claims for unemployment benefits recently reported. At the same time, there comes an increasing risk of financial disruption down the road stemming from the growing overvaluation of assets and ever-mounting US debt levels, caused by tranches of federal stimulus programs.

Widespread inoculations will not be completed before summer, and the so-called "herd immunity" will be unlikely to come into force in the US to quash the spread of the virus before August or September. Facing the next winter and possible new variants of the coronavirus - as Britain and South Africa are now encountering - the US cannot rest assured that the economy will rapidly rebound by itself.

Buoyed by the Federal Reserve's ultra-loose policy of nearly zero interest rates, which the central bank promised to execute through 2022, and the government's two-tranche fiscal stimulus of more than $3.2 trillion, many medium and small-size American businesses are facing a sudden exhaustion of funding or eviction from rented offices. They survived the coronavirus battering on federal bail-outs, with many reducing payroll or furloughing their workers.

However, financial risks continue to arise, with the Federal Reserve continuing to purchase large sums of government bonds and securities assets to ensure capital liquidity on the market, which has caused an exuberance of the US stock market lately.

Meanwhile, US federal debts are soaring toward $29-30 trillion in total, following the government's numerous stimulus hand-outs since March, and the Trump administration's generous tax-cutting legislation in 2017 that, disproportionately, favors the upper middle class and especially rich families.

The risk is developing as US market bubbles are aggravating and cascading one another. Whether one of them will break and trigger another implosion of the US financial system and cause a global economic downturn, as the world saw in the 2008-09 US financial crisis, is still unknown.

It is up to the incoming Biden administration to review all the hidden risks embedded within the US financial system. His government urgently needs to overhaul Trump's tax-reduction law and raise taxes on big companies and the American rich, while cutting sky-high US defense spending and diverting funds to support medical care, education, and pension welfare for the vast American poor. The US congressional fight is set to get fiercer, if not bloodier.

It is too early to talk about a great economic comeback. The COVID-19 health crisis will continue to pose considerable challenges to the economic outlook in the medium term. If the economy deteriorates, the Biden administration will be required to mete out further fiscal stimuli by raising US national debts, and the Federal Open Market Committee will be asked to buy more securities to prop up the monetary market. This will inevitably accelerate pressure on the US dollar.

Whether the dollar's global reserve status can bankroll another economic boom, following a devastating health crisis and recession, is yet to be tested. China, holding more than $1 trillion in US Treasury bonds, will be poring over each US government policy response, carefully. If Trump's overly discriminative trade and technology war is not stopped, China has no reason not to dump the increasingly invaluable bills.

The author is an editor with the Global Times. bizopinion@globaltimes.com.cn