A shipment containing boxes of China's Sinovac COVID-19 vaccine arrives at Esenboga Airport in Ankara, Turkey, Dec. 30, 2020. The first batch of 3 million doses of China's SinoVac COVID-19 vaccine arrived in the Turkish capital Ankara early Wednesday. Mass vaccination will start following 14 days of tests, Turkish Health Minister Fahrettin Koca tweeted Wednesday. (Photo by Mustafa Kaya/Xinhua)

The Chinese vaccine industry is entering a golden development period as China's COVID-19 vaccines become increasingly popular in the international market, an industry association president told media.

As of January 15,

at least 20 countries have purchased COVID-19 vaccines developed by Chinese manufacturers including Sinovac, Sinopharm and Cansino, according to the Global Times' calculations, with more planning to purchase Chinese vaccines despite politicalized scrutiny by some Western media over their efficacy and safety.

The popularity of China's COVID-19 vaccines in the international market has encouraged Chinese vaccine producers to step out and create new spaces for their vaccines in the international market, Feng Duojia, president of the China Vaccine Industry Association, was quoted as saying in a report by the Economic Daily on Tuesday.

Feng noted that Chinese vaccines are stepping out into the world on a larger scale and greater speed.

"Demand for Chinese vaccines has exceeded supply. Any vaccine will be a global public good once approved, so it is a golden development period for all Chinese vaccine producers involved in COVID-19 research and development," Feng said.

According to Chinese authorities, a total of 18 domestic plants are now working

to maximize their production capacity. Of those plants, leading producers such as Sinopharm's subsidiary China National Biotec Group (CNBG) had said it expects to reach a production capacity of one billion doses of the inactivated COVID-19 vaccine in 2021. Sinovac Life Sciences Co. will also be able to produce one billion doses per year after completing the second-stage of its production line.

"The international market has very high quality standards. Before the COVID-19 pandemic, there were only four Chinese vaccine companies that had obtained quality approval for their products to get onto the international market," Feng said, noting that Chinese COVID-19 vaccine producers have fully taken into account the domestic and overseas demand from the very beginning to ensure their COVID-19 vaccines meet the quality requirements of the international market.

In the future, Chinese companies should enhance their sense of serving global public health, implement international standards, strictly guarantee the quality of products and expand capacity while controlling costs, Feng noted.

Related authorities are also laying out a development plan for the Chinese vaccine industry during the 14th Five-Year Plan period to enhance cooperation between different companies and prevent insufficient or excess production capacity, according to Feng.

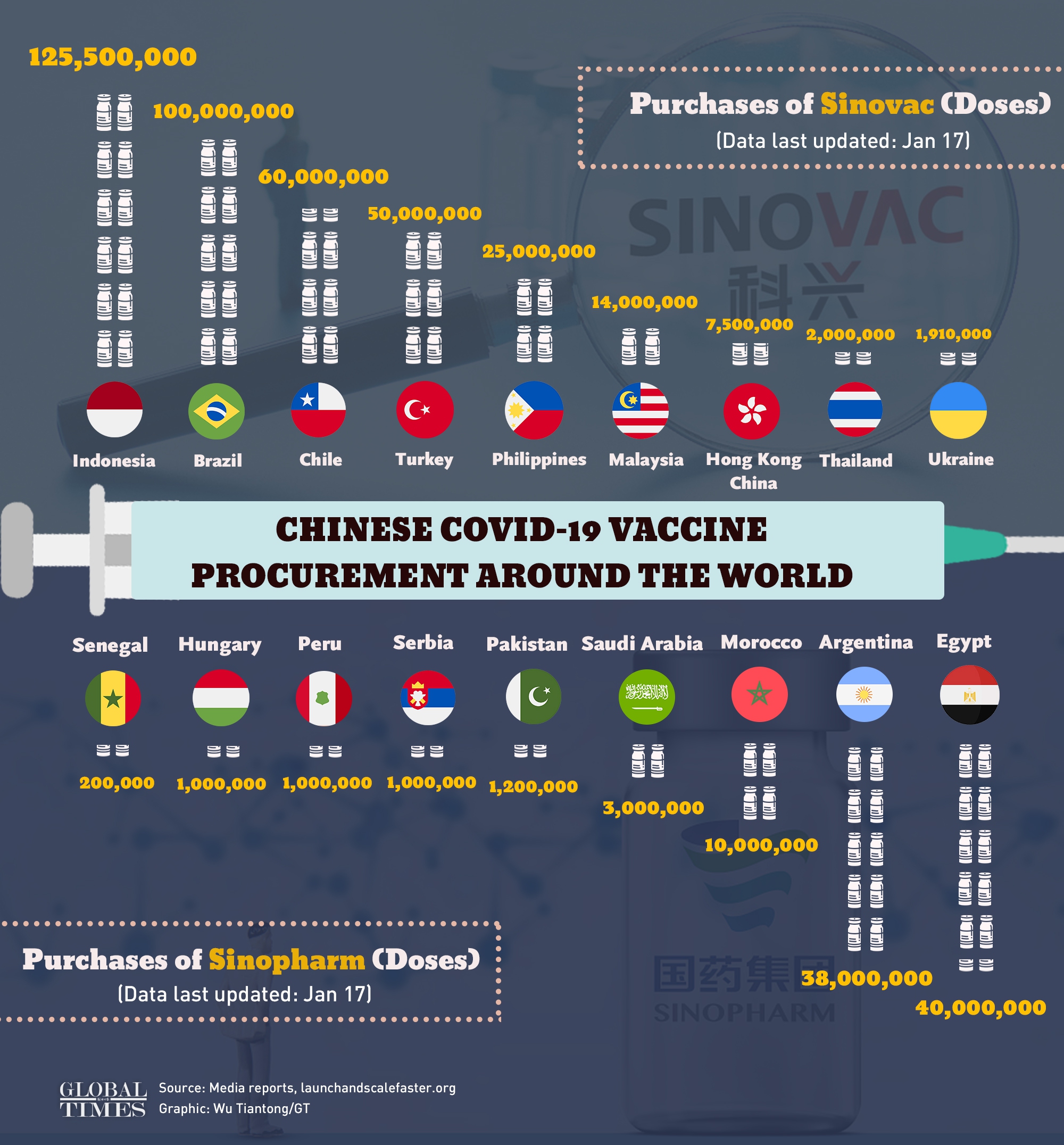

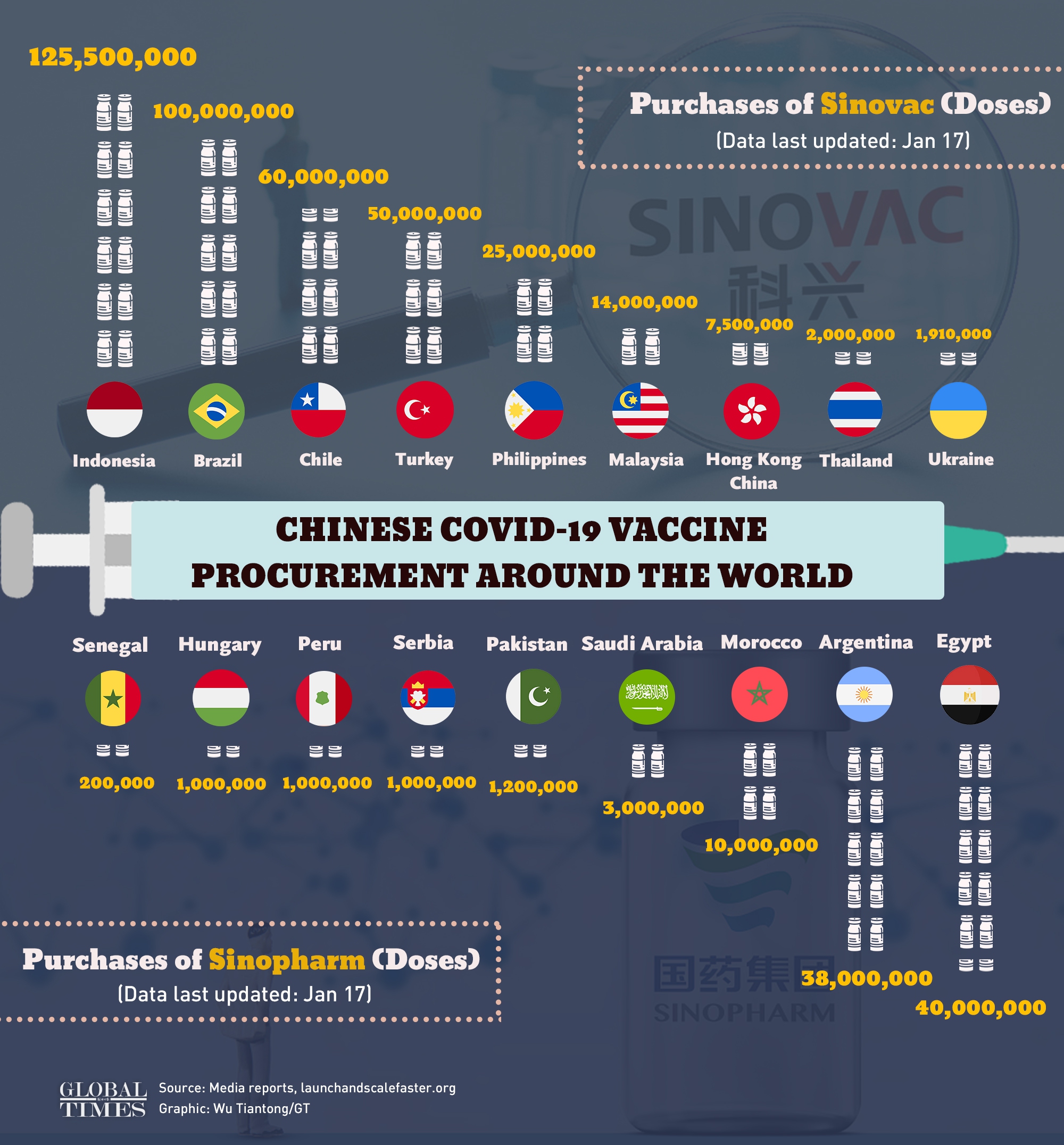

Chinese COVID-19 vaccine procurement around the world Infographic: GT

The Chinese vaccine market scale was estimated to be only 42.5 billion yuan ($6.5 billion) in 2019, accounting for 20 percent of the global $32.6 billion market in the same year, according to a report from the Qianzhan Industry Research Institute released in July 2020.

Previously, three major factors hindered the development of the Chinese vaccine industry: lack of an industry development plan, weak technical innovation ability compared to developed countries, and lack of independent supply and supply support capacity in some parts of the industrial chain, according to Feng.

Despite their development in the past century, Chinese vaccine companies still relied on imports of some equipment and raw materials, Feng explained.

Previously, companies were independent along the entire production chain, from vaccine research and development to production, marketing and delivery.

Now, however, the Chinese vaccine industry is becoming increasingly professional and more small and medium-scale companies are emerging along with growing policy support, Feng said.

Global Times