China's medical suppliers break records in 2020

Unprecedented levels of investment, and revenue built

A worker checks the quality of ordered masks at a mask factory in Huaibei, East China's Anhui Province, April 17, 2020. Photo: cnsphoto

While embracing opportunities for domestic industry participants to gain more world recognition and market share, the trend also pushed them to invest unprecedented levels in production capacity and research and development as well as build a complete supply chain against the backdrop of rocketing global demand.

Positive trend

Winner Medical, a leading mask producer based in South China's Guangdong Province, the manufacturing hub for Chinese goods abroad, said recently in a statement that its revenue in 2020 is expected to reach between 11.5 billion yuan ($1.77 billion) and 13.5 billion yuan, up 151 to 195 percent year-on-year, a significant increase compared to 4.47 billion yuan in 2019.

The company contributed the growth to its rapid response to the explosion of demand for personal protective equipment including masks and protective clothing via online and offline channels across the world.

Meanwhile, the company's independently-developed non-woven raw materials which are widely used in protective clothing, masks and other preventative products also contributed to its unprecedented business performance last year, especially when mask-making materials were in short supply.

One of the most prominent performers in the industry for medical preventive goods is INTCO Medical. On Jan 11, the face mask company's share price hit a new high, breaking the 200-yuan mark for the first time, and its total market value also exceeded 80 billion yuan.

On a range basis, INTCO Medical's stock price has risen over 20-fold since its launch around December 2019.

Kaiyuan Securities forecasted that the company is expected to become the world's largest supplier of PVC gloves as early as this year.

Behind the stock growth is company's effort for completing the supply chain. Since 2020, INTCO Medical has expanded production several times and expanded into upstream projects in a bid to reduce manufacturing costs, according to Kaiyuan Securities.

Despite booming orders, the biggest profits for medical materials lay in the hands of the international middle men and agents instead of domestic producers whose actual profits are often very small - less than 10 percent - Chen Hongyan, an industry insider told the Global Times.

While a KN95 masks usually costs about 128 yuan in the US, the price is less than 20 yuan in China, a mask producer in East China's Anhui Province, told the Global Times.

"One main reason behind the big price gap is that Chinese factories are more likely to treat mask productions as a public service and do not want to make huge profits from it," the producer said.

The positive annual reports echoed Chinese medical producers' ceaseless efforts to combat the global epidemic.

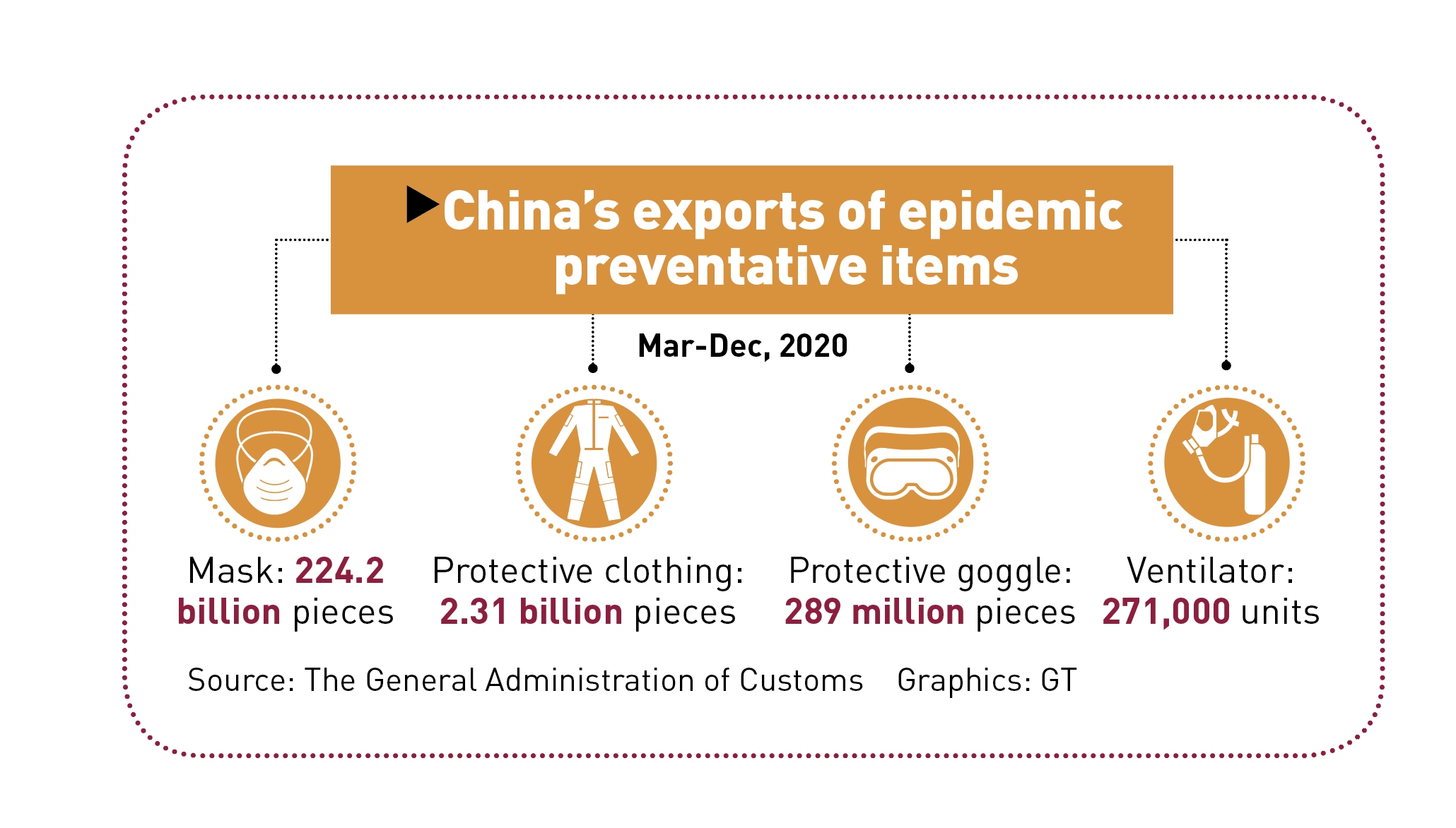

Statistics showed that from March to the end of 2020, China's customs inspected and exported 438.5 billion yuan worth of major epidemic prevention and control materials. Among them, there were 224.2 billion masks with a value of 340 billion yuan, equivalent to providing nearly 40 masks for every person abroad.

In addition to masks and clothing, domestically-produced novel coronavirus vaccines have also been gaining recognition and attention overseas for high quality, reasonable price and high levels of efficiency.

Leaders from six countries have took the lead in receiving the vaccines and more than 20 countries signed orders for over 500 million doses of vaccine so far, per media reports, another strong reflection of China's contribution to the global epidemic prevention in the post-epidemic era.

Graphics: GT

Sustainable business

Given the normalization of epidemic prevention and control and the growing competitiveness within the industry, the growth of the domestic medical industry will continue in 2021, but it will develop in a more sustainable and targeted way, especially in the low-value mask-making field, experts said.

As of mid-December, last year, there were 311,000 mask-related enterprises in China, of which 293,000 were in operation or existing, data from market information online platform Qichacha showed. In 2020, there were 163,000 face-mask related companies registered, accounting for more than 50 percent of the historical total. In other words, there have been more registrations in 2020 than units all previous years combined.

Massive factory closures loom despite the demand for masks around the world remaining strong.

The production capacity of mask makers in China is able to cover 10 times what the world needs, said Bai Yu, president of the Medical Appliances Branch of the China Medical Pharmaceutical Material Association, who expressed concerns that the oversupply of masks in China will lead to bankruptcies, which have already taken place in several parts of the country.

"Many players who were not producing preventative items have also stepped into the field, but as the industry is becoming increasingly competitive and the demand is changing from exponential growth to a more sustainable track, the market will be restructured and only those professional producers that can always adapt to the changes may survive," said Chen.