Traffic jams in North China’s Hebei Province may lead to higher prices

Traffic jams in 'Steel Belt' may lead to higher prices

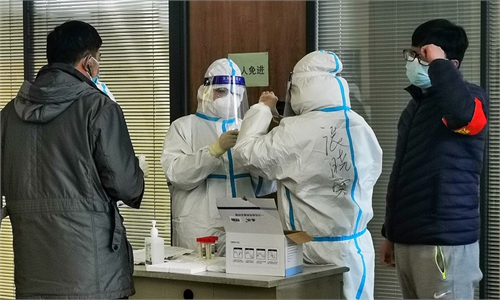

Workers work at the construction site of a centralized medical observation center in Shijiazhuang, capital of north China's Hebei Province, Jan. 16, 2021. (Xinhua/Jin Liangkuai)

China's top steel-producing province is witnessing a jam in the transportation of the vital industrial material - a collateral damage of the COVID-19 winter outbreak - with trucks backed up for some 30 kilometers along the highway, and steel prices may spike as a result, analysts told the Global Times on Tuesday.

North China's Hebei Province's steel production stood at 284 million tons in 2019, according to industry data. However, the outbreaks of COVID-19 in Hebei have disrupted the industry. As of Monday, the cumulative number of local confirmed COVID-19 cases reported in the province stood at 1,156, local health authorities said on Tuesday.

Several steel enterprises reached by Global Times said that the industry is dealing with increasing transport disruptions.

An employee surnamed Wang of Jingye Group, a steelmaking company in Xingtai, Hebei that has been locked down, told the Global Times that staff are being required to work from home. She said traffic controls are hampering the shipment of finished steel products such as rebar and sheets, but the company is striving to resolve these issues.

A manager surnamed Wang with Xingtai-based Delong Steel told the Global Times that only a few truck drivers are still working, and the company has cut daily production by 70 percent.

"Our drivers also reported that many toll stations at provincial borders were closed, such as toll stations at multiple points between Hebei and East China's Shandong Province," said Wang.

Local governments have issued passes for trucks carrying industrial goods, but there aren't enough of those passes, especially compared with trucks carrying daily necessities.

Drivers' documents are also an issue. Han Yizheng, vice president of Tangshan Shenying Group, told the Global Times that drivers must show negative nucleic acid tests taken within 72 hours, and they must pass several checkpoints between the factory and the Port of Tianjin, from which steel products are shipped to other provinces in China.

"Due to the complex checks, I've heard there are trucks backed up for about 30 kilometers on the highway," said Han.

"There will be a partial impact on the steel market," Wang Guoqing, research director at the Beijing Lange Steel Information Research Center, told the Global Times on Tuesday.

"Increased shipping costs from ports to steel mills will mean higher production costs. But steel products face a price cut if they arrive at ports too late because of road delays."

The steelmaking cluster around Shijiazhuang has an output of 25 million tons a year, while the area around Tangshan produces about 90 million tons, according to Wang.