COMMENTS / EXPERT ASSESSMENT

US economy remains in pandemic’s grip, to end flat in 2021

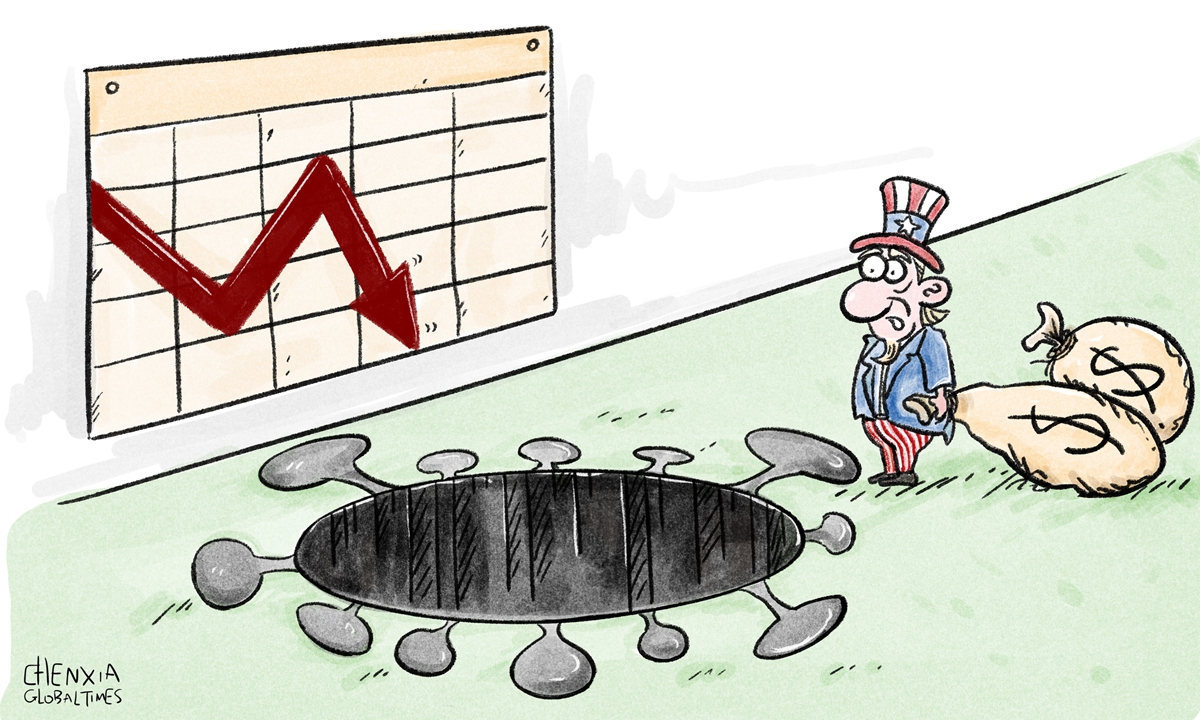

Illustration: Chen Xia/GT

Despite an unprecedentedly large scale fiscal and monetary stimulus, the US economy tanked 3.5 percent in 2020, registering the worst year since the 1940s. If the Biden administration cannot bring the disastrous coronavirus pandemic under firm control as soon as possible, the world's largest economy may end this year flat, with an unemployment rate as elevated as 6-7 percent.To pump up a still slumping economy, Biden's reinforcing fiscal remedy plan of $1.9 trillion, which is fiercely debated among Capitol lawmakers, is rendered as indispensable, although that magnitude of government spending will drive US federal debts to a historical high.

With the country's national debts skyrocketing to nearly 140 percent of its GDP, and vast swaths of the global economy still reeling under the public health crisis, it is also warranted for American deficit hawks to ask the White House to tighten the belt by enforcing some austerity programs.

At the current stage, it is premature to forecast a rapid recovery in 2021, as the US still faces grave challenges and volatilities. Right now, the economy remains in the grip of the COVID-19 pandemic. The Biden government is expected to do all in its capacity to speed up vaccine production and inoculation, but many other countries in the world are unlikely to get all their citizens vaccinated before the year-end. The risk therefore lingers that the virus will be carried to the US from abroad, again.

To make matters worse, the emergence of new mutant variants from South Africa, Britain and the Brazilian Amazon River valley has heightened the possibility that the current vaccines might not be effective to stifle the virus. No one can be certain that in a year's time, the virus will be categorically wiped out in the US.

Some organizations have estimated that the American economy will grow by 4-5 percent this year. However, taking the last quarter of 2020 for reference - which saw US real GDP drop 0.5 percent from the same quarter a year earlier - the first three months of 2021 is unlikely to be any better than 12 months ago. If the US could manage to avert a "double dip" recession or attain 1 percent real growth in the first quarter, it will be quite a feat.

Consumer expenditure, which accounts for 70 percent of US economic output, slowed to a 2.5 percent seasonally adjusted annual rate in the October-December quarter, down from a 41 percent revival in the fall quarter.

As the winter months reactivated the virus and the country witnessed an average of 170,000 daily infections, with US hospital ICUs running at full capacity, American consumers pulled back from shopping. But thanks to the $900 billion relief package which US Congress approved late last year, some economists are forecasting GDP may yet see some modest growth.

Jerome Powell, chairman of US Federal Reserve, has promised to maintain the extraordinary monetary policies now in place, and, Janet Yellen, the new US Secretary of Treasury, reaffirmed that the government's fiscal support will not be upended this year.

Claiming that US business activity has softened with the resurgence in infections, the US central bank last week left its key overnight interest rate near zero, and said it will continue to purchase monthly $120 billion bonds to ensure financial market liquidity.

Although the enormous supportive measures may buoy up the economy for the time being, the outlook for a full economic rebound from the COVID-19-induced contraction is uncertain.

To add to this, the measures are not risk-proof. Like lifting a sluice during monsoon season, the flooding of money supplies by the central bank will cause broader commodity price rises, and highly inflated asset prices too as US stock markets are thrust to over exuberance, with many shares now soaring to unsustainable levels.

Acknowledging the risks, the Federal Reserve stated that it will implement some "stress tests" and use other macro-prudence tools to address the financial stability risks. Whether the risks are already oversized is unknown.

Power admitted the limit of his monetary tools. "You cannot adapt motels, movie theaters, sports venues, restaurants, bars to function" during a pandemic. "You are just going to have to defeat the pandemic," he said last week in a high-note monetary policy address. Above all, the Biden administration urgently needs to step up efforts to accelerate widespread vaccinations so that the majority of Americans can have immunity to the contagious disease.

There is another exacerbating problem facing the US policy-makers - rising poverty rates brought about by the pandemic. The University of Chicago last week said overall US poverty rose by 2.4 percentage points to reach 11.8 percent at the end of 2020. The so-called K-shaped recovery, where lower-paid service sector workers are losing out to those white-collars working from home during the virus onslaught, is only set to make the poor's predicament even harder.

The Biden administration has promised to build up a more equitable society by narrowing the income gap between the haves and have-nots. The gravity on his shoulders will not ease up in the short to medium term.

The author is an editor with the Global Times. bizopinion@globaltimes.com.cn