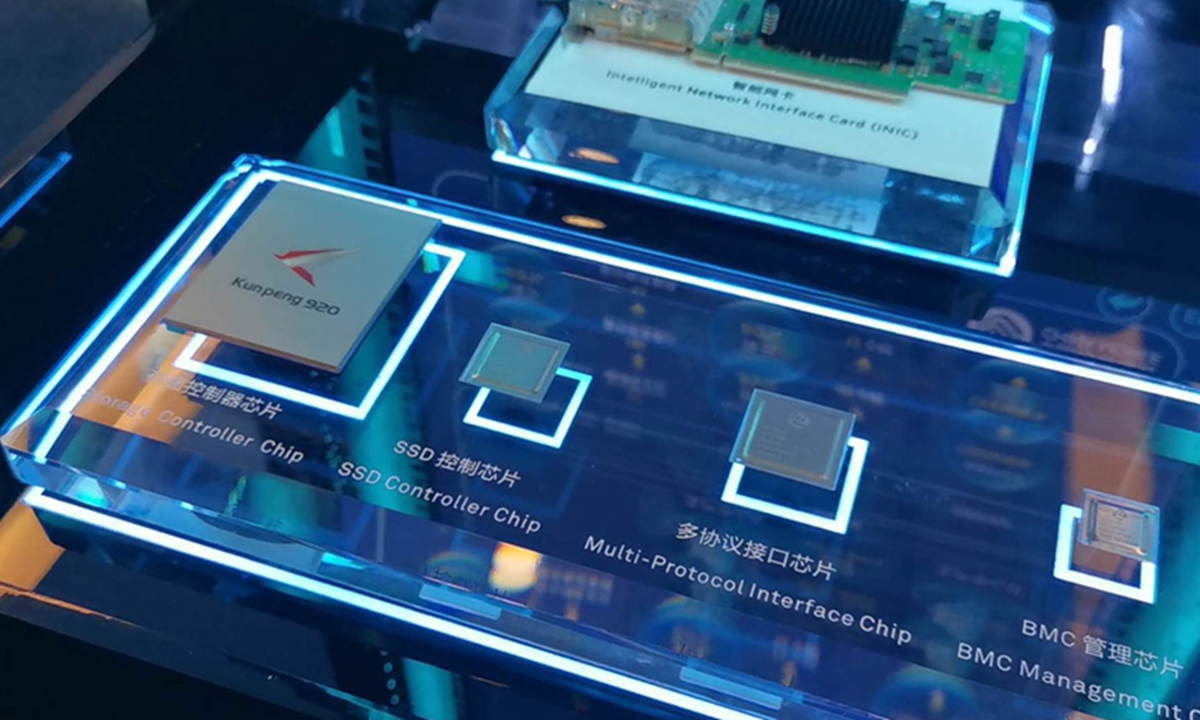

The Kunpeng 920 chip, among other server chips, showcased at Huawei Beijing research center. Photo:CGTN

The problem of tight chip supply is extending from automobiles and smartphones to security equipment, with some small Chinese security device makers facing short supplies of components such as storage chips and control chips, a situation that may last till the second half of 2021.

Shenzhen Themson Security Equipment Co told the Global Times on Monday that its manufacturing has been disrupted by the chip shortfall.

"The supply of chips for dozens of internet-based communications products that we're making has been cut, as our supplier has been put on the Entity List by the US government," said a manager at the company surnamed Tang, noting that the company has been re-designing the motherboard chipset to make do with chip replacements.

Meanwhile, the spot price of chips the company uses has risen by about 20 percent, Tang said. The company's exports largely remain intact, he said, noting that exports only account for about 10 percent of the company's total output.

"Domestic security device makers' demand for semiconductor chips is robust. Along with upstream enterprises' difficulty in expanding output and disrupted supply from foreign enterprises amid the pandemic, chip prices have soared," a Hangzhou-based wafer producer told the Global Times on Monday. The company declined to give exact statistics, but said that most products it makes now cost more.

Industry website ijiwei.com reported on Monday that the price of storage chips has increased by 20-30 percent, while that of master control chips is up by 10-15 percent.

An insider with a large monitor producer in Central China's Hubei Province told the Global Times that the company isn't facing any shortages of chips at the moment because it supplies itself with sufficient chips.

However, the insider said that there is a trend of chip stockpiling in the global market due to fears of shortages because of production halts amid the epidemic.

Xiang Ligang, director-general of the Beijing-based Information Consumption Alliance, told the Global Times that tight chip supplies may persist into the second quarter and even the second half of 2021, until supply has stabilized.

With demand for non-FinFET processes remaining strong amid tight foundry industry capacity, Chinese leading chipmaker SMIC expects its capacity for non-FinFET to continue to be fully loaded and pledges to increase monthly non-FinFET capacity for both 8- and 12-inch chips this year.