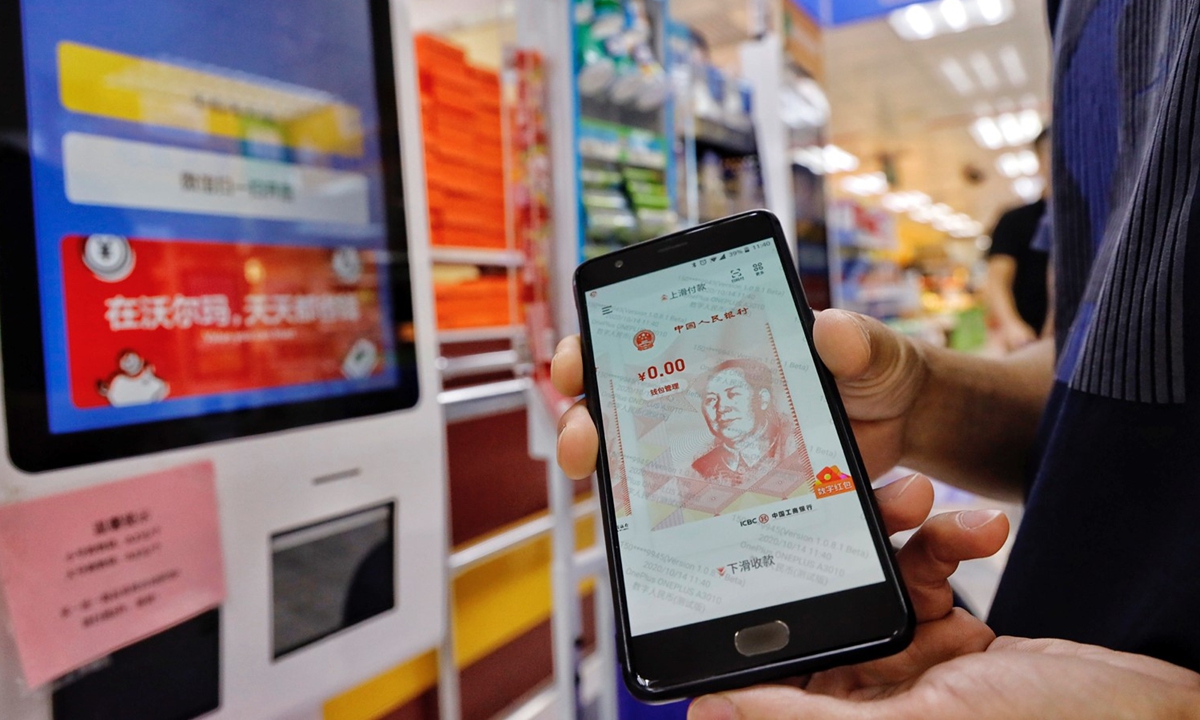

Residents who received "red packets" of digital RMB use the money in a store in Shenzhen, Guangdong Province, on October 14, 2020. The city launched a pilot program to distribute 10m yuan ($1.49m) in the form of digital currency to residents on October 12, 2020. Photo: Li Hao/GT

Automatic vending machines in some metro stations in Shanghai can now accept digital renminbi, as part of the offline application scenarios for digital currency being promoted across the city.

As a critical link in the pilot use of digital currency, offline application scenarios for digital renminbi have been piloted in a variety of situations including in shops and at hospitals across the city, according to media reports.

Users can pay through mobile phones apps or bank cards at venues that accept digital currency check-out functions or digital wallets.

At the moment, only clients who are invited can try the digital currency. Banks issued "red envelopes" of digital renminbi to users in a test before the Spring Festival holidays.

An employee at a small shop selling duck necks in Shanghai told the media that the process of using digital renminbi is very similar to the process for Alipay and WeChat, and it is "very smooth."

One bank sent "red envelopes" worth 30 yuan ($4.65) each to clients as part of a test. There were no large-scale businesses among those participating in the test.

As the first pilot institute for digital renminbi, Tong Ren Hospital affiliated to Shanghai Jiao Tong University School of Medicine launched the payment channel for the digital currency in early January and all the 2,000 medical staffers at the hospital can pay for their meals through a bank card that stores the digital renminbi, Xinhua reported.

An insider from a local hospital told the Global Times on Monday that digital renminbi is expected to be piloted in other scenarios at hospitals, such as registration with the hospital and payment for medical treatment and medicine.

The digital renminbi is a new experimental currency issued and managed by the People's Bank of China (PBC). Its development and application will help to meet the demand for a legal currency in the digital economy, as well as to improve the convenience and security of retail payments.

Prior to Shanghai, trials for Digital Currency/Electronic Payment (DCEP) developed by the PBC have been rolled out across selected Chinese cities including Beijing, Suzhou in East China's Jiangsu Province and Shenzhen in South China's Guangdong Province.

Compared with bank notes, digital renminbi is more traceable and controllable, benefiting the fight against money laundering, terrorist financing, tax evasion and corruption, according to Li Feng, a professor with the China Academy of Financial Research of Shanghai Jiao Tong University.

The offline scenario test in Shanghai will continue till the end of February, according to media reports.

Global Times