China’s de-carbonization drive to unleash huge market potential

De-carbonization calls for removal of technology, trade barriers

Workers install photovoltaic panels at a reservoir and power station in Hefei, East China's Anhui Province, on March 4. The station aims to be generating electricity by May. Photo: cnsphoto

China's goal to hit peak emissions before 2030 and realize carbon neutrality by 2060 will unleash huge market potential in the new energy sector, on both the demand and supply sides. Experts encourage foreign governments to remove trade barriers to allow Chinese and foreign companies to focus on cooperation in the battle against climate change.

According to a report by the Investment Association of China and Rocky Mountain Institute, there are seven primary areas that will be crucial for China's de-carbonization which will lead to huge opportunities for many parties. They are: resource recycling, energy efficiency, demand side electrification, zero-carbon power generation, energy storage, hydrogen and digitalization.

"By 2050, the seven sectors could create a market size of nearly 15 trillion yuan ($2.31 trillion) and contribute more than 80 percent of the emission reductions that China needs to achieve between 2020 and 2050," the report said, adding that more than 30 million new jobs will be created in emerging sectors, such as clean electricity, resource recycling and hydrogen.

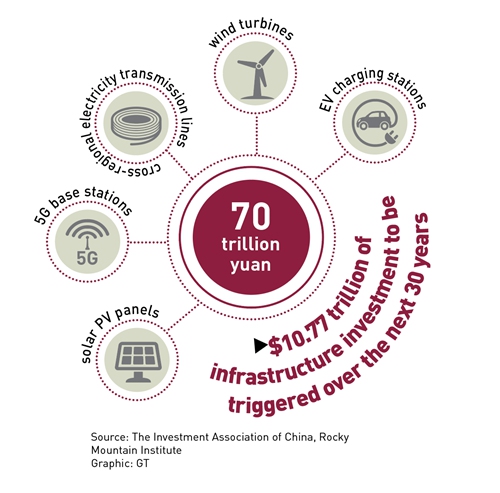

In addition, the country's carbon neutrality goal will bring 100 trillion yuan of investment opportunities in the next 30 years for new-energy-related infrastructure alone, said the Energy Research Institute of the National Development and Reform Commission.

Huge market potential

Having the world's largest energy system, China's energy market potential will be unlimited if the fossil fuel industry, which accounts for 85 percent of the market at present, could be replaced by new energy sources, Lin Boqiang, director of the China Center for Energy Economics Research at Xiamen University, told the Global Times.

Most countries have initiated the new energy sector at roughly the same time, so no severe technological monopoly has been founded in the area, experts noted, but acknowledged that China lags behind in particular areas.

Take the chips in new energy vehicles as an example. China is still unable to shed its dependence on foreign companies, according to Yang Fuqiang, a senior advisor on climate and energy with the Beijing-based consultancy Natural Resources Defense Council.

In terms of the specific conversion and utilization of hydrogen energy, such as how to use hydrogen energy in the fuel cells of new energy vehicles to generate electricity, China's position is also relatively weak, Yang told the Global Times.

Carbon-capture technology is another weak point, as China started later than other developed countries, according to Lin.

"The only influential foreign company in China's new energy market I can come up with is Tesla, but it is noteworthy that China's EV leader BYD Auto and EV battery maker CATL are chasing their foreign counterparts with a potential to overtake," Lin said.

Wind power, photovoltaic (PV) and energy storage are all China's advantages, he added.

To grasp a certain market share in the green economy means opportunities to obtain a vast fortune, but the more urgent task for the entire human race is probably carbon emission reduction, with lower costs that countries can afford.

"It is true that many foreign companies boast advanced technologies in PV, nuclear power and equipment, but their industrial chain is not as complete as China's," Lin said.

Collective efforts needed

Citing the PV industry as an example, industry observers said that although the US and Europe have accused China of dumping cheap solar panels, it is more economically viable for them to adopt Chinese products to develop their own.

Geng Song, vice president of the international department at Ying Li Group, a domestic leading solar energy solution provider, has high expectations for China's global role in clean energy development.

Unlike the past, Chinese companies have achieved self-reliance on homemade PV equipment and raw materials, he told the Global Times, adding that "the possibility of an overseas monopoly is not big due to China's leading PV manufacturing industry."

China's polysilicon output - the key feedstock in the crystalline silicon-based PV industry - reached 392,000 tons in 2020, ranking first globally for 10 consecutive years, industry data shows.

Based on this accumulated development over the years, China's photovoltaic market is expected to make a giant leap in scale.

In order to achieve the goal of making non-fossil fuels account for 25 percent of China's primary energy consumption by 2030, China's PV installation capacity should reach 70-90GW annually during the 14th Five-Year Plan (2021-25), the China Photovoltaic Industry Association told the Global Times on Saturday.

To better develop the PV industry requires joint efforts by both domestic and foreign participants, the association noted, as the structure principles of China's large-scale production of crystalline silicon cell technology are imported. The R&D investment of cutting-edge and revolutionary photovoltaic technologies in Chinese companies is also not enough.

The national PV industry association urged other countries and regions to deepen technology exploration and project cooperation, and personnel training over green and low carbon cycle development policies.

"We need to strengthen international cooperation on setting global green standards, promote conformity assessments and mutual recognition mechanisms, and do a better job in the link up of green trade rules with import and export policies," said the association.

Lin echoed the association's comments, noting that carbon emits globally - it does not center in one country or one region. "It requires a global response with a set of consistent policies and actions. I hope countries can remove their trade barriers and punitive duty imposed on Chinese products, as there will be huge potential when countries hold hands to tackle climate change."