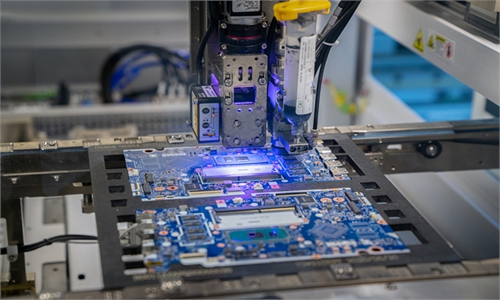

An engineer analyzes chips at a chip factory in Nantong, East China's Jiangsu Province in February. Photo: VCG

More Chinese companies are beefing up efforts in the design and production of vehicle chips amid increased awareness of the need to build an independent supply chain for core components as carmakers reel from the global chip shortage.

Shanghai-based start-up ChipON Micro-Electronic Co announced on Wednesday that it secured B round financing of 300 million yuan ($46 million) led by China Fortune-Tech Capital and SAIC Hengxu.

This round also introduced two investors that are engaged in the vehicle industry chain in a move to integrate resources in the upstream and downstream to improve market competitiveness.

The capital will mainly be used for the research and development (R&D) of automotive chips, including multi-core microcontrollers (MCU) that meet ASIL-D levels used in auto engines and domain controllers, the start-up said.

As the largest auto market in the world, China still relies heavily on chip imports due to lower costs and higher reliability, industry analysts said.

Several entrepreneurs in the sector who are deputies to the National People's Congress (NPC) or members of the Chinese People's Political Consultative Conference proposed during this year's two sessions that the build-up of an industry chain for key auto parts should be strengthened.

Although the auto semiconductor and parts market has broad prospects, there are problems including low domestic chip investment and a crunch in automotive chip production capacity, said Zeng Qinghong, chairman of GAC Group and an NPC deputy.

In 2020, the global vehicle chip market was worth about 300 billion yuan ($46.1 billion), but China's domestic auto chip industry was only about 7 billion yuan, accounting for less than 2.5 percent, data from the GAC research institute showed. The domestic market has been dominated by suppliers from Europe, the US and Japan for a long time.

Zeng suggested enhancing targeted support for the auto electronics industry chain, accelerating the build-up of domestic auto semiconductor standards and implementing the roadmap for key electronic components.

In addition to disruptions caused by the pandemic, the Texas winter storm and a tremor off Japan's northeast coast have aggravated the worldwide auto chip shortage that emerged late in 2020. This has also been a wake-up call for domestic automakers to build a secure and self-controlled supply chain for such crucial components, Cui Dongshu, secretary general of the China Passenger Car Association (CPCA), told the Global Times on Wednesday.

Compared with foreign chip producers, China has established a certain foundation in chips and electronic components, but the gap is mainly reflected in chip design as well as wafer manufacturing and packaging, said Cui.

As domestic companies gradually increase chip production, the shortage in the industry will ease and eventually be resolved, according to the CPCA.

China's economic recovery and supporting policies are expected to offset the impact of the shortage of auto chips, thereby supporting the growth of the auto market, read a note by S&P Global.

Zhou Yanwu, research director at Zuosi Auto, told the Global Times that the vehicle semiconductor industry chain is very long, and the shortages may last until the fourth quarter of this year.