China launches 2nd financial court, to review investor complaints of damages done by overseas firms

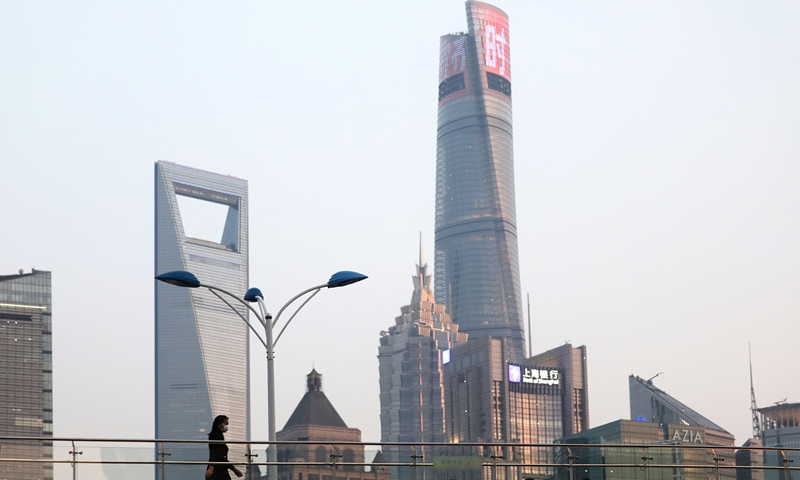

A resident walks through the overpass at Lujiazui area of Pudong, one of the influential financial centers in China. Photo: Yang Hui/GT

China's second financial court was officially launched in Beijing on Thursday, setting in motion a specialized tribunal to take up cases which relate to damage to domestic investors by overseas firms.The newly created court would have jurisdiction commensurate with an intermediate people's court in hearing finance-related civil, commercial and administrative complaints in Beijing, Beijing High People's Court announced on Thursday at a press conference.

An asset management firm's litigation against a bank, an accounting firm, an asset credit rating firm and a law firm over the liability in securities misrepresentation, filed online Thursday morning, became the first case accepted by the new court.

The Beijing Financial Court is initially seated with 25 judges, with an average age of 41.7, including 11 PhDs and 13 masters, according to Cai Huiyong, president of the court.

There are already plans for case filing with the new court, China Business News reported Thursday, citing an attorney from a law firm in Beijing representing a suit by domestic investors against an overseas-listed firm, without naming the firm.

The launch of the Beijing Financial Court, the second such assembly after the creation of the Shanghai Financial Court in 2018, came on the heels of rules unveiled by the Supreme People's Court that crystallized the new court's jurisdiction.

The Beijing Financial Court is tasked with cross-regional jurisdiction of lawsuits related to damage to the rights and interests of domestic investors by overseas firms and securities disputes concerning companies listed on the selected layer of the National Equities Exchange and Quotations, the country's over-the-counter market known as the "new third board," according to a statement on the website of the Supreme People's Court on Tuesday.

The new court's jurisdiction also includes administrative lawsuits and non-litigation administrative enforcement cases resulting from the undertaking of financial oversight duties by the country's financial authorities.

The rules were formulated by the top court based on rounds of dialogues with government departments including the Legislative Affairs Commission of the National People's Congress (NPC) Standing Committee, the Ministry of Justice, the central bank, the banking and insurance regulator, the securities regulator, and the foreign exchange regulator.

In a sign of fast-tracking, a draft decision on the setup of the new court was only submitted to a session of the NPC Standing Committee, China's top legislature, in January.