COMMENTS / EXPERT ASSESSMENT

New rules may force Chinese stocks to ditch the politicized US financial market

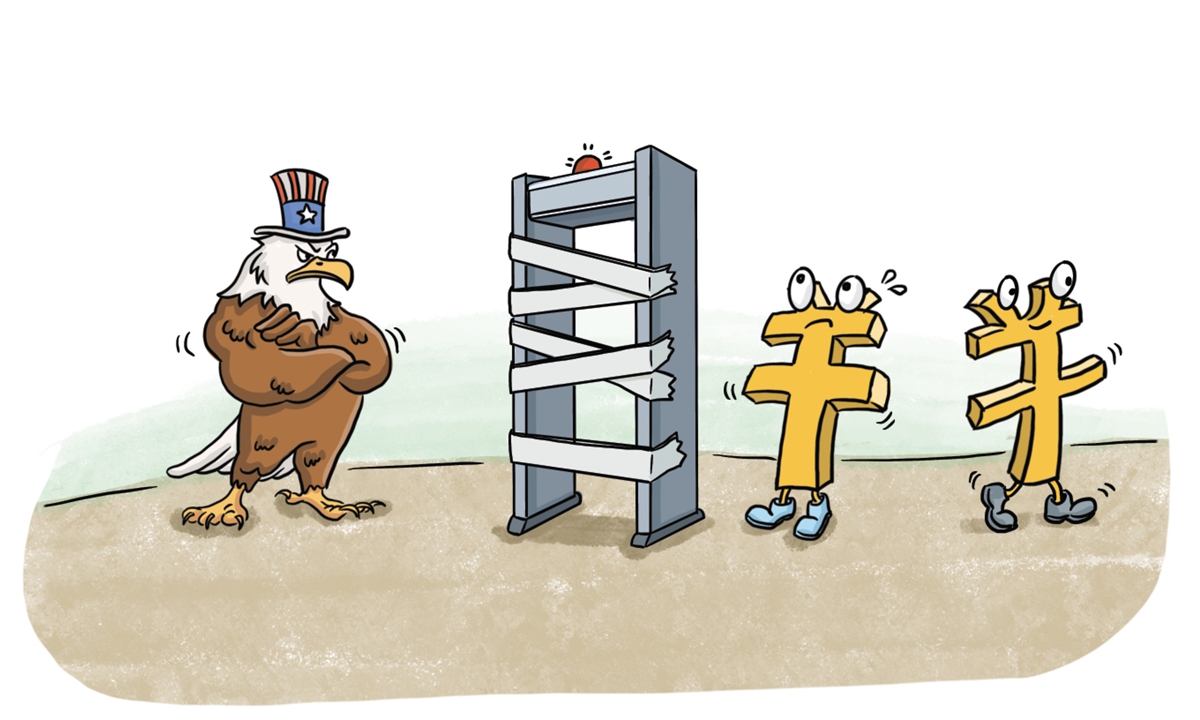

Illustration: Xia Qing/GT

The top US securities regulator recently adopted a politicized measure which widely believed to be a move targeting Chinese firms listing on the US stock market. As the nation signals no intention to redress its hegemonic approaches to confront China in near term, it might be time for some Chinese firms to ditch the politicized American financial market, returning back home or seeking new financial cooperation outside of the imperious US.

In the so-called Holding Foreign Companies Accountable Act adopted by the US Securities and Exchange Commission, it clearly underlined additional specified requirements for foreign issuers to disclose "the name of each official of the Chinese Communist Party who is a member of the board of directors of the issuer or the operating entity with respect to the issuer", and "whether the articles of incorporation of the issuer (or equivalent organizing document) contains any charter of the Chinese Communist Party, including the text of any such charter."

Instead of based on any professional considerations connected to securities regulation, the measure simply shows a vicious intention of the US to vilify China's political system and contain China's development.

The hegemonic nature of the moves is abundantly clear. What's also clear is that the US' rules never represent international rules. The CPC's leadership and China's political system are supported wholeheartedly by the Chinese people, and any attempt to change China's social system will be futile.

The new measure adopted by the US Securities and Exchange Commission may force some Chinese stocks to ditch the politicized US financial market.

There's potential space in China and other parts of the world for the firms to explore financial cooperation opportunities, paths and instruments. Facing ill-intended crack downs from the US-led clique, the only choice left for the firms is to fight back as compromising would only encourage bullies.

At the end of the day, it is the development prospect of a firm that attracts investors, rather than any listing platform or one stock market. By politicizing the financial sector, the US has seriously distorted the basic principles of the market economy that it has always claimed to champion.

It'll also deprive US investors from the opportunity to share the development benefits of Chinese companies, which in the end will only undermine the international status of the US capital market and its own interests.

What's increasingly clear is that it may not be expected for the US to resume rational approaches in short term. And after several rounds of crackdowns faced by Chinese firms from restricting technology to absurd vilification, the financial schemes of the US may have just initiated, and firms should be fully prepared for any potential obstructions in the field.

The Chinese people, as well as Chinese firms, do not afraid of confrontation, though they will never give up efforts to strive for mutual-beneficial cooperation. The US needs to quit its hegemonic intention to impose its own "rules" onto others and get back on track to work with China to enhance mutual communication, properly manage differences, strive to promote cooperation and avoid confrontation.

The article was compiled based on an interview with Dong Shaopeng, a senior research fellow at the Chongyang Institute for Financial Studies of Renmin University of China. bizopinion@globaltimes.com.cn