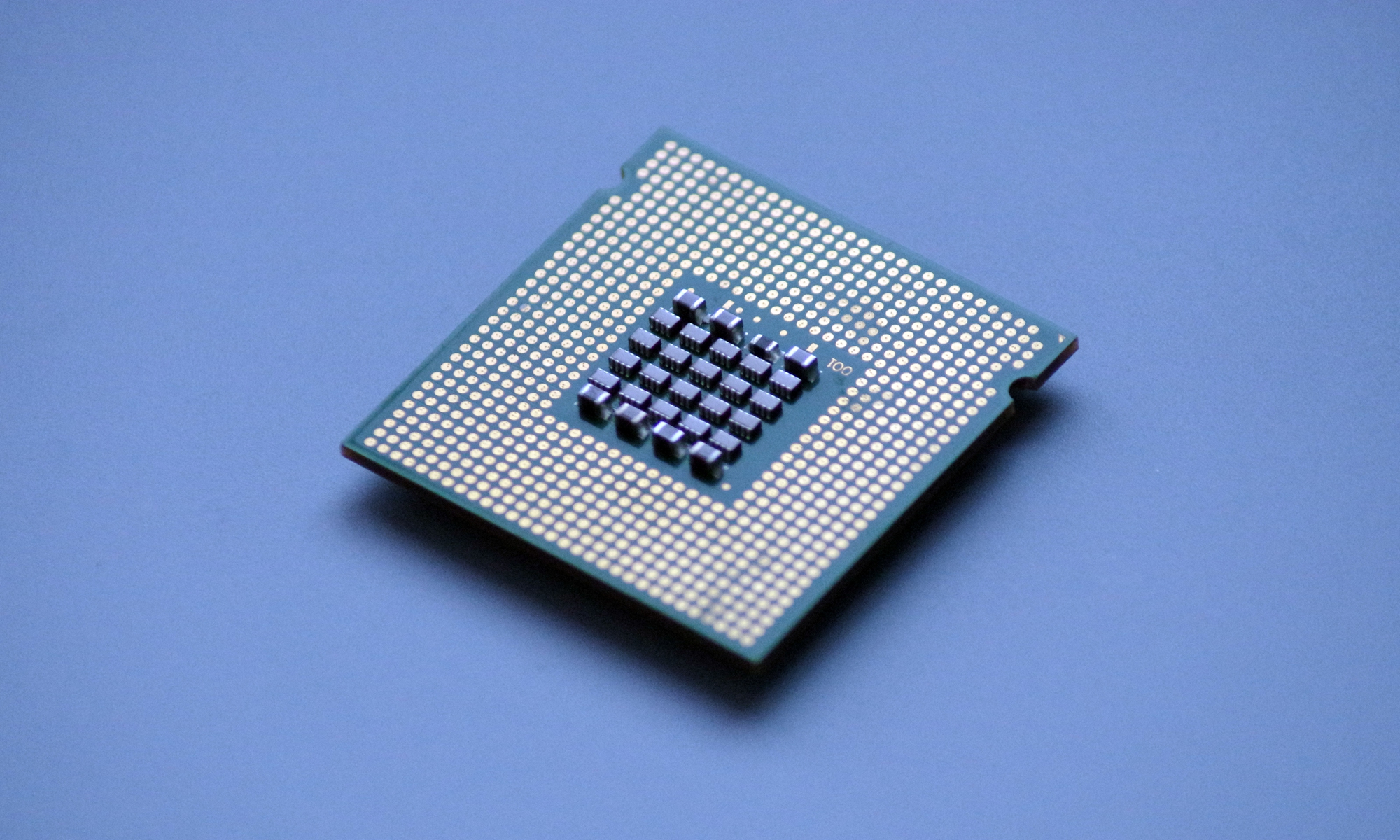

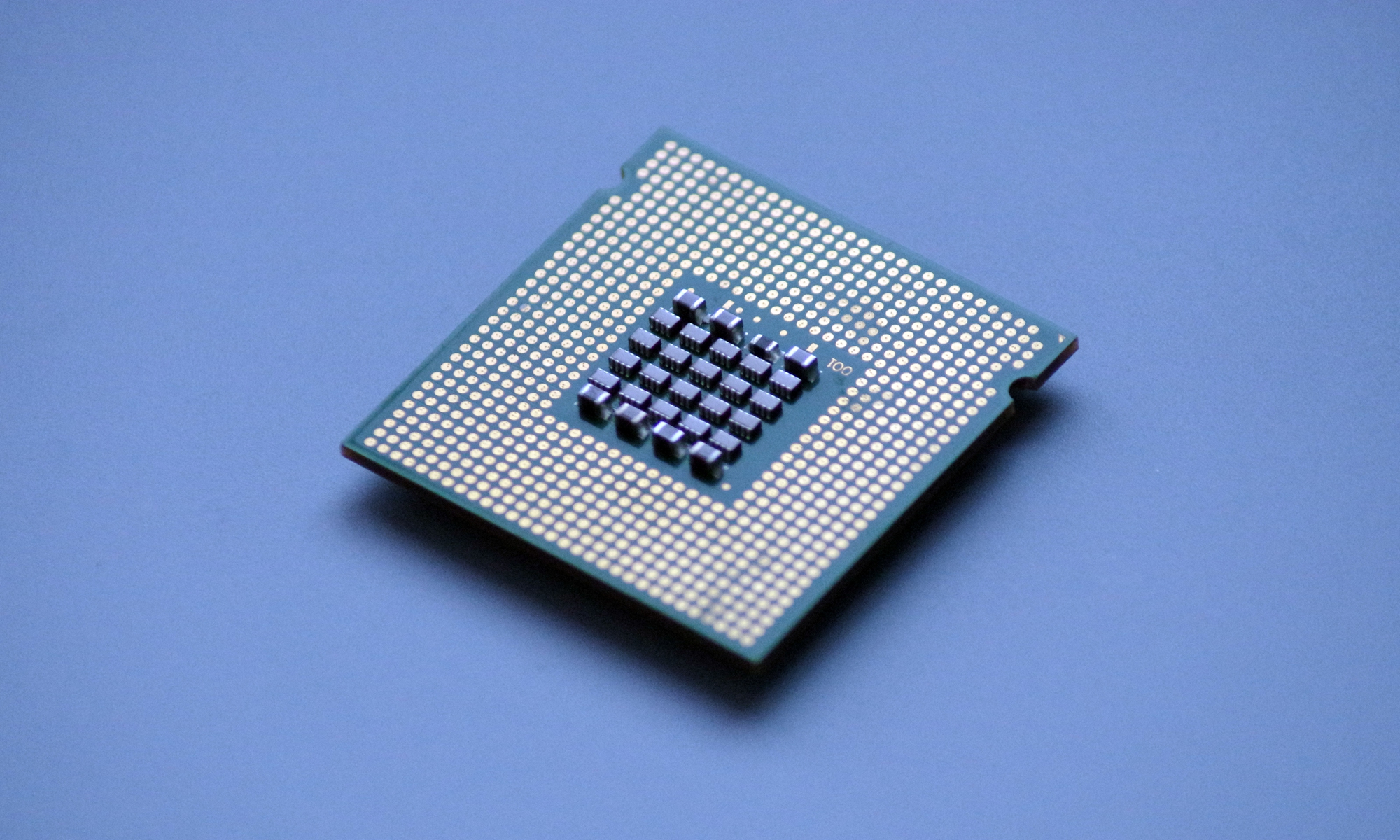

chip Photo:VCG

The White House's summit on the global chip shortage scheduled for Monday with many multinational companies, which excludes virtually all key players from the Chinese mainland, is another Washington-led push to decouple from China in semiconductors, analysts said on Sunday.

Such a plot will only end up exacerbating global supply woes, as chip producers may suspend investment plans over political risks. The chip sector also requires close international cooperation among different parts of the industry chain to achieve economies of scale, so excluding China will drive up costs, observers said.

Chief executives from about 20 companies including Google parent Alphabet, AT&T, General Motors, Samsung, Dell Technologies, Intel Corp and TSMC, which is based in the island of Taiwan, are reportedly set to participate in a White House virtual meeting on Monday billed as a "CEO Summit on Semiconductor and Supply Chain Resilience," Reuters reported.

White House National Security Advisor Jake Sullivan, National Economic Council Director Brian Deese, and Commerce Secretary Gina Raimondo will also take part in the meeting, according to the report.

Participants will discuss how to strengthen the US supply chain for semiconductors, CNBC reported, citing the White House.

"Almost all Chinese [mainland] high-tech companies are absent from the meeting, even though they are key stakeholders in the global chip shortage. This underscores Washington's malicious aim to unite its alliance and decouple from China across the semiconductor industry chain, from design and manufacturing to application," Ma Jihua, a Beijing-based industry analyst, told the Global Times on Sunday.

China accounts for roughly 45 percent of global chip demand each year, relevant data showed.

Fu Liang, an independent veteran telecom industry observer in Beijing, told the Global Times on Sunday that the US may also seek to use its global influence at the meeting to control the global supply chain and make it tilt more toward US companies.

"Washington has deemed chips as a weapon to contain China's tech rise and also as a key bargaining chip at the negotiating table," Ma explained.

The US has elevated the development of the chip industry into a national strategy for political gains. Since February, the Biden administration has embarked on a review of key US supply chains, including semiconductors, aiming to make them less reliant on other countries.

But industry insiders said that such "back stabbing" will only backfire and cause dire consequences for US chip firms and global supply.

The ongoing chip crisis, which has rocked industries ranging from vehicles to mobile phones to game consoles and TVs, was partly fueled by the US' confrontation with China under the former Trump administration, observers said.

"Chip companies had to suspend research and development (R&D) investment due to mounting uncertainties, which delayed their production and led to the shortage," Ma said.

"If the US also aims to exclude China this time, relevant global companies will again be forced to take sides out of political considerations, and some will hold off on investment to expand production to trade off their interests in the Chinese market and US hegemony."

SEMI, the US semiconductor design and manufacturing industry association, said in September that US export controls imposed in May 2020 have "resulted in $17 million lost sales of US-origin items to firms unrelated to Huawei," according to a report by the Peterson Institute for International Economics.

From a long-term perspective, the US' decoupling push also goes against semiconductor development rules, which call for close and focused collaboration, industry insiders said. The industry will be unable to generate economies of scale to cut costs if China - as a key player - is excluded.

China, in contrast to the US, has been a firm promoter of global cooperation. In March, the China Semiconductor Industry Association, an association of 774 Chinese chip companies, said that it was cooperating with its US counterpart to establish a working group on information sharing and bilateral communications over trade barriers, supply-chain security, and other related issues.

China is also climbing up the ladder to create self-reliant semiconductor technology.

Chinese chip firm SMIC recently made breakthroughs in a 7-nanometer-like process, media reports said. Chip designer Innosilicon announced that it has completed a chip tape-out and testing based on SMIC's FinFET N+1 technology, which is very similar to the advanced 7-nm process used by other world leading chipmakers.