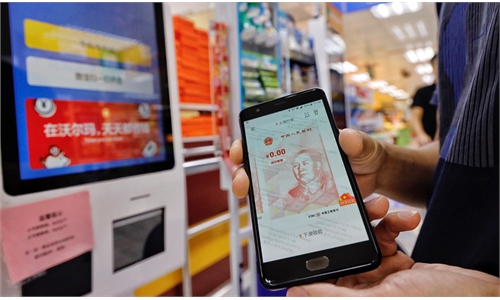

Residents who received "red packets" of digital yuan use the money in stores in Shenzhen, Guangdong Province. Photo: Li Hao/GT

China's leading position in developing and testing its digital currency, appears to be another source of disgruntlement by politicians in Washington, whose obsession of defending the US dollar hegemony is unlikely to impact China's current momentum to accelerate digital yuan test and deployment.Officials from the Biden administration are seriously worried whether China's digital yuan push will begin to dent the US dollar's dominant position in cross-border transactions in the long run, and whether the digital yuan would be widely used to evade US government's reckless financial sanctions, Bloomberg reported on Monday, citing anonymous sources familiar with the matter.

At present, central banks from Europe to Asia are stepping up work on researching and developing their own digital currency plans, and, it seems that China has become a front-runner in developing a digital currency, reportedly supported by the block-chain and mobile internet technology, with large-scale trials of the digital yuan being rolled out in major cities across the country since October 2020.

Yet, it would be overdoing it to say the efforts of working out an easier and faster digital payment platform will pose a problem or threat to the US dollar. After all, the US dollar makes up more than 60 percent of global foreign exchange reserves and a big chunk of the world's trade is settled in the dollars.

And the irony is that, even though the US seems to be increasingly nervous and overly concerned about the deployment of a digital yuan, the country is generally slow in responding to such a digital currency trend compared with other advanced economies such as Japan. It is only in February this year that US Federal Reserve Chair Jerome Powell and Treasury Secretary Janet Yellen signaled an interest in a digital dollar.

Seen in another perspective, some politicians' paranoia about the potential emergence of a new digital payment form in settling transactions, may underscore nothing but their traditional hegemonic mentality that is obsessed with preserving the US dominance over the global financial system.

While it is unclear whether the Biden administration is working on any specific measures to mete out its own digital dollar, judging from the past US track record of putting pressures on other countries, the possibility that the US may create obstacles to disrupt China's digital currency development cannot be entirely ruled out. China needs to remain vigilant.

As the world's second largest economy and the largest trading partner of more than 100 countries, China has a need to promote the development of a digital yuan, and it has already achieved remarkable technological breakthroughs. Nevertheless, it should be pointed out that there remain many uncertainties surrounding the development and deployment of a digital yuan.

The US has used its dollar hegemony as a geopolitical weapon more often than before by flexing its financial muscles, which is actually endangering the dollar's status, driving other economies to look for alternatives.

In fact, the US is certainly capable of developing its own digital currency, and there is no need for it to over-interpret innovations of other nations. Always abusing its financial hegemony in a misguided way will only end up causing self-inflicted wounds.