China’s Q1 foreign trade gets off a robust start, Jan-Mar GDP expected to hit 18%

Exporters see surging orders amid growing demand

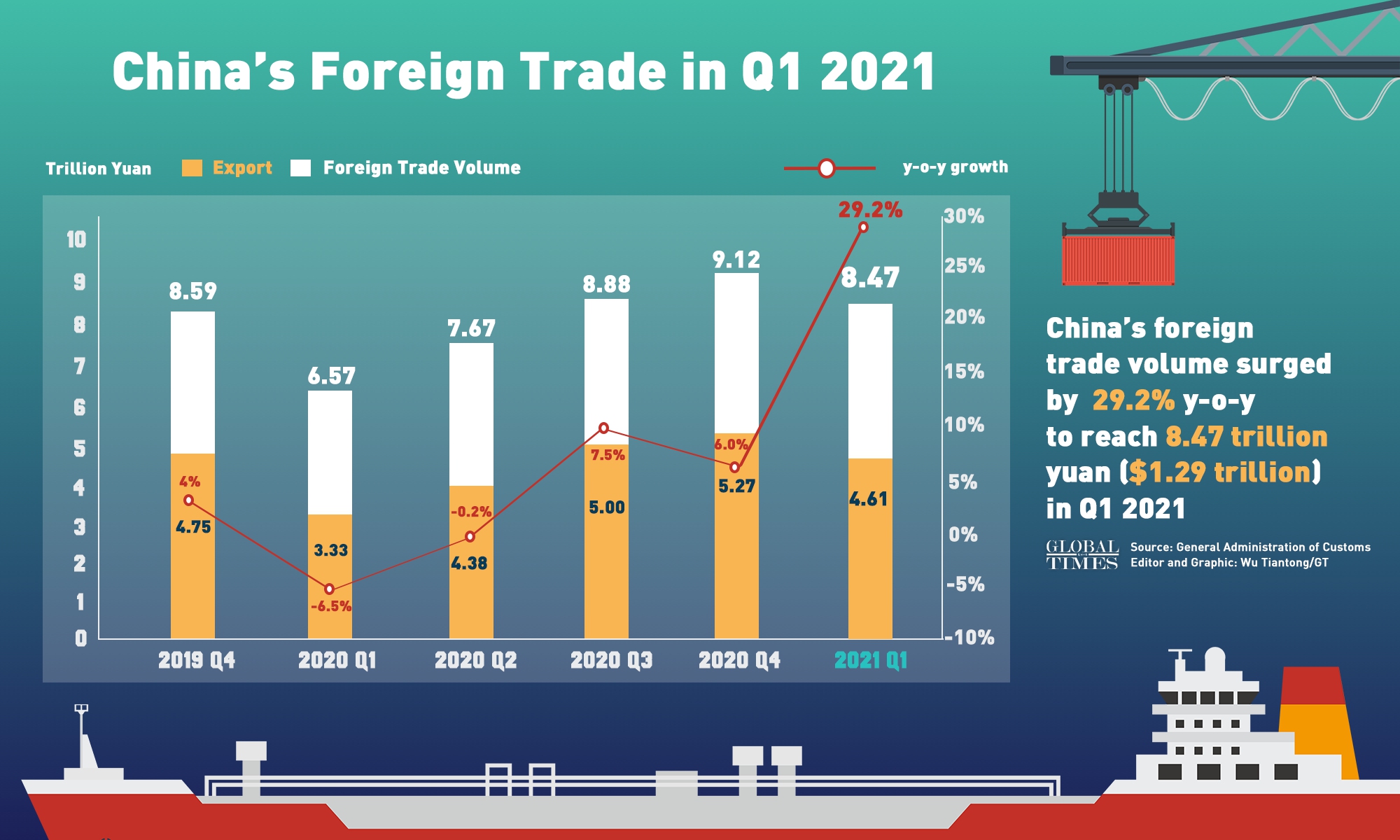

China's Foreign Trade in Q1 2021 Infographic: Wu Tiantong/GT

Photo: VCG

China's foreign trade volume surged by 29.2 percent year-on-year to reach 8.47 trillion yuan ($1.29 trillion) in the first quarter of 2021, getting off a robust start for the year despite the world is still grappling with the cloud of a global coronavirus outbreak resurgence.

A humming export machine could send China's GDP growth in the first three months to hover around 18 percent, setting a new high, analysts said. The world's manufacturing powerhouse has been shipping everything from daily necessities, medical gear to work-from-home electronic devices to the world, among which trade with the US grew the fastest, underscoring a global economic acceleration which China serves as a stabilizer and locomotive.

Yet the country is likely to hit unchartered waters this year as demands at home have not bounced back to pre-virus level and geopolitical uncertainties heightened, which could drag trade growth down quarter by quarter, observers said. Many have urged global economies to work together to shake off the dents left by the pandemic, facilitating a V-share recovery rather than further inciting trade rows that could sink the global economic resurgence.

China's yuan-denominated exports in the first quarter surged 38.7 percent from a year earlier to 4.61 trillion yuan, while imports gained 19.3 percent year-on-year to 3.86 trillion yuan, data released by the General Administration of Customs showed on Tuesday.

That translated to a trade surplus of 759.29 billion yuan in the first three months, up 690 percent year-on-year.

The better-than-expected foreign trade figures compared with a 6.4 percent slump in the first three months last year, when the country was subject to a strict lockdown imposed by China's central government to stifle spreading of the novel coronavirus. Trade also grew 20.5 percent compared with the first quarter in 2019.

"China's first-quarter foreign trade figures were highly positive, which was partly aided by the low base last year. But even if such factor is excluded, the recovery momentum remains robust," Tian Yun, vice director of the Beijing Economic Operation Association told the Global Times, pointing to strong external demand that is driven by huge fiscal and financial stimulus plans in many economies.

It also demonstrated manufacturing ability of the world's major economies such as the US are still resuming in a slow pace, thus orders all flow into China, Cao Heping, a professor of economics at Peking University in Beijing, told the Global Times on Tuesday.

Analysts said that the trade figure once again would underpin the country's rapid economic rebound from the coronavirus pandemic since the second half of 2020. It also bodes well for the country's first-quarter economy.

China will release its GDP for the first three months on Friday.

Lian Ping, head of Zhixin Investment Research Institute, told the Global Times on Monday that China's first-quarter GDP is expected to grow at a double-digit pace, fueled by low bases, accelerated production and industrial recovery streak.

Accelerated recovery

Dongxin Fireworks, one of the largest fireworks exporters in Liuyang, Central China's Hunan Province, has been running at a full capacity over past months.

The company's manager, Zhong Fang, told the Global Times on Tuesday that the factory has been working day and night trying to complete US customers' orders for US Independence Day, which falls on July 1.

"We're falling short of demand, and are hiring more employees to cope with incoming orders," Zhong said, noting that order flowing from the US has seen "an evident increase" to date this year.

In addition to the US, the company's main markets also include Canada, Germany, France, the UK and Russia.

Last year, Dongxin Firework's exports of consumer fireworks to the US increased about 20-30 percent on a yearly basis, but Zhong hoped that the volume of exports would rise further this year, riding on the boom of vaccine-powered normalization.

Guo Chun, an executive with Zhejiang KangKang Medical Devices Co, a large syringe producer based in East China's Zhejiang Province, said that the company is finding it harder to recruit workers now due to a surge in orders.

"Now, working around the clock has become somewhat of a normal state at our factory, while rising material costs are an added burden," he told the Global Times.

The company's orders, mostly from US clients, have risen by about 20-30 percent compared with the period before the Spring Festival holidays. The company is working to expand its manufacturing lines, which will allow it to quadruple production.

The flooding orders of Chinese exporters like Zhong and Guo underscore an economic recovery across the world, which is building on China's growth momentum and gradually taking firm ground with the massive rollout of vaccinations.

"Manufacturing purchasing managers' index levels in major economies further improved in March, showing that overseas economic recoveries are speeding up and supporting China's exports," Lian said

In breakdown, China's exports with the US recorded a 61.3 percent growth in the first quarter to 1.08 trillion yuan, the fastest growth among all trading partners. The US is still China's third largest trading partner, while the ASEAN and EU remain China's top two largest trading partners, climbing 26.1 percent and 36.4 percent, respectively.

"China's first-quarter trade figures foreshadow a full recovery across the world that not only could fix a break-down of industrial supply chains due to the pandemic but more importantly, could repair a global trade shrink over the boiling trade war between the world's two largest economies since 2019," Tian said.

Navigating 2021

Lian envisioned that the external rising demand for made-in-China commodities will continue powering the economy in the second quarter and the second half of the year.

"China was the only silver lining of trade growth last year, and the country is expected to make a greater contribution to the global trade in 2021, probably representing 15 percent of the global share in the export market," Tian said, estimating China's whole-year trade growth to reach 10 percent.

But industry insiders have expressed concerns on the volatile global geopolitical situation, as the US has been pushing for confrontation with China. Some worry the mounting political uncertainty may disrupt the international trade pattern and weigh on China's exports.

"There is a widening divergence between import and export in the first quarter, indicating there are also rooms to further stimulate domestic subdued demand to shore up import volume," Tian said.

According to a report IMF released in March, the global growth is projected at 6 percent this year, yet the the recovery is "divergent" and subject to high uncertainties as "new virus mutations and the accumulating human toll raise concerns."

Cao warned that the US is actually at a crossroads of recovery or deeper recession, and if the world's largest economy fails to rein in the rising momentum this year, it might be a potential threat to the global post-pandemic economic recovery.

"We also call for the US politicians to show political wisdom rather than incite apolitical conflict with China, since any confrontations between the world's largest two economies would jeopardize a hard-won global economic recovery," Cao said.