COMMENTS / COLUMNISTS

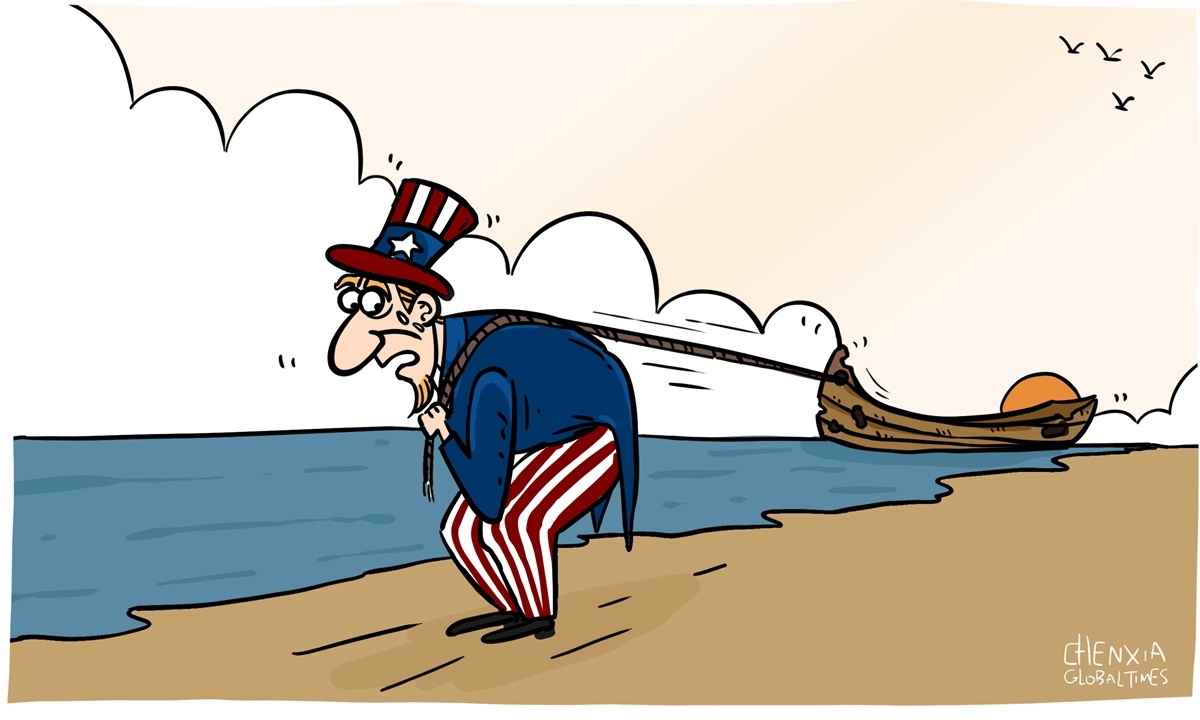

US, handicapped by systemic woes, cannot compete with China

Illustration: Chen Xia/GT

The catchwords for current US politicians center around a "fierce competition" they have launched to win over China in order to maintain America's mega superpower status. Recently, the US Senate's Foreign Affairs Committee passed the so-called Strategic Competition Act of 2021, to sharpen the US government's focus on impeding China's economic and advanced technology ambitions, and the draft bill is expected to be approved by the full US Senate.

However, the US is not always having the whip hand in this competition. China owns peculiar competitive advantages in population size, market scale, entrepreneurial spirit and efficiency, societal equity, public-private "dual-track" partnership, scientific decision-making culture, and distinct implemental fast-track. Yes, China's system is more advanced, evidenced by the meteoric economic growth seen over the past 4 decades.

The US strategic competition act of 2021, which has overwhelming bipartisan support in its Congress, is "to finally meet the China challenge across every dimension of power, political, diplomatic, economic, innovation, military and even culture", said Bob Menendez, a writer of the bill and chairman of the US Senate's foreign affairs panel. A browse of the bill finds it, egregiously, contains millions of dollars of US investments annually before 2026, to sponsor anti-China propaganda or disinformation drive by US domestic and foreign media organizations.

The international mass media platform is English-centric and has been dominated by the Western countries headed by the US for many years. In the foreseeable future, the mass communication landscape cannot be easily changed, and China's voice will continue to be limited on the world stage while the West controls the gears behind the global media.

Bogus issues made up by them against China like "forced labor" in Xinjiang and "suppression of human rights" in Hong Kong are futile to curtail China's growth, and the Western media's bashing-China narratives cannot obscure the increasingly illuminating fact that China is endowed to prevail in this "contest of the century".

First, China's 1.4 billion people offer the condition for building up the world's largest consumption market, which is envied by all the multinational CEOs and their product and service sellers. The ASEAN and EU are China's top two trade partners - just ask them how important China's market scale means to them. Or, one could ask Canberra whether it is hurting by deliberately provoking a diplomatic and economic fight with China. And, the population advantage can help China generate big data that can be repurposed for innovations including AI and digital currency.

Focusing on developing a 1.4 billion-population strong market, and adhering to the broader opening-up policy, China will continue to achieve relatively high-speed economic growth in at least 20-30 years to come.

Second, the Chinese government has pursued a vibrant economic combination of the state, the public and the private forces. State-ownership of major public utilities and services, like supplies of electricity, tap water, cooking gas, telecom and medical care services and their fair fee charges, is a key means of maintaining China as a fair and equitable society.

And, China's state-ownership of the country's three telecom operators has the advantage of expanding the advanced 4G and 5G coverage to the most remote and outlying villages. China's deployment of the world's largest 4G cellular network has vastly accelerated its digital push and shepherded ubiquitous mobile and paperless payment. No wonder American politicians are now anxious because China's advance in the digital sphere is real.

The strange happenings in the US - including the eye-popping chargers faced by consumers for electricity, gas and water in Texas two months ago when it was battered by a snow blizzard causing a days-long power outage, or poor American families unable to access medical care insurance coverage, are often scoffed at on Chinese social media.

Social inequality instituted by US government policy, coupled with rising income polarization, racial strife and proliferation of lethal firearms, has made the US such a volatile nation sitting on a volcano.

Third, China, though a socialist country, is truly committed to developing market-regulated economy by encouraging entrepreneurial competition and inspiring new and high-tech innovations.

The education system is fostering a competitive culture as students from primary, middle school up to college and post-graduate levels are competing with peers to gain knowledge and recognition. And, the government is always encouraging the country's Big Tech - the likes of Alibaba, Tencent, Huawei, ZTE, Xiaomi, JD, ByteDance, Meituan, Didi, Nio and CATL - to compete with one another.

Lately, China's top market regulator punished the monopolistic, anti-market act of Alibaba, issuing a record $2.8 billion fine. The country's finance authorities also ordered Ant Group to rectify its business model by sharing its massive data of Chinese consumers the fintech upstart has gained, with the central bank and other market players in the country.

Unlike the US where the Big Tech like Facebook, Google and Amazon have significantly grown their market dominations but the US government did little to thwart big company chokehold on digital information, China's government sends a clear message to all Chinese businesses - to foster free market competition. After all, monopoly is the adversary of innovation.

And, the last but not the least, China's governmental system has obvious advantages over the US' two-party partisan regime. As displayed by Beijing's decisive mandate to impose a blanket lockdown in early 2020 to stifle the spreading of the novel coronavirus in central Hubei Province, China's system shines in decision-making efficiency, and after a decision is made, the whole country will take notice, and move quickly on its implementation.

China's rapid rollout of the world's longest 37,000-km high-speed railways in the past 10 years and other infrastructure projects are manifesting the system's superiority. Now, facing the US government's restriction of semiconductor supply, Beijing is incentivizing its own high-tech talent and enterprises to accelerate research and development. Semiconductor colleges are being built up and investments are surging, and it is assumed that before 2030, China's semiconductor shortfall will be fully addressed.

The author is an editor with the Global Times. bizopinion@globaltimes.com.cn