Tourists climb Huashan Mountain in Weinan, Northwest China's Shaanxi Province on Wednesday, the last day of the country's five-day May Day vacation. The tourist spot put a cap of 30,000 visits per day during the holiday due to coronavirus prevention precautions. Photo: Xinhua

China's consumption engine has almost completely recovered to post-pandemic levels, as shown by surging spending on items from travel products to duty-free goods during the 2021 May Day holidays, which witnessed the country's largest population movement after last year's National Day holidays.

In Haikou, a city in South China's Hainan Province, Chinese people made 65,400 purchases amounting to 485 million yuan ($75 million) on offshore duty-free goods from Saturday to Monday, the first three days of the May Day holidays, up 215.24 percent year-on-year.

In Wuhan, the city at the heart of the initial coronavirus outbreak in China, more than 140,000 passengers trips were recorded at Wuhan Railway Station on Saturday. Many hotels were booked out days or even weeks ahead of the holidays.

It was a similar situation in Shanghai, where tourists paid about 4.66 million visits to about 170 tourism sites, up 166 percent from the level in 2020 and 6 percent from that in 2019.

On average, every Chinese tourist spent about 1,713 yuan on tourism and other items during this year's May Day holidays, setting a record among the same period in recent years, data sent by Chinese tourism site qunar.com to the Global Times showed.

These statistics reveal a steady yet robust recovery of China's consumption market as the country's services sector underwent an orderly climb after the unexpected coronavirus-triggered economic ebbs in early 2019, although pandemic threats and economic uncertainties still linger.

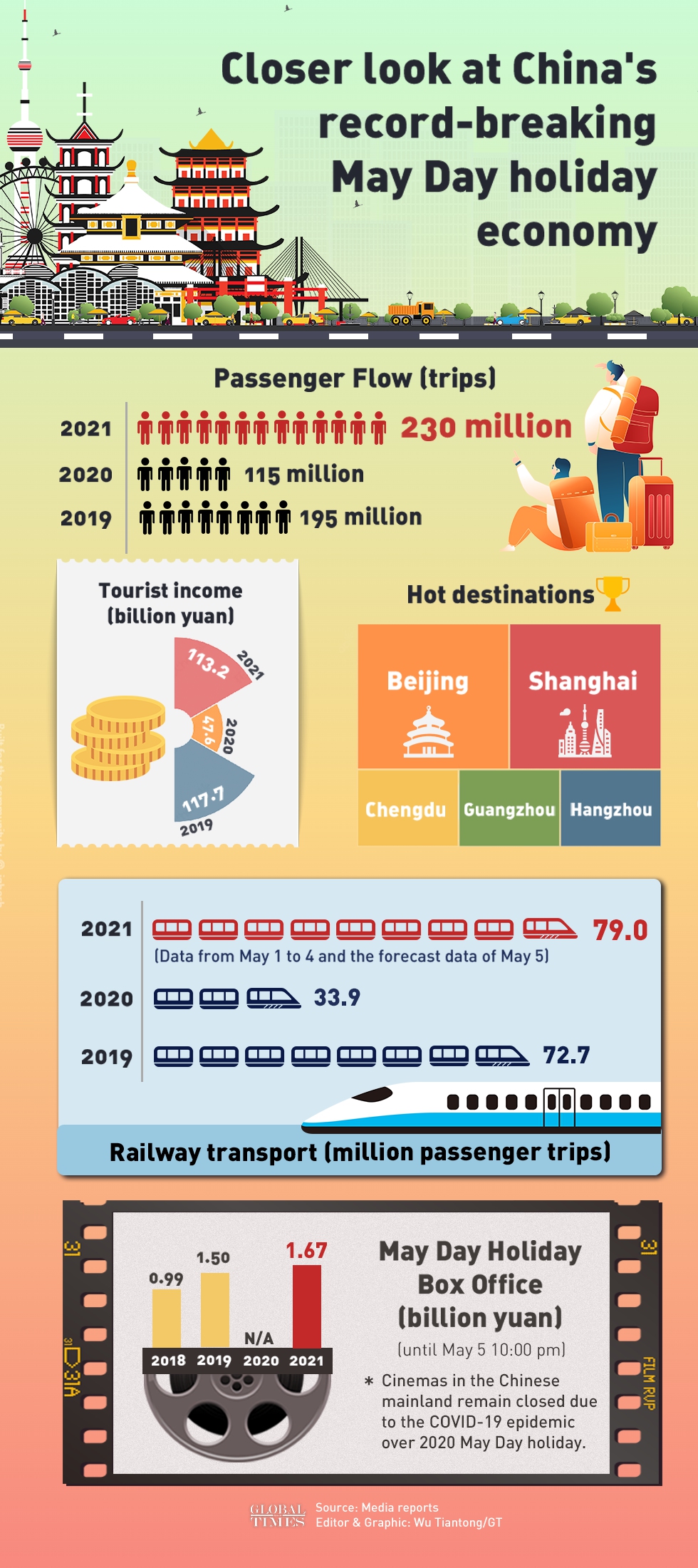

During the five-day May Day holidays, 113.23 billion yuan flowed into China's tourism industries, up 138.1 percent year-on-year and about 77 percent of that of pre-epidemic levels, according to data released by the Ministry of Culture and Tourism. A total of 230 million domestic trips were made over the five days, compared with 637 million trips during the eight-day Golden Week holiday last year which combined the National Day and Mid-Autumn Festival.

From Saturday to Tuesday, China's rail passenger flow rose by about 23 percent compared with the first three days of the 2020 National Day holidays, calculated the Global Times based on data provided by China Railway.

Closer look at China's record-breaking May Day holiday economy Infographic: Wu Tiantong/GT

A highlight of this year's May Day holiday consumption is the rising public interest in "red tourism," as many tourism sites pivotal to the Communist Party of China (CPC) saw multi-fold rises in tourist visits during the past few days.

"I have to wait about two hours to enter the Former Residence of Zhou Enlai in Shanghai, as earlier slots were all booked out," Li Minghe, a Shanghai resident who visited the site on Friday told the Global Times.

She said that from what she saw, most of the visitors were young people including local primary school and middle school students. Out of pandemic-prevention needs, no more than 40 visitors were allowed to gather in the residence at one time.

At the National Flag Plaza at the Memorial for the First National Congress of the Communist Party of China in Shanghai, the Global Times reporters saw that around a dozen people were lining up waiting to take photos of the site's exteriors on Wednesday morning.

Tourists crowd a red tourism attraction in Shanghang County, Southeast China's Fujian Province, on February 10. Photo: VCG

Contribute to general economy

The May Day holiday tourism and spending boom is an epitome of China's rebounding consumption market, which experts said has already recovered to pre-pandemic levels, if not largely exceeding pre-COVID19 levels by large.

They attributed this to multiple reasons, such as the fact that Chinese people's spending impulse was largely suppressed during the past few holidays, the steady push for coronavirus vaccines, and people's income rise in recent months along with economic growth.

Chinese people's per-capita disposable income rose 4.7 percent to 32,189 yuan in 2020.

"While the consumption sector was a burden on the Chinese economy in 2020, its contribution to the general economy will climb steadily to about 60 percent of GDP growth by the end of this year, while export momentum will slow down," Tian Yun, vice director of the Beijing Economic Operation Association, told the Global Times on Wednesday.

This is roughly the same as in 2019, which saw about 57.8 percent of the country's GDP growth coming from consumption spending, meaning that China's consumption market will return to normal this year.

Tian predicted that China's GDP will grow by about 8.5 percent this year.

He noted that the booming consumption market was in part fueled by a shift from overseas to local spending as many parts of the world are still locked down due to the pandemic, but the structure of the Chinese economy will become more balanced after the world gradually walks out of the COVID-19 shadow.

Chinese epidemiologists previously predicted that border controls among countries who keep the spread of the virus under control will be gradually eased at the end of this year. Yet they believe the devastating second wave in India is casting doubts over the prospect.

Wang Guangfa, a respiratory expert at Peking University First Hospital who was a member of the WHO-China joint expert team in February, told the Global Times that he estimated that normal people-to-people exchanges will not happen in the coming one to two years.

Black swan event

However, experts also cautioned that the resurgence of the pandemic in certain overseas countries like India will likely become a "black swan" event for China's economic growth.

"Not only is the case number in India staggering, the coronavirus mutations found in India are dangerous as they are likely to nullify the efficacy of current coronavirus vaccines," said Wang, warning China, India's close neighbor, to be cautious about the latter's outbreak, as even a little slackening of efforts would put a dampener on the previous achievements.

Tian said that if virus from India spreads to certain parts of China and causes regional lockdowns, its impact on the Chinese economy is "uncertain."

The Chinese Center for Disease Control and Prevention published an academic paper recently, saying that China has reported three imported COVID-19 cases in late April, and Indian coronavirus variants were found on those three people via genetic sequencing. The three had been working in India.

Wang noted that the impact on the Chinese economy brought by closing borders is relatively small as the country has a vast internal market. "We must strike a balance between economic development and staunching the viral spreading within the country."

Apart from coronavirus threats, rising inflation in the globe, particularly in bulk commodity products like oil would also pose threats to the Chinese economy, including shrinking exports and rising manufacturing costs, Tian said.