COMMENTS / EXPERT ASSESSMENT

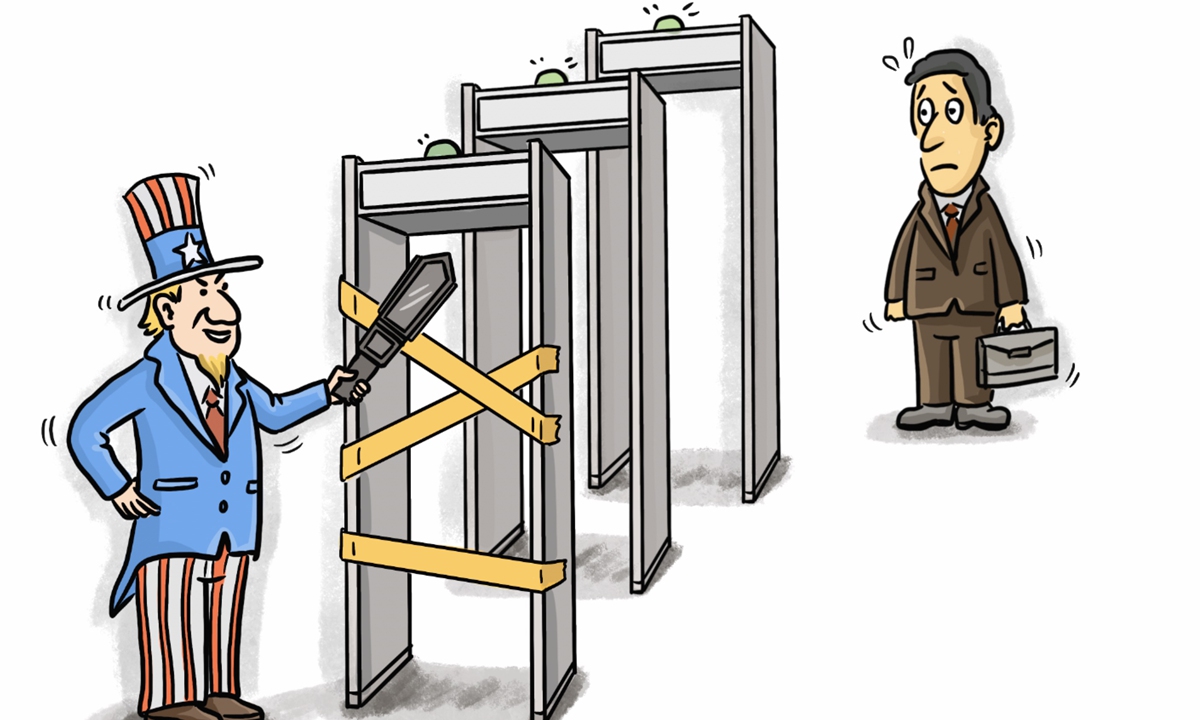

US regulators ought to be fair to Chinese listings

Illustration: Xia Qing/GT

With the US fleshing out rules that are considered to ratchet up pressure on US-traded Chinese firms to comply with stricter oversight, fears are mounting that a large-scale delisting of Chinese concept stocks might be inevitable.

Such challenges are not self-evident, although there needs to be a call for the US regulatory authorities to be fair to Chinese firms. Being fair means that the regulations should be panned out equally to "all" foreign firms listed or to be listed in the US, rather than targeting only firms originating from China. Whether US listings are still preferred by Chinese firms would largely be dependent on the nature of their businesses, their preferences for capital, investor base and information environment, as well as their current auditing practices.

And even the worst-case scenario comes true, these firms still have the Chinese mainland and Hong Kong as the backing, especially factoring in the progress on building a more transparent and efficient capital market, and clampdown on stock market manipulation.

Earlier in May, the Public Company Accounting Oversight Board unveiled a proposed rule to accord to the Holding Foreign Companies Accountable Act. The rule change, seeking public comment until July, is seen as readying US-traded Chinese firms for dealing with a tougher regulatory framework.

That said, it's hoped that Chinese firms are not singled out in confronting the tightening requirements. US market regulators need to be fair. The tougher rules when it comes to information disclosure or penalties for violations should apply to all companies from across the globe.

If they are fair, the destination of Chinese listings supposedly rests upon the company's nature, the kind of capital, investors and information environment it wants. With smart management teams, it won't be a concern for these companies to put in place necessary solutions. Even it turns out that the US market becomes intolerable for Chinese listings, they still have Hong Kong and mainland exchanges to meet their financing needs.

In a sign of future developments, Chinese online recruitment platform Kanzhun on Friday filed with the US Securities and Exchange Commission for an IPO of up to $100 million, despite a growing trend that has seen homegrown technology names such as JD.com and NetEase opting for Hong Kong for secondary listings.

Also, there's still room for Chinese regulators to strengthen communication with their US counterparts, especially when considering that the A-share market, which has only been around for 30 years, still have many aspects to be developed when compared to the mature US market. Given its longer history and experiences, the US market is arguably a regulatory template for the A-share market, particularly when it comes to information disclosure and investor protection.

Good news is that the newcomer is playing the catch-up.

There have been complaints that penalties for market manipulation remain lenient in the A-share market and class actions are beyond the reach of retail investors. It's a different case now, with the recent ruling that Shanghai Feilo Acoustics pay 315 investors more than 390,000 yuan ($60,613.59) per capita in compensation for information disclosure violation-induced investment losses. The adjudgment wound up an ordinary representative litigation in securities disputes that was filed in August 2020, the first of its kind in the country.

In a recent suggestion of a stronger crackdown on market manipulation, Yi Huiman, chairman of the country's securities regulator, vowed Saturday to maintain "zero tolerance" policies toward moves that leverage capital and information advantages to manipulate stock prices, damage investors' legitimate rights and interests and disrupt markets.

Still, investor education will have to be a sustained effort over an extended period to inform notably would-be investors against speculative and gambling bets on A-shares.

In this context, the country's financial deregulation that sees foreign investors, especially institutional investors, lining up for a bigger footprint in its stock market, would set A-shares for more rational investment decision-making, putting in place a two-way road that facilities flows of global investors into the market as well as the enabling of a broader horizon for local investors.

The article was compiled by Global Times reporter Li Qiaoyi based on an interview with Zhang Xiaoyan, associate dean at PBC School of Finance, Tsinghua University, and previously a member of the Issuance Examination Committee of the China Securities Regulatory Commission, at the Tsinghua PBCSF Global Finance Forum in Beijing on Saturday. bizopinion@globaltimes.com.cn