Illustration: Liu Rui/GT

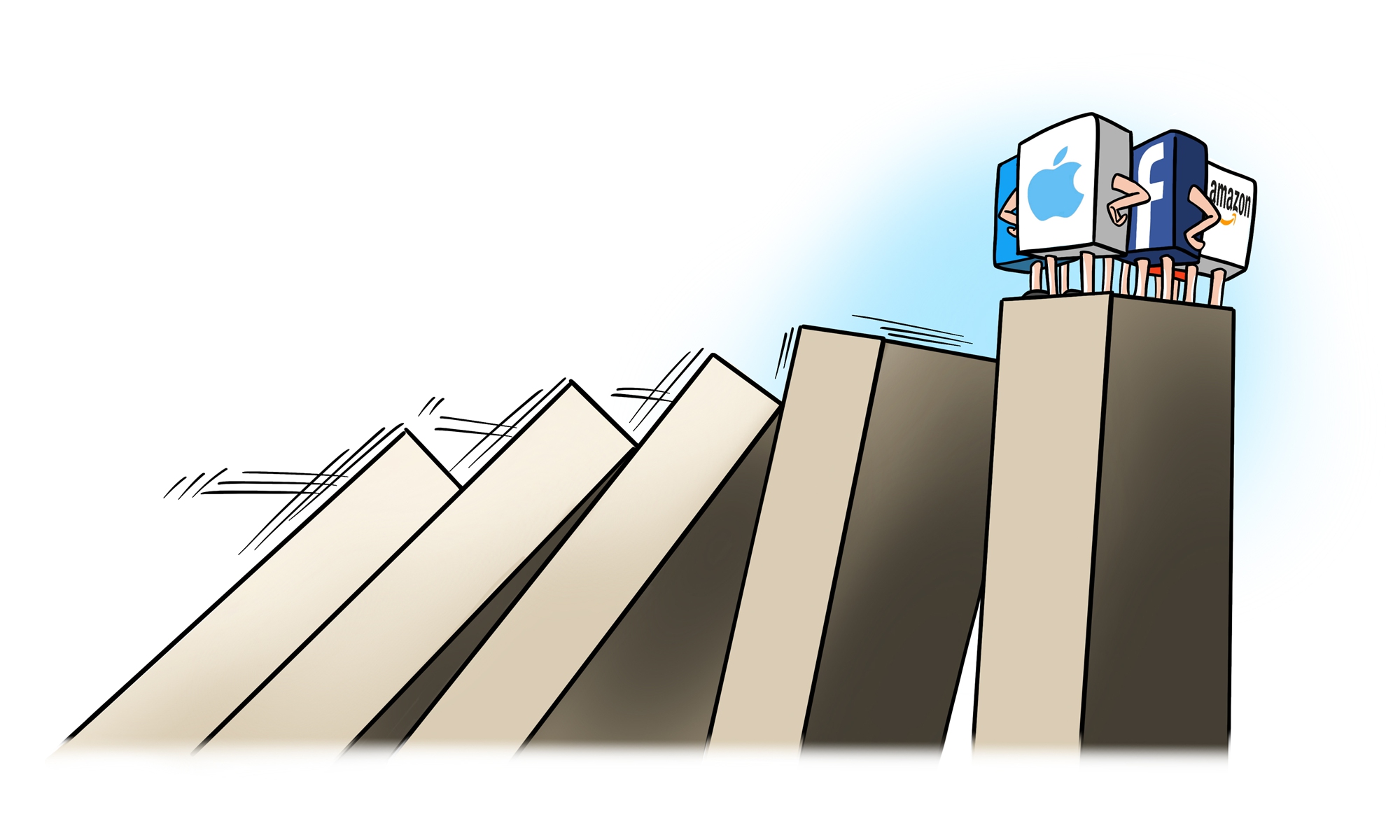

The values of top five US companies - Apple, Amazon, Alphabet, Microsoft and Facebook - have increased $1.28 trillion since the beginning of the year. Analysts believe the year of 2021 is likely to be the same as last year - another year of carnival of US high tech giants.But behind this carnival is the deepening of virtualization of the US economy. This will make the Biden administration's goal of boosting US infrastructure and reviving its manufacturing sector ever more distant.

This has nothing to do with money. It is a question of whether the US economic structure can sustain the operations of a "major empire."

De-industrialization does not mean a substantial decrease of the proportion of the manufacturing industry according to the US GDP. It means that industrial varieties and relevant jobs are disappearing. In fact, the volume of the US manufacturing output is still large, but generally the US investment to real economy is declining, with many factories closed, jobs lost permanently and job opportunities being transferred abroad.

The de-industrialization of the US has been long in the making. The proportion of labor forces in the manufacturing sector peaked at 28 percent in 1965, but by 1994 that figure had dropped to 16 percent.

During the decade between 2000 and 2010, the US lost 36 percent of job opportunities in the manufacturing sector. After that period, the job opportunities increased a bit, but the COVID-19 pandemic in 2020 has made the employment rate go back to 2010 levels. With the easing of the pandemic, employment began to resume, but most jobs are related to the services sector.

De-industrialization posed a direct destruction to the national economy and to entire communities. Without other economic opportunities, it has led to the decline of the middle class and brewed poverty. Long-term de-industrialization has led to the losing of skilled workers in the manufacturing sector.

As a result, the once glorious bases of the Five Lakes Manufacturing region have become desolate rust belts. The closure of a factory always means the fall of a town.

Meanwhile, more middle-class families will not allow their children to work in blue-collar sectors or study manufacturing-related subjects. The children of many Chinese in the US I know have chosen finance, information technology and bio-technology. Eventually, this has led to changes in US higher education.

One of the biggest impacts of de-industrialization has been that low-skilled workers now have fewer opportunities to improve their technical capabilities, as the sector has shrunk. The social outcome of this has been the shrinking income of the middle class and lower-middle class.

The development of modern countries is always accompanied by industrialization, and their decline often begins with de-industrialization. Having reserve currency is an advantage of empires. However, the retreat of industrialization due to the growing status of reserve currency will destabilize the foundation of the empires. The UK is a typical example of this process.

Alex Hochuli, a Brazilian scholar, published an article entitled, "The Brazilianization of the World" in American Affairs Journal in May. He wrote, "Fewer and fewer workers in the West are involved in economic activity that is productive of new value. This crisis of the society of work, or modernization through formalized work, began in the Third World, then hit the Second World, and is now with us in the First World."

De-industrialization has changed both domestic and foreign policies in the US. The current China-US relationship is, as a matter of fact, the result of US de-industrialization. The US attributes its own declining strength to the emergence of China, especially the competition brought by the rising Chinese manufacturing industry. US containment policies toward China are often mixed with anxiety and a sense of loss.

Will Joe Biden be able to make the US manufacturing industry rise again through policy adjustments? This is hardly likely. There is no precedent in the world in which a country can re-industrialize after de-industrializing.

The future competition between China and the US will not only take place in the high-tech field, but also across a wide range of industrialization sectors. The real economy is the foundation. This is China's advantage, which must be consolidated and further developed.

For the moment, China seems to have maintained an advantage in the real economy. Yet there are also signs over the tendency of de-industrialization in the country. Therefore, China needs to learn more from Germany, which is still Europe's manufacturing base due to its long-term maintenance and development of its foundational industries.

Germany might not be able to achieve economic structural transformations which centers on finance. But Germany can keep the investment of its real economy at a relatively high level via efficient policies, which in turn, have helped consolidate its real economy.

Sticking to industrialization, offering more support to the real economy and pursuing to realize high-tech industries on the solid foundation of industrialization, all these policies have been inked in China's 14th Five-Year Plan (2021-25).

The author is a senior editor with People's Daily, and currently a senior fellow with the Chongyang Institute for Financial Studies at Renmin University of China. dinggang@globaltimes.com.cn. Follow him on Twitter @dinggangchina