COMMENTS / COLUMNISTS

China’s economy likely to power ahead at more than 8% in 2021, beyond

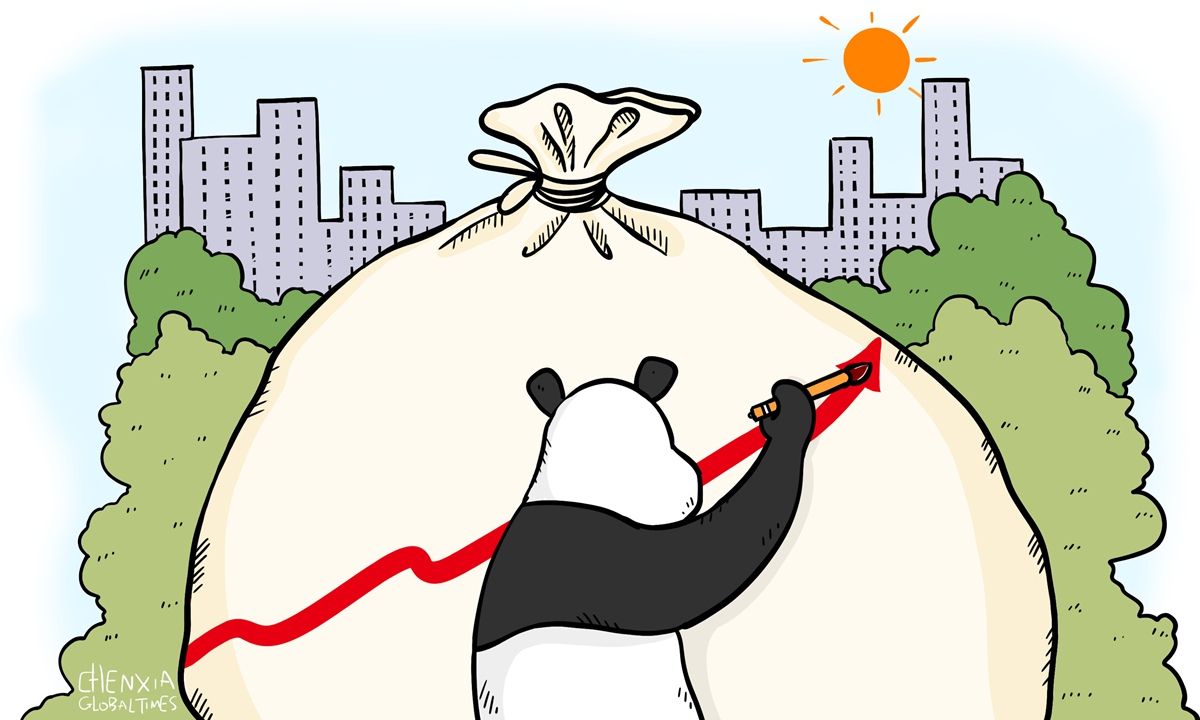

Illustration: Chen Xia/GT

China's economy grew 7.9 percent from April to June, the National Bureau of Statistics (NBS) announced on Thursday. The growth rate, lower than forecasted 8.1 percent by most market analysts, immediately draw major Western news media outlets to pour cold water on the world's second largest economy, with some portending it will deteriorate further in the coming months and unable to compete with the US economy.

But it will prove those media pundits wrong when the year-end results come out. Past experiences tell the world that the Chinese government owns unparalleled acumen and coveted ability in managing its economy. This explains why China stood firm and prevailed during the 2008-09 global financial debacle and the 2020 novel coronavirus health crisis, while many other countries, including the US, suffered grave recessions, human loss and social upheavals.

There are plenty of policy tools available to Chinese decision-makers to steer the economy to run at a higher gear. The People's Bank of China's 50-basis-point cut to the reserve requirement ratio, or the amount of funds commercial lenders must hold in reserve, released 1 trillion-yuan ($154 billion) worth of liquidity into the economy last week to support the third-quarter GDP grow at a considerably higher rate.

Unlike the Trump and Biden administrations which resorted to several rounds of pandemic- rescue stimulus plans, spending more than $5 trillion borrowed money to keep the US economy retain its "sugar high", Beijing has been cautious to avoid "flooding" its economy with excessive liquidity - that partially explains why the yuan has steadily appreciated in value against the US dollar since March 2020 by more than 10 percent till today.

As a matter of fact, to manage financial risks from negatively impacting the economy, China has been deleveraging and all of the so-called "too-big-to-fail" state-owned banking giants are now on a stronger and healthier footing. Local government debt has also been brought under tighter control. In the first five months of this year, special purpose bond issuance totaled only 1.2 trillion yuan, compared with 2.3 trillion issued over the same period last year.

Therefore, Chinese policymakers have room to maneuver when it comes to creating a stronger and healthier economy. They could reduce the reserve ratio again in the second half of the year, or move to cut the benchmark interest rate to make sure the economy expands at 8.5 percent in 2021 and 7 percent in 2022, when the ruling Communist Party of China (CPC) is expected to hold its 20th national congress, another event of global importance.

Chinese economists are aware that the economy is highly resilient after overcoming the coronavirus pandemic fallout. Increasingly, the giant economy is being boosted by rising domestic consumption, roaring external demand for Chinese goods, and the government's laser-like focus on infrastructure investment, new and high technology investment, and non-stop improvement of 1.4 billion people's welfare.

The "dual-circulation" development strategy proposed by China's top leadership last year - primarily relying on enlarging Chinese home consumption power and actively accelerating the economy's "electromagnetic effect" through enlarging foreign trade and investment - ought to be enforced vigorously, such as the iconic Belt and Road Initiative helping other friendly countries to develop faster, while boosting those countries' appetite for Chinese goods and technology.

Looking into the detailed numbers released by the NBS on Thursday, retail sales in June rose an impressive 12.1 percent from a year ago and industrial production grew by 8.3 percent, both higher than market estimates. Meanwhile, the customs administration said earlier last week that China's exports surged at a more-than-expected 32.2 percent in June. These figures speak of the health and resilience of China's economy.

"Our economy has seen a sustained and a steady recovery with the production and demand both picking up, employment and prices remaining stable, new driving forces thriving fast, quality and efficiency enhancing, market expectations improving, and prime macro indicators staying within reasonable range," the statistical bureau stated. So, allegations by some US media outlets that China's economy is hitting the wall and will sink and go broke is outright nonsense.

Also, their muckraking on China "exporting inflation" to the US is equally laughable.

It is US President Joe Biden's lavish fiscal spending policy, particularly the $1.9 trillion "American Rescue Plan" that he signed in March, is responsible for the sharp 5.4 percent rise in American CPI inflation in June.

And, why are made-in-China goods these days seeming pricier to American families? Just ask the US Federal Reserve officials how much they have pumped the greenback to the global monetary system, causing a stormy round of price rises of raw materials from steel, copper, lithium, gasoline to timber and chemicals.

In addition, the Biden administration's inheriting Trump's higher tariffs policy and waging a technology "decoupling" battle with China that has seriously disrupted global supply chains, including a prolonged shortage of auto chips, caused prices of American supermarkets and car dealerships skyrocketing. If the US government's policies are not revised quickly, the price elevation will only flare up in the coming months, forcing the Fed to raise interest rates and stifling its growth.

Cooperative competition is the correct way for Washington to pursue America's economic contest with China's. Unfortunately, the Biden administration, eager to contain China's rise, has followed a roadmap of "confrontational competition" with China, which is against economic basics and global development trends. Now, inflation has raised its ugly head, bedeviling a nascent economic recovery in the US.

It won't be very long that the US media pundits and the American people will recognize it is Biden's policies are handcuffing the American economy, while at the same time, China's economy and other economies, big or small, which interact positively with China, are keep powering ahead.

The author is an editor with the Global Times. bizopinion@globaltimes.com.cn