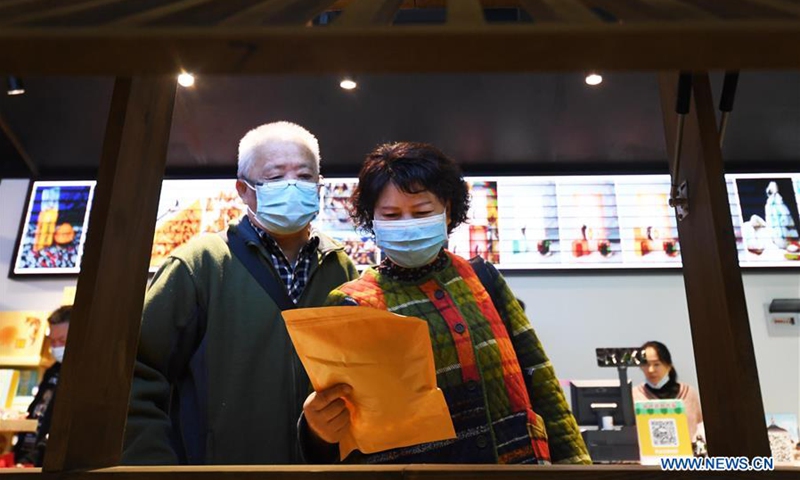

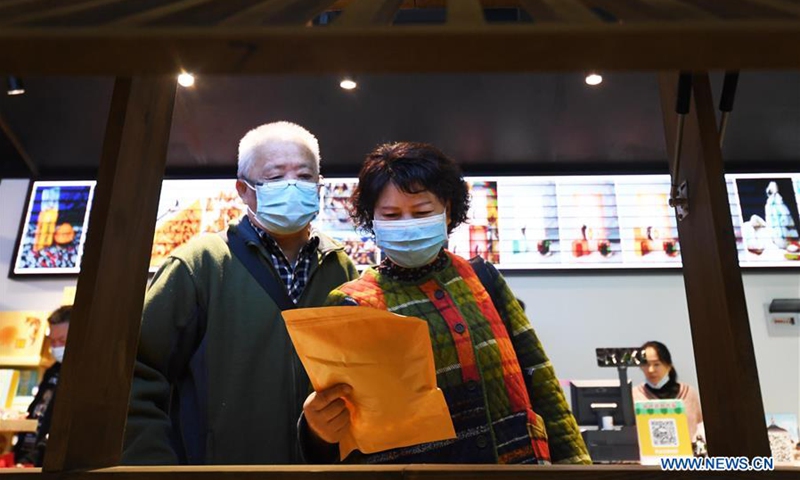

Customers select goods at the China Western Consumption Poverty Alleviation Center in Chongqing, southwest China, Oct. 31, 2020. The center, covering an area of 15,000 square meters, consists of 11 pavilions for China's western provinces and autonomous regions, and 33 pavilions for Chongqing's districts and counties. (Xinhua/Wang Quanchao)

Five major Chinese cities - Shanghai, Beijing, Guangzhou, Tianjin and Chongqing - have been selected to develop international consumption centers, a senior trade official announced on Monday, in the country's latest step to bolster the domestic market.

The move mainly aims to shore up domestic consumption under the country's wider push for the dual-circulation strategy, as well as to construct global shopping centers that could rival cities such as Tokyo, Dubai, London or New York, observers noted.

Chinese Commerce Minister Wang Wentao said that the State Council, China's cabinet, has approved plans for the five cities to build international consumption centers. But he did not reveal any further details.

Analysts said they expected that follow-up measures from the central government might be released later this year.

Given the uncertainty in the external environment, China needs to emphasize the role of internal circulation to drive economic development, Bai Ming, deputy director of the international market research institute at the Chinese Academy of International Trade and Economic Cooperation, told the Global Times on Monday.

"As a country with per capita GDP exceeding $10,000, we need to increase the proportion of consumption in GDP, which is more sustainable than investment," Bai said.

Nationally,

retail sales rose 23 percent year-on-year in the first half of 2021 to 21.2 trillion yuan ($3.28 trillion). The contribution of consumption to economic growth reached 61.7 percent, according to data from the National Bureau of Statistics (NBS) released on Thursday.

Retail sales grew by an average of 4.4 percent in the past two years, and they surpassed the level recorded in 2019, said the NBS.

An industry observer told the Global Times on Monday that apart from efforts to shore up domestic consumption, the plan announced on Monday also aims to pave the way for China's cultivation of its own mega international shopping centers similar to Tokyo or New York.

"It also means the vast Chinese consumer base may not need to go overseas for shopping, as it can find everything at home," said the observer.

However, there is still a gap between Chinese cities and the world's first-tier cities in terms of service facilities and quality, suggesting that Chinese cities could learn from those leading cities in a targeted way, for instance, learning from Paris in the field of fashion, said Bai.

The five cities, spanning China from the south to the north, have already announced their own development plans as early as 2019 with difference focuses based on their advantages.

For instance, Guangzhou in South China's Guangdong Province said in September 2020 that it would vigorously attract international well-known brands to set up their first stores and flagship stores, and appoint general agents. It aims to gradually bring in 200 international brands within three years.

The city would also speed up the development of port-based duty-free shops, explore the establishment of duty-free shops in the city, and introduce international brand discount stores.

In a document in 2019, Southwest China's Chongqing municipality said that apart from efforts to attract international brands, it would also build an international exchange center for the central and western regions.

Chongqing, known for its hot and humid summers and spicy hotpot, has risen as an emerging first-tier city in China in recent years.

According to the document, the contribution rate of consumption to economic growth will exceed 55 percent by 2022 in the city, with total

retail sales expected to exceed 1.1 trillion yuan.

By 2025, the contribution rate of consumption to economic growth will exceed 60 percent.

Shanghai said in a statement in April this year that it would support brands to open more high-end flagship stores and experience stores in Shanghai, and support the upgrading of the headquarters of international brands in China to become Asia-Pacific and even global headquarters.

It would also explore and simplify regulations for customs clearance, commodity inspection, and Chinese labeling of seasonally limited cosmetic products that meet certain conditions.

To build international consumption centers, the software and hardware should be in line with the world's first-class consumer cities, with a focus on new models, new formats, premium brands and high-end positioning, Bai added.