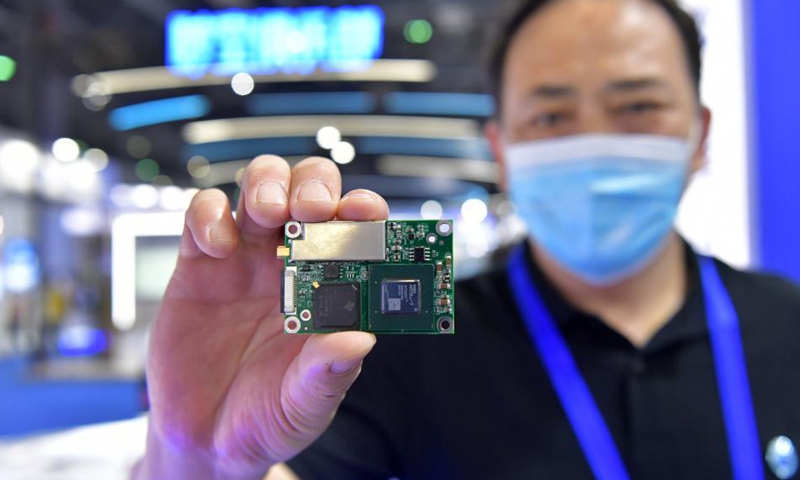

An exhibitor shows a module with an anti-jamming chip during the 12th China Satellite Navigation Expo (CSNE) in Nanchang, capital of east China's Jiangxi Province, May 27, 2021. Photo: Xinhua

The president of Taiwan Semiconductor Manufacturing Co (TSMC) called on countries to adopt "free trade" at a time when many governments were pushing localization of the semiconductor industry, as he said that semiconductor localization could only be regional phenomenon, according to media reports.

The company's call for free trade showed its concern that the rising protectionism trend and political friction would harm its global strategy, such as hindering its sales to Chinese customers or being forced to set up more overseas plants as a result of semiconductor localization strategies, experts said.

Liu Deyin, president of the TSMC, said on Monday during a stockholder meeting that free trade should be adopted apart from national security concerns. He also said that the current push for semiconductor localization by many governments is a result of mixed factors such as coronavirus, trade row and natural disaster, but eventually governments will make the wisest choice.

"Semiconductor localization will happen but only in the form of regional development. The world's semiconductor supply chains are deeply integrated, and it's impossible to localize customers," he was quoted as saying by Chinese electronics information portal ijiwei.com.

The company has already recorded losses in the US strike against Chinese tech companies and was forced to drop one of its biggest clients Huawei, although experts said that influence of the drop has been offset by rising global demands for high-end chips.

"What TSMC is afraid is not only about rising costs under the semiconductor localization strategies, under which it is forced to build more plants overseas, but about the possibility of being asked to choose sides, which will hit its business whatever side it picks," independent tech analyst Fu Liang told the Global Times on Monday.

Liu also disclosed that it is moving to expand overseas capacity, such as building a $12 billion wafer factory in Arizona, the US and planning to expand the capacities of its Nanjing plant in East China's Jiangsu. It is also considering building a new chip making plant in Germany, although the plan is only at early stages now.

According to Fu, some of those plans should be a "helpless choice" for TSMC, as it should be under increasing pressure to build "localized" plants in overseas countries, but the costs and industries in certain countries are unfit for such operation.

TSMC's business statistics revealed this year showed a rapid upswing, though falling behind market expectations. In the second quarter this year, TSMC recorded $13.3 billion in revenue, up 19.8 on a yearly basis. Its profits surged 11.2 percent to $4.804 billion.

Liu said that all aspects of the company had made significant progress over the last two years. In 2020, TSMC's revenues surged 31 percent in US dollar terms, and he expected the company's revenues could grow by 20 percent this year.

Fu noted that TSMC's biggest challenge is how to adjust and expand its capacities in a short period of time to meet spiking global demands, as well as how to deal with potential risks, arising from political uncertainty, that might bring them business losses in the process of capacity expansion.

Global Times