COMMENTS / EXPERT ASSESSMENT

International shipping prices continue to soar, calls for flexible logistics arrangement

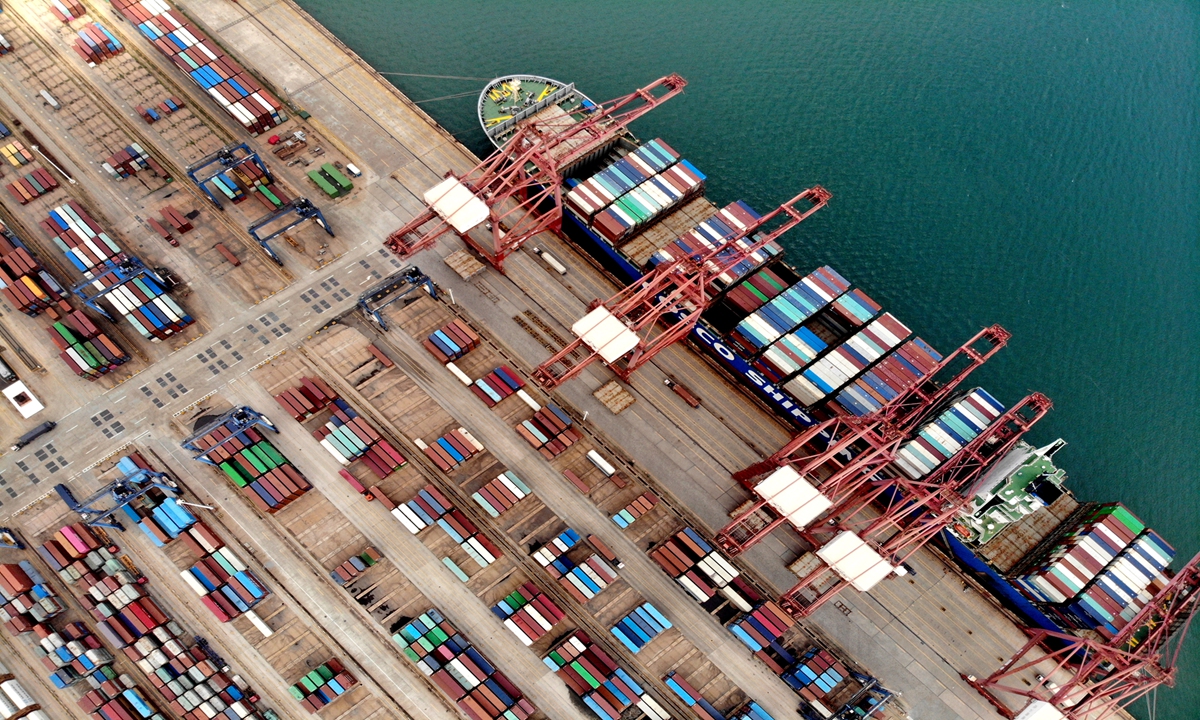

An aerial picture shows a terminal of Lianyungang Port in East China's Jiangsu Province on Sunday. In the first half of 2021, cargo throughput at the port reached 134.41 million tons, up 6.29 percent year-on-year, and container throughput was 2.49 million standard containers, up 4.26 percent. Photo: VCG

The rocketing shipping prices and a drastic shortage of containers have been putting huge pressure on Chinese trading companies since the beginning of the pandemic. China Central Television (CCTV) on Wednesday reported that, since April, freight rates have surged by around five times compared with the same period in 2019.

Particularly for the European and US routes, firms are now booking containers a month in advance, the report said, noting that increasing shipping demand and short supply of shipping capacity have been driving up the prices, combined with falling turnover efficiency in overseas ports which has also aggravated the container shortage.

In fact, skyrocketing freight rates is no longer breaking news. During the past year, the prices have been climbing on a weekly and even daily basis. The price of delivering one container from China to the UK in last November jumped 300 percent from that of March in 2020. Industrial data showed that global shipping prices in May have hit a 12-year new high.

The deadly novel coronavirus and emerging variants have been battering the global trade, altering the previous international production pattern and creating an extremely uneven distribution of containers.

As China managed to bring the epidemic under control faster, its manufacturing sector has seen an earlier recovery and increasing external demand. It reported a 27.1 percent year-on-year growth for trade in the first half of 2021. Its exports surged 28.1 percent during the period, and imports increased 25.9 percent, becoming a stabilizer of the global trade throughout the pandemic.

Meanwhile the virus and its variants will not be eradicated any time soon. While the spread continues in many countries and regions and resurgence risks remain, market observers estimate that the imbalance between demand and supply of the shipping capacity may persist until next year. Though transport departments have been stepping up efforts to relieve pressure, more coping measures may still be needed from different parties to jointly tackle the challenges, such as firms forming a more flexible logistic arrangement to shore up flexibility and anti-risk capability, and industrial groups to enhance related coordination to increase shipping efficiency.

It will undoubtedly be a tough campaign, but the international freight patterns have already seen obvious changes during the pandemic. Land transportation has witnessed faster growth and played an increasingly important role in the cross-border trade sector. For instance, some stations of the China-Europe freight train routes rolled out contact-free clearance services to control the infection risks of goods delivering.

The Suez Canal jam in March also disrupted the shipping market order which observers believe it still causing ripple effects. The accident served as a warning for global traders that they may need a more diversified logistic arrangement, which is crucial not only during the pandemic, but also important for their long-term growth.

Industrial organizations need to enhance coordination, especially among small-sized trading firms, as reports have revealed that many companies choose to book more containers than actual need in order to secure their delivery amid the container shortage, it may only aggravate the market imbalance. Also, frequent price changing requires closer supervision from industrial organizations and market regulatory authorities.

Currently, the potential resurgence of the infection has clouded near-term prospects for some countries and regions, but the overall global outlook remains promising. China, as the largest manufacturing hub and the second largest economy of the world, has shown its strong resilience during the health crisis. With continuous effort to keep inflection at bay and support production, its trade sector is expected to remain rosy in the future which will bring about challenges such as shipping problems for the trading companies, but, also an opportunity for them to upgrade and grow.

The author is an editor with the Global Times. bizopinion@globaltimes.com.cn