Amazon blocks top Chinese sellers, forcing industry to seek new pathways

Cross-border e-commerce challenged

Cross-border goods are sorted at a facility in Rongcheng, East China's Shandong Province in June 2020. Photo: cnsphoto

The move to block Chinese sellers by US-based e-commerce giant Amazon may speed up the pace for the Chinese companies to develop more direct selling channels and construct their own platforms, online vendors said.

On Friday, the Shenzhen Municipal Bureau of Commerce held a closed-door conference with about 10 leading cross-border e-commerce enterprises in response to Amazon's move to shut down Chinese sellers, to discuss and navigate the influence it had on local cross-border e-commerce, the Security Times reported on Friday.

This comes after the US platform has banned a number of top Chinese merchants from its platform who have been alleged for paying for reviews. The list includes some big-name wholesalers on the platform with annual sales exceeding $1 billion.

According to the Shenzhen Cross-border E-commerce Association at least 50,000 Chinese merchant accounts had been affected by Amazon's move since May, and that Chinese cross-border e-commerce companies had suffered losses of more than 100 billion yuan ($15.4 billion).

A number of cross-border e-commerce enterprises and associations told the Global Times that the incident has prompted the industry to develop more selling channels and build their own independent websites.

The storm

Since May, Amazon has blocked up to 50,000 Chinese sellers on its platform. The reasons for the ban include "improper use of review functions", "soliciting fake reviews," and "manipulating reviews by giving gift cards."

The ban came as a huge blow on some Chinese vendors.

Yiwu Huading Nylon Co, one of the major domestic civil nylon filament manufacturers, issued an announcement on August 5 that its wholly-owned subsidiary Shenzhen Tomtop Technology has a number of brands suspended and funds frozen by Amazon. As of August 5, 54 stores under Tomtop Technology were banned and 41.43 million yuan was frozen, accounting for 4.27 percent of the company's cash reserve at the end of 2020.

On August 6, another mega seller Patozon issued a notice that it has suspended its research and development staff for six months until February 6, 2022. In 2020, Patozon reported net profit of 300 million yuan and is known as one of the top three Chinese sellers on Amazon with more than 600 Best-Seller products.

The way that Amazon has blocked Chinese selllers is unfair, Wang Xin, president of the Shenzhen Cross-Border E-Commerce Association, told the Global Times.

"It not only blocked accounts in violation of its rules, but also other related accounts, which could paralyze upstream supply chain and kill the enterprises," Wang said. "Is it a penalty decision based on the rules of the platform, or is it a strategic decision? In fact, we see that Amazon itself is also selling products similar to the products of the closed accounts," she said.

Way out

The digital blockade put in place by Amazon has taken a heavy toll on the sellers, however it also educated the cross-broader e-commerce traders on how to optimize operations and form relationships with global sellers.

"The internet has undoubtedly put us in the fast lane, but we need to run faster on the track. It depends on the cultivation of the quality of the sellers, improved learning ability and national-level support," Wang said.

Following the latest incident, many sellers are reducing their reliance on Amazon, instead pursuing a multi-platform development strategy and developing their own websites.

"Amazon's closure of accounts is a blow to our industry. A lot of people told me that I would not put goods on Amazon anymore. In the past, maybe 90 percent of their goods were sold on Amazon but now the ratio may be under 30 percent," Wang said.

Many top sellers in the business are setting up their own websites with their own payment and information system to prevent the sudden attack and accounts closure by a single website like Amazon.

"With self-built websites, there will be enhanced security," she said.

Challenges remain

There is a necessity for merchants to set up their own online stores; however, compared with the large data flow and trading volume on Amazon, establishing stores alone cannot replace selling goods on Amazon in the short run, Michael Qi Yong, general manager at consumer electronics distributor Shenzhen Muchen Technology Co, told the Global Times on Sunday.

The blow was a challenge to e-commerce practitioners in Shenzhen, Qi said. Some of his customers, who are traders based overseas, have found their funds frozen, or shutting down stores and downsizing.

"They put more efforts to set up their own online stores or on other platforms but Amazon. Speeding up destock of inventory which had been prepared for Amazon is another job," Qi noted.

Wang noted that developing own websites can be relatively difficult at first requiring a significant input. "They need to be familiar with the rules of the game, the construction of the internet and recruit a team of talent", Wang said.

However, Amazon's behavior will not slow down the pace of Chinese cross-border e-commerce trading.

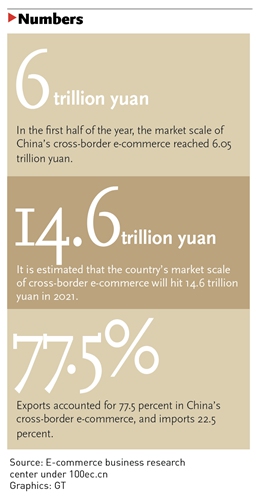

In the first half of the year, China's cross-border e-commerce trading continued to maintain strong momentum, reaching 886.7 billion yuan, a year-on-year increase of 28.6 percent, according to customs statistics.

The cross-border e-commerce exports growth in the second half of the year will not be lower than 28.6 percent, Wang said.

"The speed will be higher, because in addition to the US market represented by Amazon, some developing countries in Southeast Asia and Africa also have demand for Chinese products. As long as we can sell all the products, there is sure to be a high-speed development," she said.