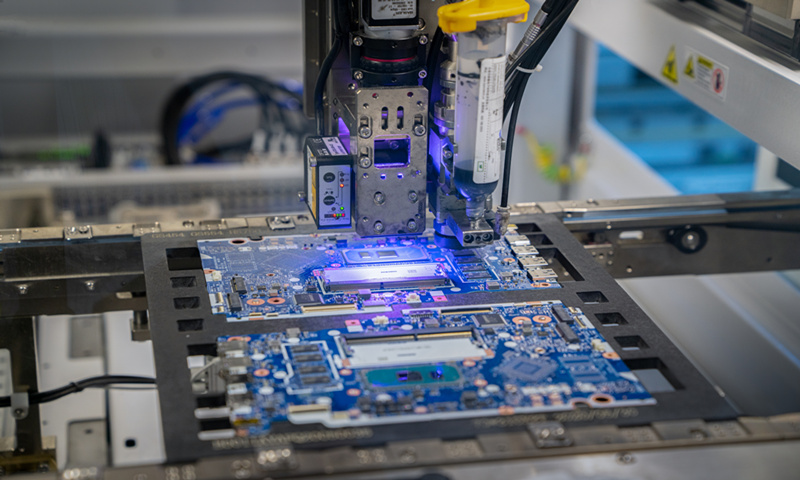

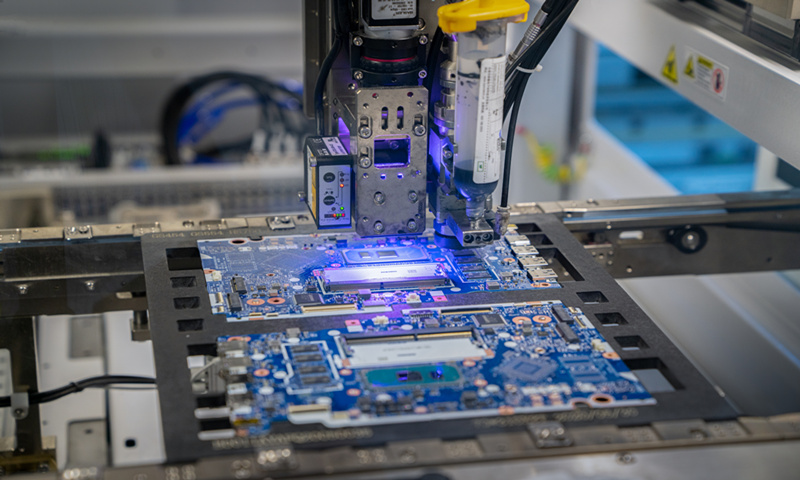

A chip manufacture machine Photo: VCG

Chinese chipmaker Wingtech announced on Monday that it had completed the acquisition of UK's Nepture 6 Ltd, the parent company of the UK's largest wafer manufacturer Newport Wafer Fab (NWF), despite disruptions and noises from certain anti-China forces in the West over the deal.

The deal is said to be the largest of its kind for the Chinese chip industry since the COVID-19 pandemic, during which the US has also stepped up a blockade on chip supplies to China. Though the move is significant for both companies, potential risks still exist, the Chinese firm and analysts warned.

In a filing with the Shanghai Stock Exchange on Monday, Wingtech confirmed the completion of the deal and reminded investors of potential risks since "the target company may be influenced by domestic and foreign industrial policies and other factors in the follow-up operation process."

Driven by news about the acquisition, shares of Wingtech closed up 1.21 percent at 107.59 yuan ($16.6) on Monday.

A source at Wingtech told the Global Times on Monday that the company saw great significance in the acquisition of the British chip plant for its own future development, which would help the firm expand its chip production.

"The impact on our overall performance will be significant just like our previous purchase of Nexperia in 2019," said the person.

A source at the China Semiconductor Industry Association (CSIA) also told the Global Times on Monday that amid a global chip shortage, Wingtech is dealing with its production capacity problem by acquiring foreign fabs.

Wingtech announced in early July that Nexperia, its subsidiary based in the Netherlands, signed an agreement to acquire Nepture 6 Ltd and its shareholders, intending to obtain full ownership of NWF.

Some UK politicians have since repeatedly asked for a probe into the deal for so-called national security reasons.

While this is a win-win deal for both sides, industry insiders said that the Chinese company's acquisition is more of a last straw for the British company, whose business was on the brink of collapse over declining profit before the acquisition.

In 2020, the UK company had a net loss of 18.61 million pounds ($25.78 million) on an operating income of 30.91 million pounds.

The completion of the deal is a good sign of how international cooperation rather than isolation in the chip industry supports the sustainable growth of all parties, analysts said.

But an expert with the CSIA noted that such cross-border acquisition is unlikely to become a broader trend given hostile attitude toward Chinese companies in some countries fueled by political bias.