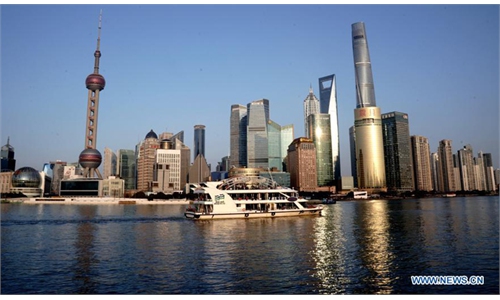

Photo: China International Finance Annual Forum 2021

Senior officials of Chinese finance regulators on Saturday vowed to step up to fix weaknesses in financial technology regulation and to promote institutional opening-up of the capital market at a forum of the China International Fair for Trade in Services (CIFTIS).

China will step up to fix weaknesses in financial technology regulation and bring all financial institutions, businesses and products into the prudential regulatory framework, Chen Yulu, deputy governor of the People's Bank of China (PBC), said at the China International Finance Annual Forum 2021 held in Beijing Saturday.

"We will enhance the effectiveness and professionalism of financial regulation, building firewalls to resolutely prevent systemic risks," Chen said.

China will continue to deepen the opening-up of the financial sector and implement opening-up commitments while accelerating the improvement of various institutional arrangements and promoting systematic and institutional opening-up, Chen noted.

The China Securities Regulatory Commission (CSRC) will further promote the institutional opening-up of the capital market, implement new regulations for qualified foreign investors, and facilitate the allocation of yuan assets by foreign investors, CSRC vice chairman Fang Xinghai said at the same forum.

The Hong Kong Exchanges and Clearing (HKEX) will start A-share futures trading this year, providing a good risk management tool for overseas investors to hedge their risks of investing in China's A-share market, Fang said.

Extreme easing policies by central banks in major developed economies during and over the COVID-19 pandemic have led to increasing financial fragility globally, said Zhou Liang, vice-chairman of the China Banking and Insurance Regulatory Commission.

China will actively participate in the formulation of international financial rules and strengthen financial technology cooperation and data security governance, Zhou said.

The State Administration of Foreign Exchange (SAFE) will build an open and diversified foreign exchange market, further increase foreign exchange market products and domestic and overseas participants, and continuously improve the infrastructure system of the foreign exchange market, said Zheng Wei, deputy administrator of SAFE at the forum.

Global Times