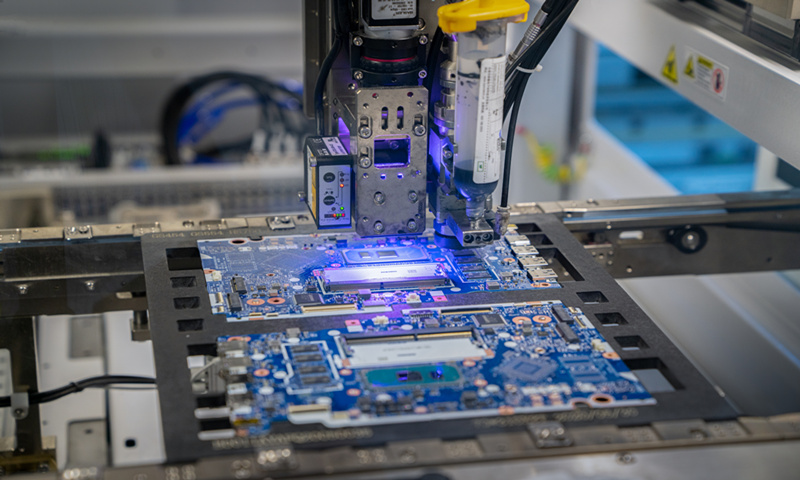

A chip manufacture machine Photo: VCG

Chinese technology company Vivo unveiled its self-designed imaging chip V1 on Monday, joining other leading domestic phone vendors including Huawei, Xiaomi and OPPO in building in-house chips as they seek self-sufficiency in chip-making amid the US' push of "tech decoupling" with China.

It's the first professional imaging chip the company has independently developed. The research and development (R&D) process lasted 24 months and more than 300 people participated in the project, according to a press release the company sent to the Global Times.

With a 32Mb cache, the image signal processor (ISP) chip features high performance, low latency and low power dissipation, it said.

The ISP chip is responsible for taking in raw pixel data from a camera sensor and then performing all necessary steps to convert that to final photos or video frames, whereas a system on a chip (SoC) chip is the processor of data in a smartphone, and many domestic manufacturers rely on products from foreign suppliers like Qualcomm.

The announcement comes prior to its formal launch of the Vivo X70 series, scheduled on Thursday.

Vivo has held the top spot in China's smartphone market so far in 2021, according to market research firm Counterpoint Research. The manufacturer captured a 23 percent market share in the second quarter, followed by OPPO at 21 percent and Xiaomi at 17 percent.

Chinese smartphone makers ramped up investment in innovation after Huawei's crucial components supply was banned by the US. Their dependence on external companies including Qualcomm and MediaTek results in almost no differentiation among smartphones produced by phone vendors, experts said.

In addition to Huawei's Kirin SoC and Xiaomi's self-made smartphone ISP named Surge C1, OPPO's semiconductor subsidiary Zeku is reportedly developing its own ISP chips, which are expected to be equipped with the Find X5 series in early 2022. Meanwhile, OPPO is doing R&D on SoC technology, media reports said.

Sun Yanbiao, head of Shenzhen-based research firm N1mobile, told the Global Times on Monday that developing their own chips is the only way for domestic smartphone brands to compete with highend players like Apple and Samsung, which already have a comprehensive layout in chips, algorithms, supply chains and even the capability to make smartphone processors.

"As the vision of future consumer electronics is for increasingly smart devices in the 5G era, ISP chips will be the threshold for competition," Sun said. He said that these companies' investment in chipset R&D will create a virtuous circle, since smartphones will sustain remarkable performance, compared with other smart devices, in market size, technological innovations and functions over the next five years.

The Chinese central authorities' favorable policies including tax breaks to buoy the growth of the chip and software sectors are also prompting more terminal manufacturers to jump on the chip design and manufacturing bandwagon, Sun said, adding domestic firms are expected to make new breakthroughs based on the experience they've built up over the years.

Global Times