A view of Great Wall Motor's Coffee 01 SUV in the International Motor Show Mobility 2021, which runs from Tuesday to Sunday in Munich Photo: Courtesy of Great Wall Motor

Europe, in the midst of a booming electric vehicle (EV) sector, has become a main target for Chinese automakers to go abroad and export their advanced technology and mature supply chains that have experienced rapid growth in China.

Several Chinese automakers including Great Wall Motor and EV start-ups like Xpeng and Leap Motor participated in the International Motor Show (IAA) Mobility 2021, which runs from Tuesday to Sunday in Munich.

Chinese tech giant Huawei also took part in the exhibition, showcasing its AR-HUD (augmented reality head-up display) solution, which uses a vehicles' front windshield as a display screen to provides a safer and enhanced driving experience.

Despite limited number of Chinese firms represented at the IAA, their presence reflects a trend of Chinese new-energy vehicle (NEV) makers eyeing Europe as their main overseas market, industry observers said.

Great Wall said at the IAA auto show that it will start taking orders for its latest launched plug-in hybrid vehicle (PHEV) Coffee 01 sports utility vehicle for the German market at the end of 2021 and deliveries of the vehicle will start in the first half of 2022.

It will also announce other European markets in addition to Germany in which they firm plans to launch the Coffee 01 vehicle. The Chinese automaker will launch its first European brand experience center of the WEY brand in Munich in 2022.

WEY is a luxury SUV brand in China owned by Great Wall. The head of WEY's European business told the Global Times that the exploration into European luxury auto market marked an important milestone not only for the firm but also Chinese auto industry in throughout the global market.

A concept car of WEY, a luxury SUV brand owned by Great Wall Motor, is on display at the International Motor Show Mobility 2021, which runs from September 7 to 12, 2021, in Munich, Germany. Photo: Courtesy of Great Wall Motor

Exports to scale upChina's auto export market still has significant room to scale up given the current size of around one million units per year, Cui Dongshu, secretary-general of the China Passenger Car Association, told the Global Times.

China exported a total of 1.08 million vehicles in 2020, down 13.2 percent year-on-year, customs data showed.

Despite a decline during the COVID-19 pandemic, Cui said that there was an obvious trend across 2020. In the past, the country's vehicle exports were mainly concentrated in developing countries and regions such as Latin America, West Asia, and Southeast Asia. From the perspective of export market distribution in 2020, developed countries are increasingly expected to become new growth centers.

"And NEVs could be a key driving force in enhancing China's exports in the developed regions like Europe, where it is rapidly shifting to green mobility," he noted.

Data from the China Association of Automobile Manufacturers showed that in the first half of this year, China exported 88,000 NEV units, an increase of 298.1 percent year-on-year.

But a positive trend does not mean the export market does not face challenges, said an auto industry analyst, who asked to remain anonymous.

"Problems including lack of brand awareness, imperfect service channels and poor localization adaptation still needed to be solved by Chinese auto players," he told the Global Times.

Why Europe?A number of Chinese EV makers including state-owned firms and a rising force of pure EV players have announced their plan since the start of this year to tap into the European market where the NEV market is rapidly expanding and business environment is under a favorable condition driven by local governments' push for a low-carbon society.

On September 8, the NIO ES8 vehicle has been awarded the five-star safety rating by European New Car Assessment Program. The Chinese Tesla challenger said it will soon start delivering ES8 units to Norway and will then launch sales in five more European countries.

Another Chinese EV player Xpeng has shipped the first batch of its upscale P7 sedan to Norway, with vehicles set to be delivered to local consumers from October onwards.

According to the European Electric Car Report issued by Berlin-based Schmidt Automotive Research this year, total sales volume of Chinese EV brands in 18 major European automobile markets reported an increase of over 13 times in last year compared with the same period in 2019, and their market share has reached 3.3 percent, signaling a fast development phase that Chinese EV makers are embracing on the European continent.

Electric cars in Europe are usually divided into two categories - battery electric vehicles (BEVs) and PHEVs. Both have been gradually penetrating the EU market over recent years.

One in every nine new cars sold in Europe last year was a BEV or PHEV, according to the European Environment Agency.

The EU's stricter rules on fleet's emission have triggered auto players on the continent to quickly drive onto the EV track.

On July 14, the European Commission adopted a series of legislative proposals setting out how it intends to achieve carbon neutrality in the EU by 2050, including the intermediate target of an at least 55 percent net reduction in greenhouse gas emissions by 2030.

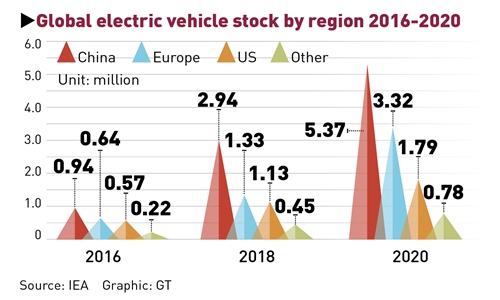

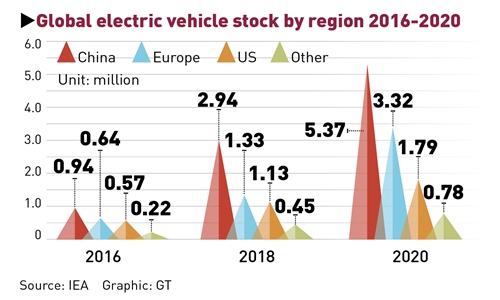

Global electric vehicle stock by region 2016-2020 Graphic: GT

Europe beat China as the region that registered the most EVs in 2020, the first time since 2015. Europe recorded 1.3 million newly registered units while China recorded 1.2 million units. In 2019, those numbers were 465,000 for Europe and 1.1 million for China, according to the International Energy Agency.

"But this year, we estimate that China will regain its No.1 position in terms of NEV sales based on figures over the past few months," Cui said. Cui forecasts that NEV sales in China this year could hit around three million units, while the figure for Europe could grow to two million.