Aircraft giants double down on China cargo market

Plane manufacturers mull more efforts on freighter business

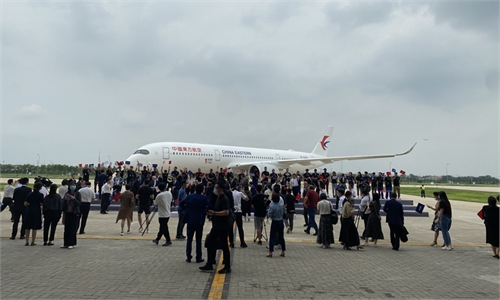

A press conference hosted by Airbus in the Zhuhai airshow on Tuesday Photo: Tu Lei/GT

US giant Boeing and Guangzhou Aircraft Maintenance Engineering Company Limited (GAMECO) Tuesday announced plans to create additional capacity for the 767-300 Boeing Converted Freighter (BCF) to help meet continued strong market demand.

The agreement, revealed by the two companies during a signing ceremony at the China International Aviation & Aerospace Exhibition in Zhuhai, South China's Guangdong Province, will expand freighter conversion capacity at GAMECO, opening two new 767-300BCF conversion lines next year.

GAMECO will be the first MRO in China to convert the 767-300BCF and the only MRO converting both the 767-300BCF and the 737-800BCF. Earlier this year, GAMECO announced plans to open a third 737-800BCF conversion line.

Airbus said on Tuesday the firm's plan for a new A350 freighter has been approved, and the first A350 freighter is expected to hit the market in 2025.

"We will bring a new choice to the market," George Xu, CEO of Airbus China said on Tuesday.

Airlines that suffered heavy losses in passenger traffic have realized the huge value of cargo business almost "overnight." When the number of cargo planes was not enough to meet the capacity demand, they even did not hesitate to convert a large number of passenger planes into the cargo business by simply refitting the cabins.

According to data released by the Civil Aviation Administration of China (CAAC), in 2020, the cargo and mail transportation volume of China's civil aviation still reached 6.76 million tons, equivalent to 89.8 percent in 2019, when the belly compartment of a passenger plane carrying about 70 percent of the cargo was suspended; airport cargo and mail throughput reached 16.079 million tons, a decrease of only 6 percentage points year-on-year.

A Boeing 757 freighter loaded with cargo by SF Airlines arrives at Nantong airport in East China’s Jiangsu Province. Photo: CFP

As the impact of the global pandemic begins to fade, will air cargo return to its previous "normal state"? Brian Pearce, chief economist of the International Air Transport Association said over the next few years, air cargo will continue to play a greater role than before the emergence of COVID-19, according to Beijing-based China Times.

In an interview with Global Times earlier, Michael Qu, SkyCargo manager of Emirates China, said that "China is a significant market among our network, and our global network recovery is firstly started from China."

He said starting from March, 2020, its cargo routes from China have increased dramatically, such as in one week, there were 18 cargo flights starting from Chinese mainland, increased from 10 before the pandemic. In comparison, at that time, a lot of countries were facing strict lockdown measures.

Emirates said it had barely paused its cargo flight operations during the pandemic. By mid-February last year, Emirates had fully resumed scheduled cargo flights to Chinese mainland to transport medical supplies and goods between China and other countries. During the COVID-19 pandemic in 2020, 87 additional charter flights operated from Chinese mainland, on top of scheduled flights, with the total tonnage on these flights being close to 4,000 tons.

For aircraft manufacturers, the slump in passenger transportation has reduced the demand for new aircraft orders. The increase in freight demand can increase the demand for new cargo aircraft on the one hand, and on the other hand can bring about the growth of converted cargo aircraft business.

In early May, Boeing completed a passenger-to-cargo 737-800BCF freighter at GAMECO and delivered it to China Post Airlines. This is also one of the three 737-800 passenger-to-cargo production lines Boeing has opened in China. Boeing has launched this modification task on a large scale in China. Since the first delivery in 2018, Boeing has delivered more than 50 737-800BCF freighters.

Boeing forecasts that 1,720 freighter conversions will be needed over the next 20 years. Of those, 520 will be wide-body conversions with Asian carriers accounting for more than 40 percent of total demand. The 767-300BCF has more than 95 orders and commitments.

Within the freighter market, Boeing occupies an absolute dominant position for its complete product line and huge market share. In comparison, in addition to the early A300/310 series of converted freighters that won some orders, the later launch of the A330-200F freighter has always had very few orders.

But Airbus is obviously not satisfied with the status quo. At a press conference last year, Airbus CEO Guillaume Faury made it clear that it will become "more active" in the freighter market, especially for wide-body freighters. In his view, there is only one "player" in this segment of the market that is not healthy, and Airbus will address weakness in the freight business.