US congress Photo:VCG

In the latest instance of fearmongering commentary over the Chinese real estate giant Evergrande's debt crisis, an opinion piece on Bloomberg on Tuesday tried to use the firm's troubles to disparage China's genuine aspirations to improve quality of life for its 1.4 billion people and its poverty alleviation efforts that have already achieved a historical milestone in eradicating extreme poverty, claiming that "common prosperity can turn into shared poverty very quickly."

Seizing on recent power shortages in Northeast China, many US and other foreign media outlets declared that China is suffering an energy crisis that threatens the Chinese economy. On Tuesday, US investment bank Goldman Sachs cut its forecast for China's economic growth for 2021 to 7.8 percent from the previous 8.2 percent growth, citing energy shortages.

Reading the foreign press converge on the Chinese economy, many would come away feeling that the world's second-largest economy is about to collapse. But the truth is that the Chinese economy is still on a solid recovery path despite also facing challenges.

There was already broad consensus that after rapid growth over the past several quarters, China's GDP growth will slow down in the second half of 2021. Chinese policymakers are well aware of that because they set the official growth target for 2021 to above 6 percent. That means even 6 percent growth would still be solid, not to mention that most credible organizations have predicated China's GDP to grow around 8 percent.

That's not to say that the Chinese economy does not face challenges. In fact, there are many serious challenges that need to be addressed, including power shortages, risks of a COVID-19 resurgence, surging commodity prices, increased burdens on firms, especially small businesses and even the US' relentless containment campaign.

But it should be clear to all fair-minded people to see that Chinese officials, from top leaders to local workers, have moved swiftly to tackle these challenges one by one head on. Just look at how China handled the COVID-19 - not just the initial outbreak in early 2020 but many subsequent outbreaks. Just look at how quickly central and local authorities moved to address the power shortages in Northeast China, as they moved to coordinate power distribution and sought to increase coal imports from Russia and neighboring countries for power generation. This - Chinese policymakers' ability to swiftly and effectively address challenges and risks, while continuing long-term development plans - is precisely what makes the Chinese economy resilient.

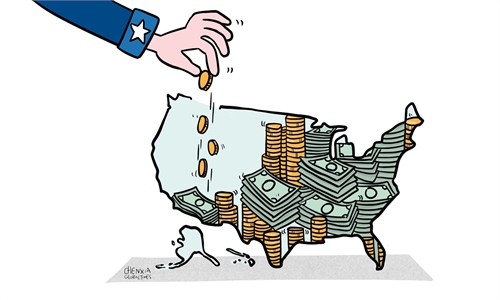

Meanwhile, the US is actually facing an "economic catastrophe," as the US Treasury Secretary Janet Yellen warned last week. On Monday US time, the US Senate failed to pass a measure to suspend the US government's debt ceiling. That means the US government is facing a shutdown at the end of the week and a potential default shortly thereafter, which some estimate may wipe out nearly six million jobs and erase around $15 trillion in US household wealth.

Even if the US Congress comes up with a plan to avoid a government shutdown and a default, as many expect, the partisan fight at the US Congress that puts the US economy on a brink of collapse is the latest example of just how dysfunctional and inept the US political system is in tackling any challenges and risks.

Forget about addressing challenges of the future with the massive multi-trillion infrastructure and reconciliation bills that still face tremendous hurdles to pass, the US can't even address the most pressing risks today - the COVID-19 epidemic and its economic fallout. Daily number of deaths in the US still remain above 2,000. And it is estimated the US economy will only grow 2.9 percent in the third quarter, compared to earlier predictions of 6.5 percent.

With such dire crises at home, many US politicians and media outlets are still busying casting stones at China and promoting the "China threat" theory. Apart from their inherent bias toward and lack of understanding of China, they also clearly want to divert attention away from the US' real crises. That may hide the lurking risks for a while, but it certainly won't make them disappear.