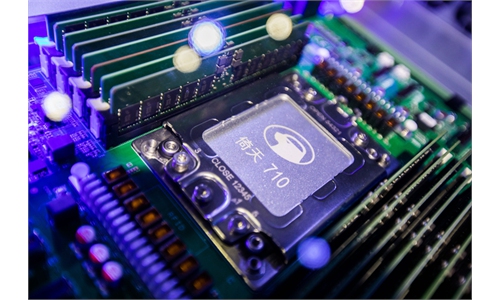

Workers make semiconductors at a company in Guiyang, Southwest China's Guizhou Province on Tuesday. In recent years, China has witnessed the blossoming of its chip industry, thanks to generous government policy support, as well as enthusiastic entrepreneurs and venture investors. Photo: cnsphoto

Chinese semiconductor firms have reported strong profitability in the July-September quarter thanks to price hikes caused by global semiconductor shortages since 2020, which has seriously disrupted the output of electronic products makers and auto manufacturers for months.

In a filing to the Shanghai Stock Exchange late on Sunday, Hangzhou Lion Electronics Co said its net profits surged 257.3 percent on a yearly basis to hit 195 million yuan ($30.6 million) in the third quarter, a record for a single quarter.

The company said that sales of its major products - including semiconductor silicon wafers and semiconductor power devices - increased significantly thanks to strong demand from downstream industries like vehicles and consumer electronics. Profitability has improved significantly.

Shanghai Fullhan Microelectronics Co, which is mainly engaged in microchips design, research and development, posted a 554.4 percent increase in its net profits in the third quarter to hit 269 million yuan.

Demand from downstream industries such as consumer electronics, smart autos and telecommunications equipment is expected to remain strong for the remainder of the year, industry observers said.

With business booming, domestic chip firms are also expanding their production lines.

In Pingshan New District, Shenzhen, South China's Guangdong Province, China's leading chip maker Semiconductor Manufacturing International Corp (SMIC) will build a new wafer fabrication plant there, adding more capacity amid the global microchips shortage.

According to a recent announcement by the Shenzhen Pingshan District Investment Promotion Service Agency on the selection plan for the 12-inch wafer foundry production line supporting project, the supporting facilities include gas stations and chemical warehouses required by the production line, with a total construction area of approximately 69,410 square meters.

Under the cooperation framework agreement issued by SMIC in March, investment in its new Shenzhen project was estimated at $2.35 billion, and it is expected to be put into operation next year.

"With the active expansion of wafer foundries in the Chinese mainland, the semiconductor industry chain will have opportunities to achieve sound development," a semiconductor analyst surnamed Liu told the Global Times on Monday.

Taken together, five major global wafer producers - TSMC, Samsung, Intel, GlobalFoundries and SMIC - have announced a total of more than $225 billion in investment since the beginning of this year, media reports said.

In a recent interview with CNBC, Intel CEO Pat Gelsinger said "every quarter next year we'll get incrementally better, but they're not going to have supply-demand balance until 2023."

Amid the chip crunch, the shortage of auto chips has become particularly acute.

"The darkest moment of the auto chips crunch has passed and the situation will continue to improve. But to completely end the shortage of chips, we will may have to wait until the peak sales of the traditional Spring Festival next year is over," Cui Dongshu, secretary general of the China Passenger Car Association, told the Global Times.

IHS Markit predicted the auto sector won't start to recover and normalize until the first half of 2023.

The shortage of microchips may reduce car production by about 2 million units throughout the year in China, Chen Bin, executive vice president of the China Machinery Industry Federation, said at the China Auto Supply Chain Conference on October 15.