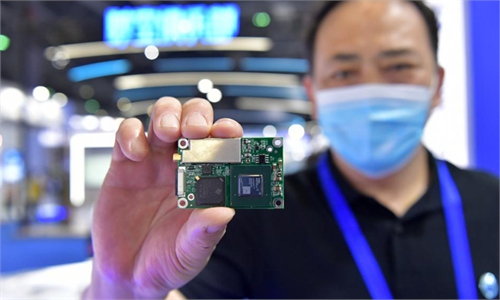

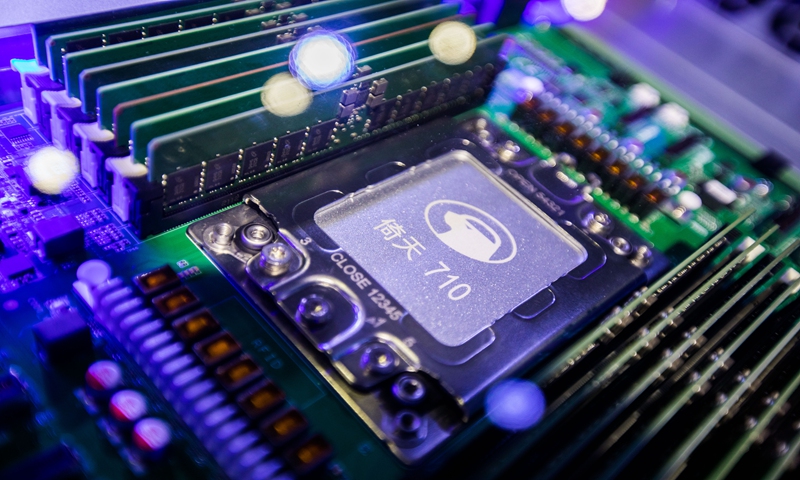

Alibaba's in-house semiconductor unit Pingtouge unveils self-developed cloud chip Yitian 710 in Hangzhou, East China's Zhejiang Province on October 19, 2021. Photo: VCG

With only a few days to go before a US-set deadline for global semiconductor companies to submit sensitive data to the US government, South Korean semiconductor giants appear to be among the last to make preparations to hand over their data, despite a clear reluctance to do so, The Korean Herald reported on Wednesday, citing anonymous industry insiders.

Samsung Electronics may not need to submit "classified" business information through negotiation between the US and South Korean governments, since South Korean Trade Minister Moon Sung-wook will visit the US this month to meet with US Secretary of Commerce Gina Raimondo, according to the report.

While it is unclear whether the information Samsung eventually submitted will violate the confidentiality clause in its contracts with clients, most global chipmakers seem to have resigned to the fact that they will have to meet the US government request for sensitive information even if they may suffer a backlash. This is perhaps because the US has made no secret of its ability to punish non-compliant firms, as the US Secretary of Commerce Gina Raimondo once said that if companies fail to respond to the US request "then we have other tools in our tool box that require them to give us data. "

Although the US Commerce Department requested sensitive business information from chipmakers under the disguise of boosting supply-chain transparency, there are growing concerns that the move may mark the beginning of the US taking a more aggressive approach to manipulate and control global semiconductor industry.

The US wants the global major chipmakers to meekly submit to its oppression so that it could build up its own advanced manufacturing capacity in the US by defining the "rules" in the global semiconductor industry, even at the expense of new round of disruptions to the snarled supply chains.

Moreover, since the sensitive business data in question will inevitably include confidential information regarding Chinese companies, many are worried that the data mandate may be part of the sinister efforts of the US government to escalate its technology containment against China as the White House has made it clear that technology is at the center of US-China competition.

From China's perspective, US access to sensitive data relating to chip supplies, which may seriously harm the interests of Chinese semiconductor-related industries, is a red flag for relevant firms to become more vigilant. China will not allow chipmakers, whether they are forced or not, to violate Chinese laws and regulations, putting Chinese technology companies at risk.

It is worth noting that China has its own edge in the global semiconductor supply chain. The struggle between South Korean chipmakers over how to answer the US request while complying with the business redline indicates their fears of potential consequences of getting involved in the China-US tensions.

China is the world's largest semiconductor market with significant chip application manufacturing capacity. It is essential for China to make good use of its market demand and manufacturing strength to gain more strategic initiative in the semiconductor supply chain by better organizing and coordinating downstream markets and the country's manufacturing activities.

Meanwhile, China needs to increase its influence on upstream supply chains through a number of measures. First, China needs to firmly develop its own semiconductor technology. Second, it is necessary to choose suitable suppliers by taking advantage of the competition among different chipmakers. Third, China may also pass on the cost pressure of semiconductors to end-users, exerting influence on upstream pricing.