Double 11 sales maintain momentum, as industry overhaul shows effect

Shifting trends highlight positive results from industry overhaul

Logistics company staff sort packages at a storage center in Qinhuangdao, North China's Hebei Province on November 10, 2021 as huge amounts of goods flood in amid the Double 11 online shopping festival. Photo: VCG

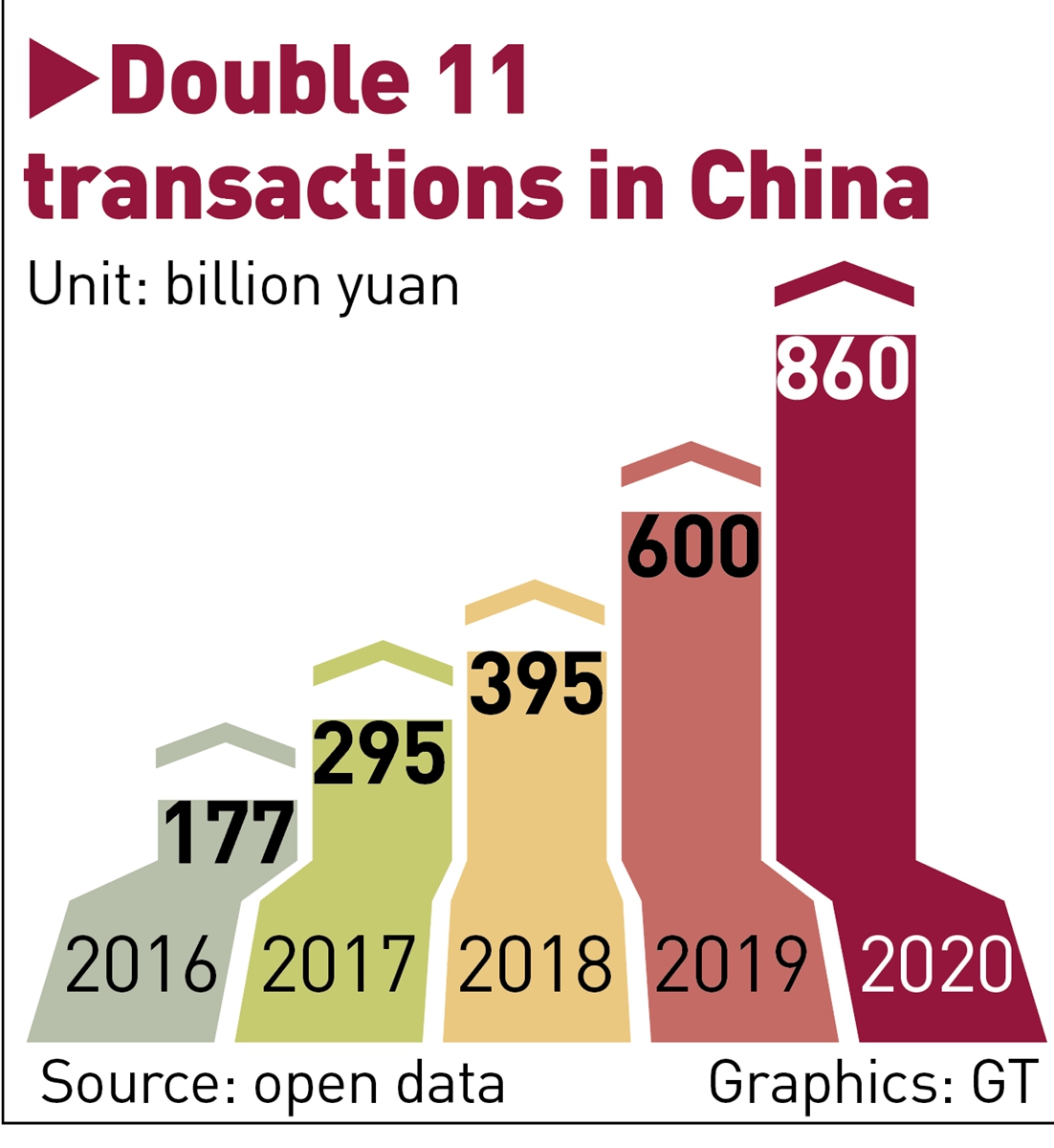

Double 11 sales

This year's Double 11 online shopping festival turned out to be vastly different from previous years, as e-commerce platforms on Thursday refrained from releasing "battle reports" showing new records are created by the minutes and hours as they have done for about a decade.

Still, various indicators showed that sales maintained momentum with some analysts estimating new sales records, despite some challenges, including new COVID-19 outbreaks and disrupted global supply chains. There were also other positive trends, including the rise of smaller platforms during the event that is usually dominated by industry giants.

The profound changes on the sales day highlighted the initial results from a regulatory overhaul that aims to rein in problematic, unfair business practices, while solid sales performance underscored still-strong spending power of Chinese consumers, even as they become more rational, analysts noted.

It was the first Double 11 shopping festival for more than 10 years where platforms did not disclose time-sharing transaction data, which analysts said showed that e-commerce platforms are focusing more on quality, and more attention is being paid to the sales growth of brands.

Within 45 minutes after midnight on Thursday, a total of 382 brands had sales exceeding 100 million yuan ($15.6 million) on Alibaba's e-commerce platform Tmall. This included popular domestic brands such as Huawei and Erke, and international brands, including Apple and L'Oréal.

As of 2 am on Thursday, the total sales of Xiaomi during the festival, which started on October 20, on omni-platforms exceeded 15 billion yuan, the company said on its Sina Weibo account.

Tmall said its total volume of transactions on this year's Double 11 shopping festival hit 540.3 billion yuan ($84 billion), up from last year's 498.2 billion yuan from Nov 1 to 11. Tmall started its presale on October 20 this year.

Rival JD.com said it received a total order valued 349.1 billion yuan, a record high, and the turnover of 43,276 merchants increased by more than 200 percent year-on-year. JD started its gala on Oct 31.

According to data from several major e-commerce platforms, the Double 11 festival in 2021 is likely to set new records, with sales, transaction speeds and participation rates all on the rise, Zhang Xiaorong, director of the Beijing-based Cutting-Edge Technology Research Institute, told the Global Times on Thursday.

"E-commerce has become an important stimulus to consumption and there were two main changes for this year's Double 11 - physical stores joined in the big party and more foreign brands moved in," said Zhang.

Due to the impact of the COVID-19 pandemic, more and more international brands have entered China by opening flagship stores on Tmall or other e-commerce platforms, eyeing the huge consumer market in China.

For example, many foreign brands that debuted at the 4th China International Import Expo, which ended on Wednesday, launched simultaneously on e-commerce platforms for the Double 11 event. Chinese consumers can buy goods from all over the world without leaving home.

But analysts also said that although the gross merchandise volume (GMV) of each major platform is still growing, the growth rates of GMVs have slowed and started to approach stability.

China's consumer market has huge potential because of its large population and growing middle class. However, e-commerce has basically become part of the nation's lifestyle and online shopping is not limited to the Double 11. The sales of the festival have flowed over into other months of 2021, Zhu Qiucheng, CEO of Ningbo New Oriental Electric Industrial Development, told the Global Times on Thursday.

In the first three quarters of 2021, retail sales totaled 31.8 trillion yuan, up 16.4 percent year-on-year, and online retail sales reached 9.21 trillion yuan, up 18.5 percent year-on-year, accounting for 28.9 percent of the total, according to statistics released by the National Bureau of Statistics.

For the 2021 Double 11 shopping festival, both sellers and consumers were more "rational," and e-commerce platforms no longer blindly pursued sales but paid more attention to quality, Zhu said, adding that "in general, the performance of the event is good. Many of our products were sold out seven days ago, so it might look like sales were flat on November 11."

Although more records are expected, the recently launched anti-monopoly policies, the supervision of digital economy platforms, and relevant guidance on e-commerce promotion activities meant that the overall promotion strategies of platforms tended to be conservative, Wang Peng, an assistant professor at the Gaoling School of Artificial Intelligence at the Renmin University of China, told the Global Times on Thursday.

In this context, platform diversification has seen a strong upward trend, and new platforms have emerged. In particular, short video platforms, such as Douyin and Kuaishou, have risen due to the new trend of livestreaming sales.

"Also, emerging platforms offer many discounts in normal times, which greatly reduces consumers' expectations for the Double 11," Wang said.