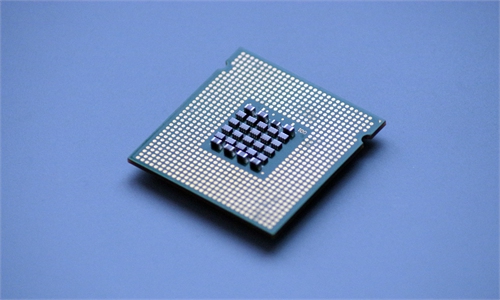

A worker checks a chip product at a factory in the Sihong Economic Development Zone in Sihong county, East China's Jiangsu Province on Monday. Photo: VCG

Chinese chip producers expect a very limited impact from the recent monthly fall in output amid logistics hurdles, booming demand, long delivery times and US restrictions targeting Chinese tech companies, calling it a " temporary crunch" that will be eased with production expansion.

China's integrated circuit output fell to 30.1 billion units in October from 30.4 billion in September, after reaching a record high of 32.1 billion in August, but output in each of the three months showed year-on-year growth of more than 20 percent, according to the National Bureau of Statistics.

The month-on-month drop was a result of the supply bottlenecks emerging from a shortage of global chip production capacity, analysts said.

"The production fall was partly due to the ongoing pandemic in many parts of the world, including in some Southeast Asian countries, one of the major chip-processing regions, where disrupted production has posed continuous uncertainties for chip supplies," an industry insider told the Global Times on Wednesday on the condition of anonymity.

A chip production line uses more than 30,000 parts and components, with many heavily relying on imports. If anything is missing, production and deliveries will be delayed, said another industry insider.

An employee surnamed Zhang at a chip packaging and testing plant based in East China's Jiangsu Province told the Global Times on Wednesday that although the facility is working at full capacity, its output dropped by around 5 percent in October from September, due to the tight supply of certain components from abroad.

"We are planning to expand our capacity again to cope with increasing demand, after the last expansion in March, which is necessary in the long run," Zhang said. This latest capacity expansion may take a longer time due to logistics hurdles, the epidemic and other untold restrictions.

China's leading chipmaker Semiconductor Manufacturing International Corp (SMIC) said last week that its capacity expansion was facing constraints.

Major global chipmakers said that chip shortages will continue at least into 2022, while some foundries said they are sold out of wafer capacity through 2023.

There are also concerns that the trend could have an impact on downstream businesses, ranging from home appliances to mobiles and new-energy vehicles (NEVs).

But industry insiders said that compared with the hard times experienced in the first half of 2021, the global chip shortage has been relatively alleviated, and its impact on businesses would be limited and manageable.

In previously announced third-quarter results, SMIC said revenues reached over $1.41 billion, exceeding market expectations, with a year-on-year increase of 30.7 percent.

Despite restraints from the US and supply chain disruptions, SMIC stated that 12-inch production capacity will be tripled in the next few years with the addition of three new wafer fabs in Shanghai, Beijing and Shenzhen in South China's Guangdong Province, meaning an extra 240,000 wafers per month, to meet the growing localization needs of end customers.

China's participation in the chip industry has increased rapidly. In 2020, the output value of packaging substrates in the Chinese mainland stood at $1.48 billion, which was about the same as that of global packaging substrates, industry data showed.

China accounts for 20-30 percent of the total market for US chip companies, and the proportion is expected to rise as the country embraces 5G, NEVs and intelligent industries, where advanced chips are heavily utilized.

In order to restrict China's semiconductor development, the US has imposed stricter export controls on software, equipment, and other technologies used to make chips in recent years, but such attempts will ultimately fail since the US government should know that it will potentially be a bigger loss for US companies, an industry insider said.