COMMENTS / EXPERT ASSESSMENT

It's difficult for Biden, Powell to address surging inflation

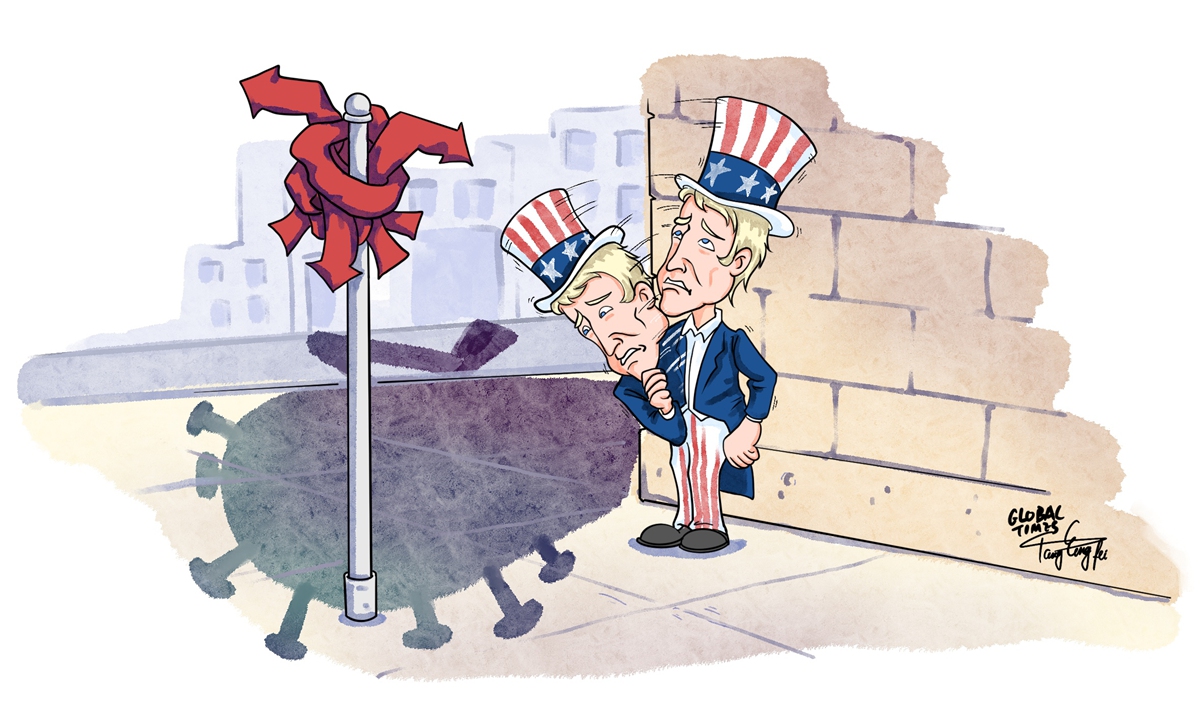

Illustration: Tang Tengfei/Global Times

To prevent rising inflation from impeding his political ambitions as the 2022 midterm elections draw near, US President Joe Biden this week asked major economies in Asia and Europe to take concerted efforts to tap into their national oil stockpiles to cut gasoline prices in his hope to show American voters that he understands their financial pain.As rising prices of energy, groceries and services put a strain on Americans' finances, triggering their growing disgruntlement with the White House, Biden is shifting his public messaging lately, telling American people that he cares about their livelihood. The president has pledged to do all he can to tame inflation, which surged to 6.2 percent in October, the highest level since 1990.

However, the Biden administration is unlikely to see the surging consumer prices ease in December or next year, as his government is embedded and obsessed with stimulus spending programs, one after another, to fire up America's GDP and compete with the Chinese economy.

Two other factors will also significantly hinder the Biden administration's ambitions, the threat from the coronavirus pandemic and the breakout of new and more contagious variants which will likely be a big deal in the country in 2022, and the severely snarled global supply chains which won't likely improve significantly in the coming months.

Unlike the Chinese government whose top priority is always the 1.4 billion people's health and welfare, the US government's governance dogma, whether it is in fighting contagious diseases or curbing inflation, seems to be only to serve the country's rich and upper middle class. The US government do all it can to protect the wealth of the country's elites.

As a slowdown in economic growth reduces their net worth, Washington doesn't consider taking stern anti-virus measures, like China's, to shut down parts of the economy in order to stifle virus spreading. Nor would it dare to raise the bank interest rates to stop inflation because higher rates will inevitably inhibit economic growth and cool the stock market.

As a result, tens of thousands of mostly Hispanics and black people died of the coronavirus and its mutant variants disproportionately in the past 20 months. The US stands as the leading country with one of the most pandemic-induced deaths (fatalities in India may have exceeded US' toll, but it's not clear due to incomplete statistics there).

Now, the 10 percent American rich and upper middle class can hardly feel the pinch of inflation, but the other 90 percent, including the 15 percent very poor people, have suffered from across-the-board price rises.

Last week, quite unexpectedly, Biden picked Jerome Powell to serve another four-year term at the helm of the Federal Reserve. Powell has been known to be a dove at the US central bank as he persistently refuses to take aggressive policy tightening to keep prices down despite inflation rising to alarming levels. Many Republican and some Democrat lawmakers do not approve of Powell's reappointment. Since early 2021 when the prices began to creep up, Powell has, stubbornly, claimed that inflation is only "transitory" which he predicted to dissipate soon.

American media outlets claim Biden and Powell are "philosophically aligned" when it comes to keeping interest rates incredibly low in order to support the US economy. But, the stakes in that pick are unusually high.

In theory, the Federal Reserve is charged with keeping consumer prices stable at a 2 percent annualized rise, and at the same time striving for maximum employment in the US. Ostensibly, in the past 10 months the Fed has made a big mistake by tilting too much to the side of ensuring employment, while neglecting to maintain price stability.

Now, Powell should move fast to immediately stop the Fed's purchases of Treasury bonds and other mortgage-backed securities, and start to raise the interest rates at Fed's next policy meeting in December, instead of next summer. If he continues to coddle buying the bonds, he risks inviting a hyper-inflation rate of more than 10 percent in early 2022, and subsequently a sluggish American economy - or even a recession - in 2023 or 2024, as the economy is almost certain to sputter under the weight of inflation.

Biden has seen his approval ratings slump as gasoline, food and other prices have surged. Republicans have used the situation to launch a steady series of attacks blaming Democrats. Higher prices in the US in November are matching October's record levels, as companies continue to pass on cost increases to customers. Gasoline prices in November went up 50 percent from the same month 2020, putting them at levels last seen in 2014. In most supermarkets, grocery prices have climbed by 6-10 percent, with meat prices up15-20 percent.

Biden's Build Back Better agenda is projected to make America's already troubling inflation woes even worse. According to the nonpartisan Congressional Budget Office, Biden's fiscal stimulus plan will increase the US federal deficit by $300-400 billion in the coming two years, while the agenda will encourage consumers to buy more and putting upward pressure on inflation.

Powell has revised his tone saying at the White House after Biden nominated him to a second term that the Fed will prevent higher inflation from becoming entrenched. "We know that high inflation takes a toll on families, especially those less able to meet the higher costs of essentials like food, housing and transportation," he said.

Problems with American supply chain run deeper. Even if the Biden administration succeeds in getting the nation's ports to operate around the clock, other choke points, such as overwhelmed railroads, the scant warehouse spaces and a shortage of truck drivers, will continue to slow the delivery of goods. So, inflation won't be easily resolved in the US.

The author is an editor with the Global Times. bizopinion@globaltimes.com.cn