COMMENTS / EXPERT ASSESSMENT

Asian semiconductor alliance is imperative under the US chip hegemony

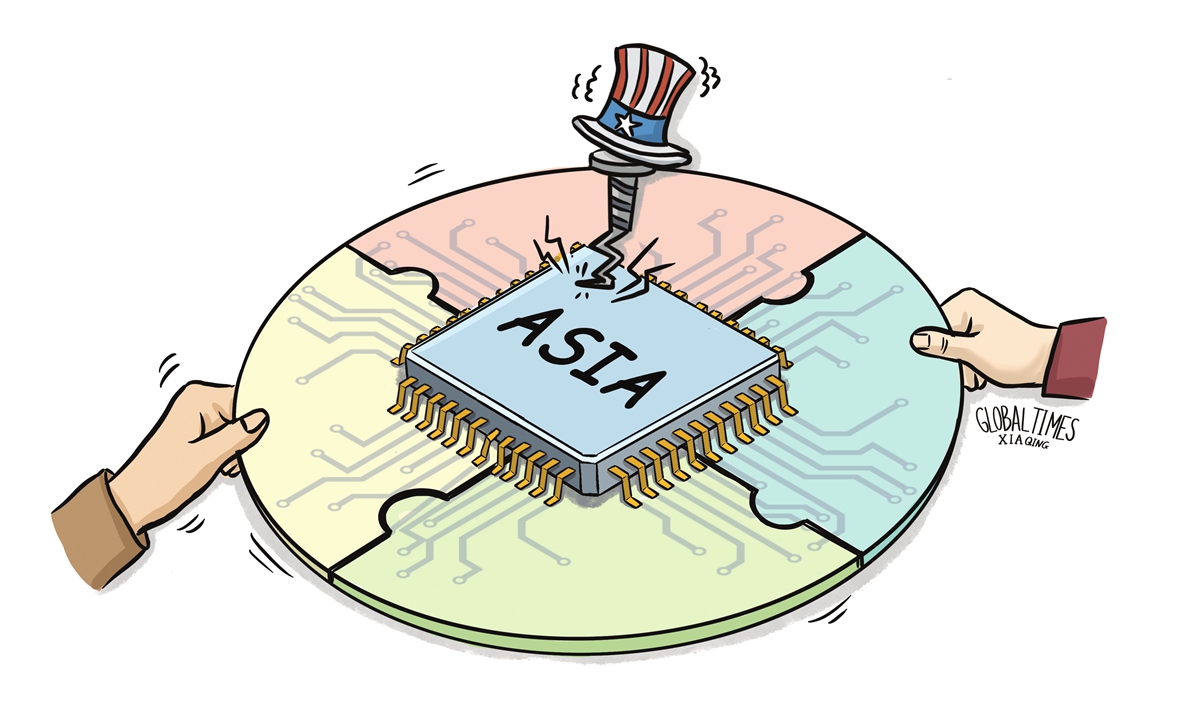

Illustration: Xia Qing/Global Times

A report from the Harvard Kennedy School last week predicted that China is poised to overtake the US in core 21st century technologies, including AI, 5G and semiconductor within the next decade.In the semiconductor field, the report titled "The Great Rivalry: China vs. the US in the 21st Century," predicted that China will become the world's largest semiconductor manufacturer in mature technology nodes over the next decade.

In the face of China's inevitable rise in the semiconductor field, the US is using its recklessly wielding hegemonic influence. In addition to arbitrarily suppressing Chinese companies such as telecom giant Huawei Technologies and top chipmaker Semiconductor Manufacturing International Corp (SMIC), preventing them from obtaining chips and other chokehold technologies, the US has spared no effort to disrupt the global semiconductor industry chain.

The US has long attempted to corral Japan and South Korea with both mild and stern measures to build a US-led "China free" semiconductor supply chain alliance, in an attempt to maintain US semiconductor dominance, and stifle the development of China's chip sector.

For instance, South Korea's SK Hynix's chip factory's recent renovation plans in Wuxi, East China's Jiangsu Province remain in jeopardy because US officials do not want advanced equipment used in the process to cross into China, according to Reuters.

At present, manufacturers from auto production to consumer electronics across the world are suffering from a global chip supply shortage. The US government's political coercion and interference in attempting to split the global semiconductor sector will not stop China's semiconductor sector from development, but only serve to further escalate the current chip shortage and stresses throughout the global industrial chain.

History has demonstrated that the US' political maneuvers will end in failure. In the 1980s, Japan's memory chip industry caught up with the US' technologically and started taking away market share. The US launched a trade war against Japan, using tariffs to force Japan to agree to set aside a portion of its domestic market for US-made memory chips. But the US' arbitrary trade war failed to save domestic producers. The US market share in the industry never recovered from the plunge it took in the early 1980s, according to the Bloomberg.

Today, against the backdrop of the hollowing out of its domestic manufacturing capacity, global supply chain fractures and the COVID-19 pandemic, the US is seeking to rely on political coercion and interference to corrupt the laws of market economy, forcing Japan and South Korea to form a semiconductor alliance to expand US' domestic semiconductor production capacity and ensure domestic supply, another move set to fail.

The disruption of the global semiconductor industry chain by the US has sparked a fragmentation of the global semiconductor industry chain. Europe was reportedly considering the formation of its own semiconductor alliance. The urgency of establishing a semiconductor alliance in Asia is becoming increasingly apparent.

The formation of an Asian Semiconductor Alliance is a forced move under the current US chip hegemony, and is consistent with the trend toward regional integration and development.

According to a recent Deloitte report, the Asia-Pacific semiconductor market has been growing rapidly. Driven by factors such as government support, huge market size, and increased research input, China, Japan, and South Korea are among the top six countries in terms of total semiconductor revenue globally. The Asia-Pacific region is also the world's largest semiconductor market, with sales accounting for 60 percent of the world's total sales, of which Chinese mainland accounts for more than 30 percent.

The advantage of establishing such an alliance is to integrate Asian countries' semiconductor industrial chain and bridge the separation caused by competition. In terms of chip manufacturing capacity, South Korea has a significant accumulation in chip manufacturing. Japan has strengths in equipment and materials. China is not only home to the largest market, but also has access to critical resources, such as rare earths.

Asian countries not only share complementary strengths in semiconductors, but also have both market and production advantages. If they can form an alliance centered on integrated development, it would represent a formidable economic grouping in the sector, while also helping to address the global chip shortage.

The author is a reporter with the Global Times. bizopinion@globaltimes.com.cn