China Mobile surges on Shanghai debut, shrugging off US delisting

More firms may seek home-return listings amid US crackdown: experts

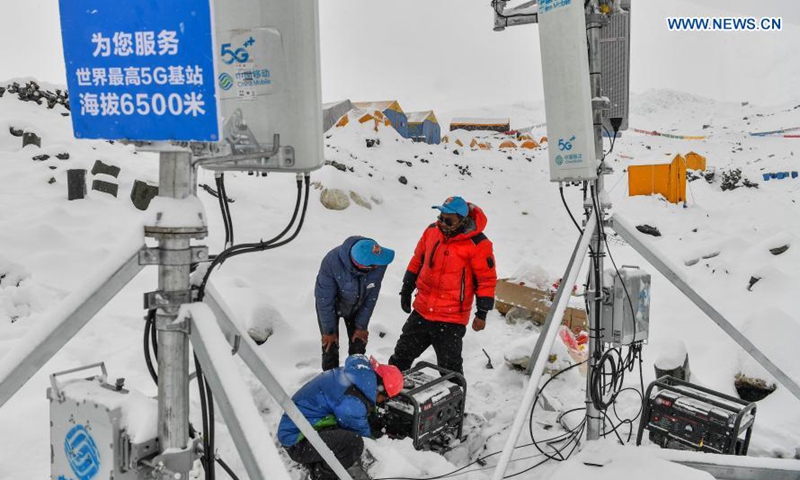

Staff members of China Mobile test the signals of the 5G base station built at an altitude of 6,500 meters at the advance camp of Mount Qomolangma in southwest China's Tibet Autonomous Region on May 21, 2020. (Xinhua/Jigme Dorje)

China Mobile, the telecom behemoth that was delisted from the US stock market last year, surged by 9.41 percent to 63 yuan ($9.92) during its Shanghai debut on Wednesday, an iconic event that may prompt more Chinese firms to seek home-return listings amid rising uncertainties in the US capital market.

The move, which comes as the US intensifies its crackdown on Chinese tech firms, indicates the rising strength of the Chinese market to accommodate listings of local tech giants, analysts said, noting that this certainly puts China in a better position to respond to US financial coercion targeting Chinese firms.

In an apparent effort to avoid potential risks in the US, state-owned China National Offshore Oil Corp also announced on Wednesday that it will terminate its American Depositary Shares Program on February 3, 2022.

China Mobile floated in both the Hong Kong and US markets in 1997. The telecom giant had plans to list its shares in the Chinese mainland market in 2007, but that did not materialize. After more than a decade, the telecom giant finally debuted shares domestically after its delisting from the US.

The shares opened at 63 yuan, 9.41 percent above the offer price, and closed up 0.52 percent at 57.88 yuan on Wednesday.

With an issue price of 57.58 yuan per share, the company raised 56 billion yuan, marking China's biggest public offering in over a decade.

China Mobile's Hong Kong-listed shares were up 3.8 percent in early trade. The company said in a filing on Tuesday that it would press ahead with a plan to buy back as many as 2.05 billion shares, worth nearly $13 billion.

The successful listing of China Mobile in the A-share market is an iconic event for the Chinese capital market, the company said in a statement it sent to the Global Times on Wednesday.

"As the first red-chip stock on the main board, China Mobile's return to the A-share market will help strengthen the overall situation of blue-chip stocks in the A-share market," it said.

The company's domestic competitors, China Telecom and China Unicom, are already listed on Chinese mainland stock markets.

The three were delisted from the New York Stock Exchange in January 2021 following a US government decision to restrict investment in Chinese technology companies.

The presence of the three telecom giants in the domestic stock market will help them tap huge funding to expand businesses like 5G amid the country's digital transformation, Ma Jihua, a telecommunications industry veteran analyst, told the Global Times, noting that the companies' market value will be reassessed.

The carrier's debut is being closely watched, as a number of Chinese companies recently saw their share prices fall below their offering prices on the first day of trade.

According to its prospectus, in the first three quarters of 2021, China Mobile's revenue was 648.63 billion yuan, a year-on-year increase of 12.92 percent, while net profit stood at 87.88 billion yuan, up by 6.59 percent.

In terms of net profit, China Mobile ranked first among the country's three major telecom operators, far exceeding China Unicom's 12.926 billion yuan and China Telecom's 23.436 billion yuan.

China Mobile has 5.28 million base stations, covering over 99.5 percent of the country's population. It's 4G base stations account for about 30 percent of the world's total, and its 5G base stations account for about 35 percent of the global total, both ranking first in the world.

China Mobile's successful A-share debut is also expected to spur the homecoming of more US-traded Chinese companies, a veteran industry observer told the Global Times on Wednesday, citing a stronger domestic equity market where listing rules have been revised to facilitate new-economy firms, as well as tougher regulations on overseas listings.

"Chinese investors' deep pockets and improved capital infrastructure are giving the trend a leg up," said the observer.

In recent days, the US government's attempts to crack down on China's high-tech sector have become broader and more frequent, with the Biden administration in mid-December moving to ban a string of Chinese tech companies from receiving US capital and supplies, just days after Chinese artificial intelligence giant SenseTime was put on a US investment blacklist.