Photo;VCG

Despite the ongoing pandemic and geopolitical volatility, most entrepreneurs from China, Japan and South Korea are optimistic about China's economic growth in 2022 and the recently implemented mega trade pact - the Regional Comprehensive Economic Partnership (RCEP), according to a joint survey by the Global Times Research Center, Maeil Business Newspaper and Nikkei.

Tighter cooperation on supply chains among the three biggest economies in Asia, representing around 20 percent of the world's population, 70 percent of Asia's economy and 20 percent of the world's GDP, has never been so urgent after a year-long shipping disruption, supply crunches amid US government's efforts to separate China from global supply chains in 2021.

Surveyed entrepreneurs from the three countries agree that they are facing hardships including a labor shortage, sluggish domestic demand and supply chain crunches, but over 70 percent of respondents have pinned their hopes on a global economic recovery in 2022.

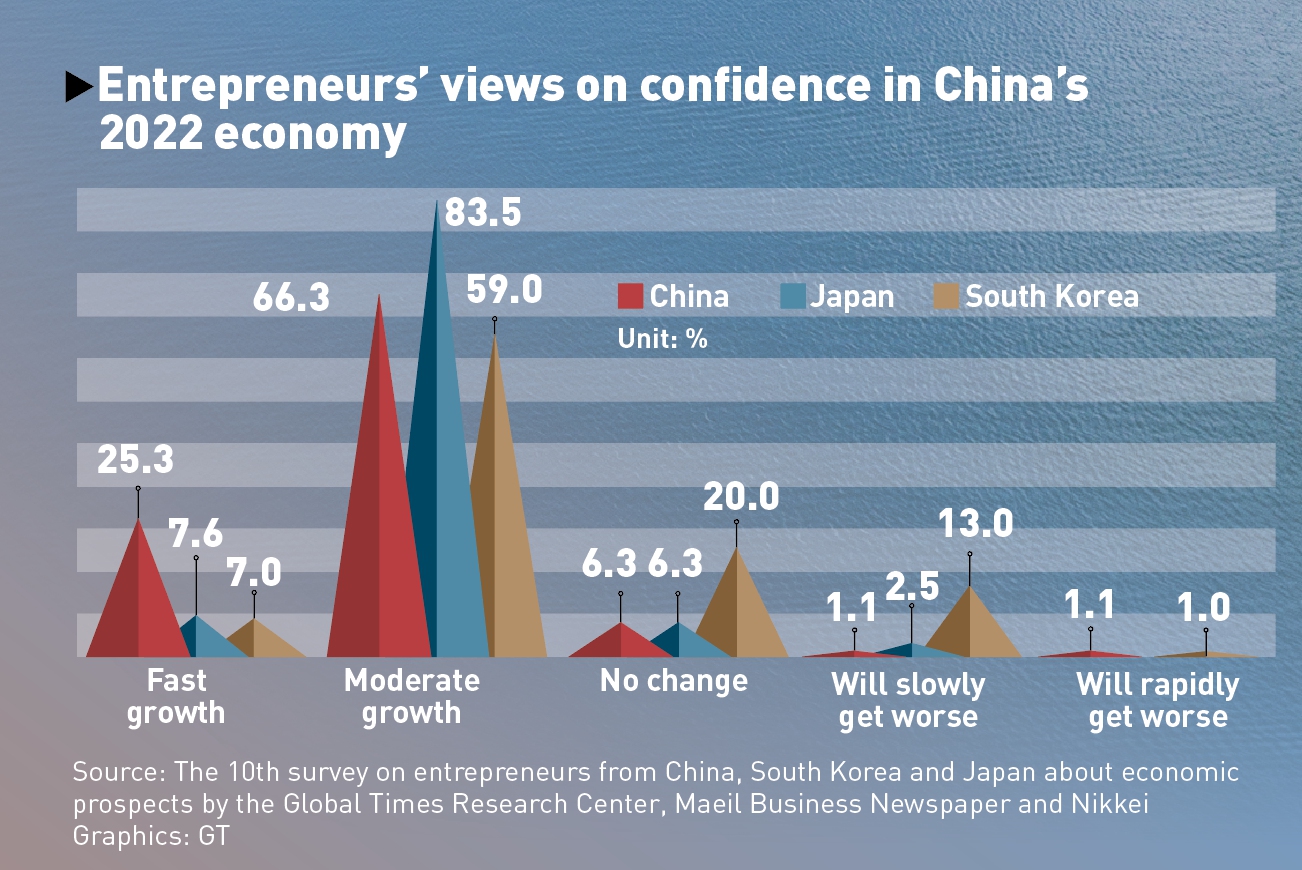

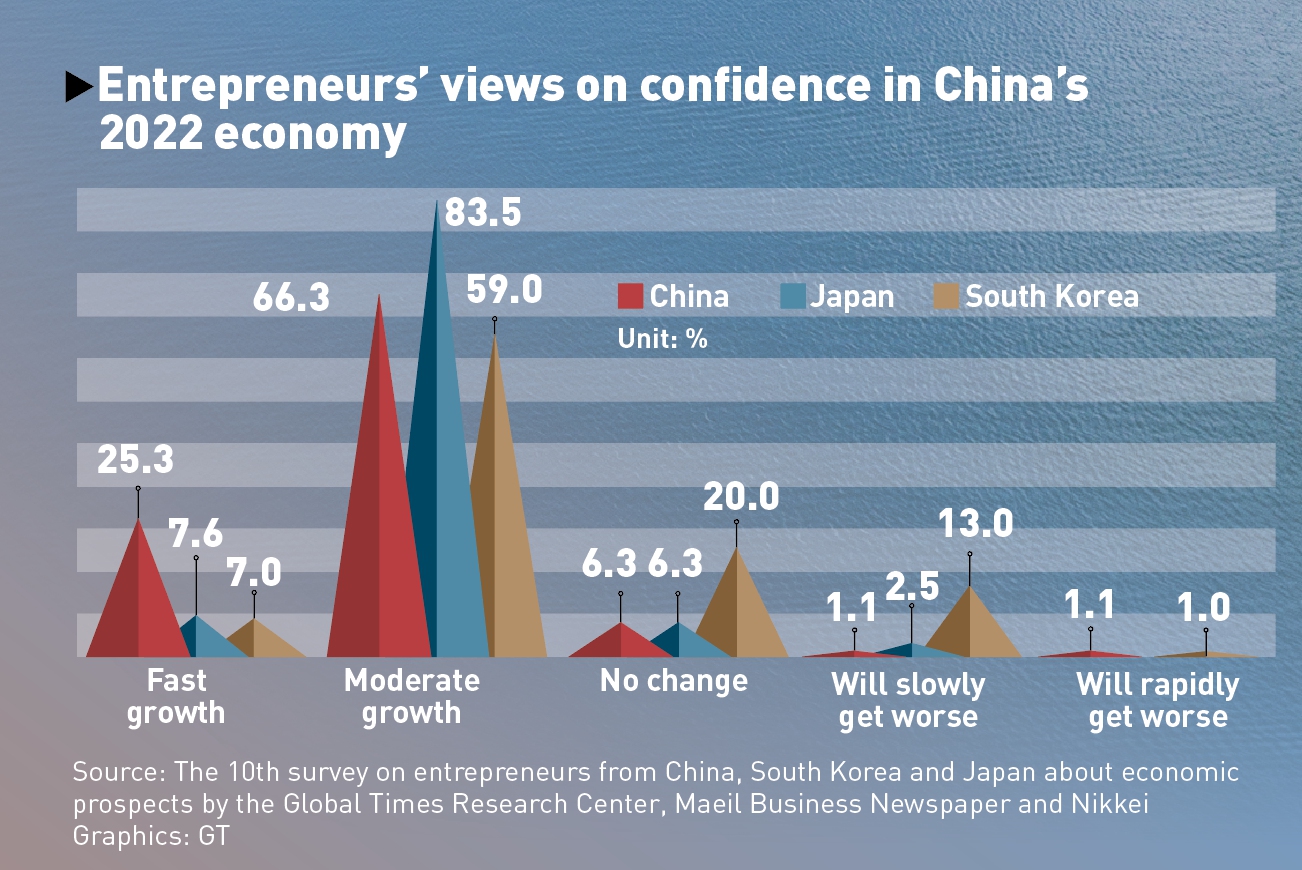

In particular, confidence in China's 2022 economy is the strongest compared with the other two countries among surveyed entrepreneurs. Around 66.3 percent of the Chinese respondents, 83.5 percent of the Japanese respondents and 59 percent of the surveyed South Koreans believe China's economy could achieve moderate growth this year.

Respondents' expectation for China to achieve rapid economic growth is also higher than that for Japan and South Korea.

Prior to major economies announcing their 2021 economic performance, China had already posted outstanding GDP growth in 2020 with 2.2 percent when the coronavirus wreaked havoc across the global economy. Japan's economy contracted 4.8 percent in 2020 and South Korea's GDP down 1 percent.

About 97.9 percent of surveyed Chinese entrepreneurs gave approval to China's Zero-COVID policy and believe that policies to battle against the virus in Japan and South Korea had not been as effective as China's approach.

The survey, which was conducted between December 6-24, 2021, received responses from 95 Chinese entrepreneurs, 102 South Korean high-level executives and 87 Japanese entrepreneurs. The Global Times Research Center and CJK Enterprise Exchange Center of CCOIC together collected the answers from Chinese respondents.

Call for closer supply chainsRegarding the biggest challenge to the economy, Chinese respondents raised their concern with labor shortage and the rising labor costs, while Japanese and South Korean respondents said their businesses had been hit by sluggish domestic demand and pandemic-induced weak exports.

Supply-chain disruptions, particularly in the semiconductor sector, were felt by Japanese enterprises, according to the survey. South Korean firms said they suffered from the chaos caused by shipping and air transport issues.

"As an export-oriented economy, South Korea highly relies on overseas markets. Considering its dependence on China's economy, South Korea could enhance its cooperation with the global market with the help of the implementation of the RCEP and the Belt and Road Initiative (BRI)," Shi Ming, director of the CJK Enterprise Exchange Center of CCOIC, told the Global Times.

Shi noted that based on the recognition of Chinese firms' innovation capability in the Japanese business sector, some Japanese enterprises were seeking to cooperate with Chinese internet companies and innovation-based enterprises while some look forward to jointly developing African and BRI markets.

According to the survey, artificial intelligence, IT and renewable energies are the key sectors targeted by Japanese and South Korean firms.

"In 2022, China, Japan and South Korea will implement the rules of RCEP, which will further promote the free trade among the three countries. More importantly, this may become an important opportunity for them to reach the consensus of the China-Japan-South Korea Free Trade Agreement for a higher-level, better quality and more opened free trade zone in a bid to boost Asian even the world's economic recovery and growth," he said.

The survey shows that respondents from the three countries held positive views toward the implementation of the RCEP which came into force on January 1, as they agree tariff reductions will help with exports expansion and purchasing cost reductions.

On Thursday, China's Ministry of Finance announced that South Korea will adopt the favorable tariff rates of the RCEP trade pact starting on February 1, as the country has finished ratification of the trade deal.

After the RCEP comes into force in South Korea, the pact will play a better role in enhancing regional trade and economic cooperation and help RCEP members to enjoy win-win results and mutual benefits, said a statement by the ministry.

Explaining the RCEP effects on Japan's economy, Chen Yan, executive director of the Japanese Corporations (China) Research Institute, said that Japan will probably not experience sharp export expansion as it sets a great number of factories overseas, but increasing exports to China would be very likely under low even zero tariffs; in return, Japanese consumers could enjoy well-priced and high-quality Chinese products.

However, the survey shows nearly half of the Chinese respondents predicted China-Japan relations may worsen in 2022, in contrast to the predictions of keeping the status quo supported by most Japanese respondents. But over 70 percent of surveyed Japanese and Chinese entrepreneurs said their businesses would not be impacted.

In comparison, most Chinese and South Korean respondents agree China-South Korea relations would remain unchanged in 2022.

Amid trade frictions and diplomatic disputes between China and the US, most surveyed companies from Japan and South Korea - both US' allies - are expecting to continue to feel the weight of US pressure in the region. Half of Chinese respondents said the China-US frictions will maintain the status quo under the Biden administration, and 72.4 percent Japanese respondents agreed.

"The Biden administration on one hand pushes forward the construction of the supply chains that are independent from China, on the other hand China is fighting against it by speeding up its localization. This indicates intensified competition," Hidehiko Mukoyama, a senior economist at the Japan Research Institute, told the Global Times.