Work begins on the Tongling Yangtze River Bridge on January 4, 2022. Photo: VCG

China's central and local governments are expediting the rollout of major infrastructure projects as the country faces growing downward economic pressure, with the country's top economic planning agency announcing on Tuesday that it will moderately front-load infrastructure investment and steadily push forward the 102 mega projects earmarked for the 14th Five-Year Plan period (2021-25) to achieve concrete results.

Analysts noted that the combined measures could result in a robust growth in fixed-asset investment, a major economic growth driver, for the January-March quarter and would give a much-needed boost for the economy, which grew 8.1 percent in 2021 but faces downward pressure from shrinking demand, supply chain disruptions and weakening expectations.

Yuan Da, a spokesperson for the National Development and Reform Commission (NDRC), said in light of more uncertainties in the first quarter, policy will be "upfronted" accordingly for the earlier materialization of intended effects.

China will appropriately advance the deployment of infrastructure and steadily push forward construction of 102 mega projects that were already spelled out in the country's 14th Five-Year Plan, Yuan said, noting the efforts are aimed at generating more concrete results in the first quarter.

Supportive work will include a detailed list of projects, measurable appraisal system, and support in the use of land, energy and funding.

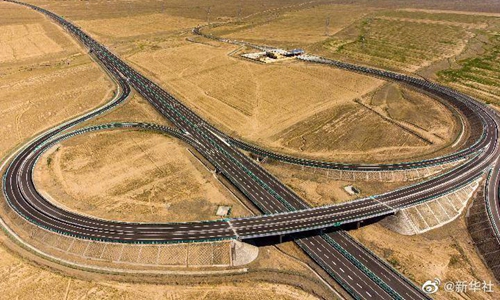

Some of the mega projects are roads, railways, public transit systems, airports, nuclear power plants, power transmission lines and pipelines.

Yao Jingyuan, special researcher of the Counsellors' Office of the State Council, the cabinet, told the Global Times that the measures will be effective in addressing contracting domestic demand and sluggish consumption growth, the two major weak points in the Chinese economy at the moment.

Pointing to near-flat infrastructure investment for 2021, at a mere 0.4 percent annual growth rate, Yao said that "this is a sector that the government could spur, and boosting this area will help combat sluggish domestic demand. External demand at the moment seems to be quite strong, as shown by the export figures."

On Monday, Ning Jizhe, head of the National Bureau of Statistics, also noted that there is great potential for infrastructure investment in China compared with developed nations.

Continuous expansion in effective investment is still needed in the effort to achieve high-quality growth and build a modern socialist power, Ning concluded.

Localities took the cue from central authorities and are moving swiftly.

On Tuesday, economic planners in Shanghai, China's economic powerhouse, announced five specific policies aimed at speeding up major projects, while disclosing the municipality's annual plan to boost effective investment and stabilize the economy.

The municipality said it will appropriately advance infrastructure investment, and accelerate projects ranging from shipping and public transit to water conservation and sewage systems. Shanghai also said it will tap into major projects listed in the 14th Five-Year Plan period (2021-25).

On the same day, the Lingang New Area in Shanghai's Pilot Free Trade Zone announced that it is eyeing fixed-asset investment totaling 120 billion yuan ($18.89 billion) for 2022, roughly a 20-percent increase from 2021.

Shanghai is not alone. A report by the Securities Times on January 11 said that 3 trillion yuan worth of infrastructure projects have been announced by 11 localities including South China's Guangdong, East China's Jiangsu and Central China's Henan provinces.

Lian Ping, head of the Zhixin Investment Research Institute, told the Global Times on Tuesday that infrastructure investment, which will see an estimated 5-percent growth from a flat performance in 2021, will be the top highlight for the first quarter.

The infrastructure boom will be further boosted by approximately 1 trillion yuan worth of special-purpose local bonds that were put on hold by local governments in the final months of 2021.

Infrastructure, along with real estate and manufacturing, forms the bulk of investment. Lian predicted that there will be a second wave, or even a third wave, of infrastructure projects later in the year.

Combining last year's leftover allocations and what's been allocated for the new year, local governments' special-purpose bonds in 2022 in real terms will be double the amount of 2021, Lian said.

The Ministry of Finance has allocated 1.46 trillion yuan from its 2022 quota for local governments' special-purpose bonds, as the country seeks to boost local infrastructure investment and steady economic growth for the upcoming year.