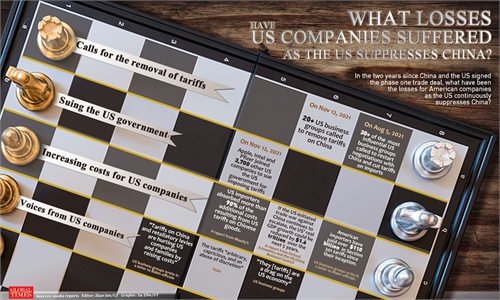

US going deeper into China containment obsession with new House bill: observers

China ‘should prepare for worsening situation,’ closely watch US firms’ reaction

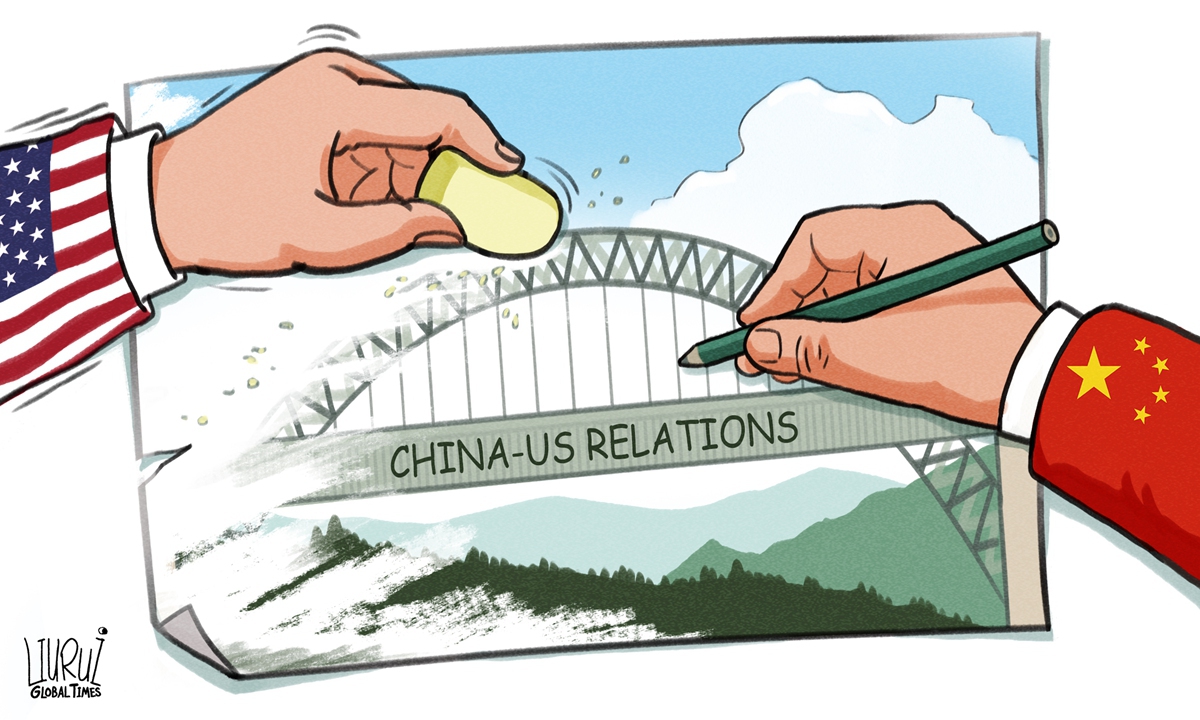

China-US relationship. Illustration: Liu Rui/Global Times

The US, up to its old anti-China tricks, has taken its maneuvers a stage further with the House of Representatives on Tuesday unveiling a bill meant to contain China in especially chip making.The new bill, the House's version of a comprehensive China bill the Senate passed in June, is an indication that the US has gone deeper into its China containment obsession, said observers and semiconductor industry insiders.

Such brainwork that remains a long way off from being signed into law is a slow remedy that could hardly address the US' shortages of semiconductors, they opined, noting that it will not be concern to China which is adamantly on track for tech self-sufficiency.

Old trick playback

The 2,912-page America COMPETES Act, made public on Tuesday, apparently outcompetes, in terms of length, its Senate predecessor - the 2,376-page United States Innovation and Competition Act (USICA). Even so, the new bill has not impressed international affairs watchers.

In a Tuesday statement posted on the White House's website on the America COMPETES Act, US President Joe Biden said, "The House took an important step forward today in advancing legislation that will make our supply chains stronger and reinvigorate the innovation engine of our economy to outcompete China and the rest of the world for decades to come."

The legislation, though it seems comprehensive and detailed, involves nothing out of anticipations and is in line with the US' strategy on China over the past year, Gao Lingyun, an expert at the Chinese Academy of Social Sciences in Beijing, told the Global Times on Wednesday.

The lengthy bill includes $52 billion in subsidies for semiconductor manufacturing and research. It also calls for more provocative moves such as renaming the Taipei Economic and Cultural Representative Office (TECRO) in the US.

China has lodged solemn representations with the US in response to media reports that the US government is seriously considering changing TECRO's name to the "Taiwan Representative Office," Chinese Foreign Ministry Spokesperson Zhao Lijian told a regular press conference in mid-September.

When asked for comment on the USICA, a day after the bill's Senate passage in early June, Foreign Ministry spokesperson Wang Wenbin said China firmly rejects the bill, which is "filled with Cold War zero-sum mentality."

"How the US intends to develop and strengthen its competitiveness is its own business, but we are firmly against the US making an issue out of China and perceiving it as an imaginary enemy. The US is the greatest threat to itself. Getting its own house in order trumps all else," Wang remarked.

One thing for sure is that the US is now trying to go against the historical trend of global cooperation in innovation, and the bill itself is not conducive to global cooperation and human scientific and technological progress, according to Gao.

China still has to prepare for a worsening global context, the expert noted. He advised the Chinese government to closely watch US tech giants' reactions to the bill, like Intel, and offering necessary support to domestic tech firms that have become mired in the US' containment.

On Friday, US chip giant Intel announced an investment of up to $20 billion to build potentially the world's largest chip-making complex in Ohio.

For provisions included in the legislation that aims to strengthen relations with US allies including Japan, Australia, observers said that people do not have to worry too much.

"The current so-called anti-China campaign is basically a US self-directed and self-acted show. Traditional allies such as Japan, Britain and Australia will do some pandering, but political slogans are one thing, economy and trade are another," Gao said.

"If the US-led bloc is already strong enough, then why did some of its allies join the Regional Comprehensive Economic Partnership [RCEP]?" he asked.

In an effort to lubricate the RCEP, the world's largest trading bloc that encompasses 15 Asia-Pacific countries - the 10 ASEAN members plus China, Australia, Japan, New Zealand and South Korea, six Chinese government departments including the commerce ministry have rolled out a raft of guidelines devised to better implement the deal.

By Tuesday, China's export-oriented firms had been granted 24,695 certificates of origin and declarations of origin under the RCEP framework, the commerce ministry said on Wednesday.

Bill effectiveness in doubt

The new US bill, in addition to the USICA that secured Senate passage with partisan support but is yet to be passed by the House, is less likely to reinvigorate US chip supply chains as conjectured by the Biden administration, experts said, arguing against its fallout on China's chip push.

The House's finalization of its China bill coincided with a Tuesday statement by the US commerce department, which cited semiconductor data to warn of an "urgent need" for the Congress to pass the US Innovation and Competition Act.

The USICA, introduced in Senate in April 2021, was agreed in the Senate about two months later. It still has to pass the House before being sent to the US president to sign into law, per an overview of the USICA on the website of the US Congress.

The proposals pave the way for the rollout of corresponding industrial policies later on and might turn out to be a conventional tool to be applied to other industries, said Li Zheng, an associate research fellow with the Institute of American Studies of the China Institutes of Contemporary International Relations.

Nonetheless, the global semiconductor industry would remain crippled by supply shortages, Li told the Global Times on Wednesday.

The impact of the proposals on the chip sector should not be overestimated in the short term, Li continued.

A senior industry insider told the Global Times on Wednesday on condition of anonymity that the new bill is unlikely to have any direct impact on China's chip industry, citing China's push for independence and controllability as well as the replacement of foreign technologies by their domestic alternatives.

As to the US commerce department statement on Tuesday that cited findings from a recent chip supply chain report, "median inventory held by chips consumers (including automakers or medical device manufacturers, as examples) has fallen from 40 days in 2019 to less than five days in 2021," the insider said that the data exaggerated the severity of the actual chip inventory.

Moreover, an industry as globalized as chip making is by no means a single-handed effort by any country or region, the insider pointed out, stressing that even the US has not achieved a whole-of-industry prowess.

Looking ahead, the $52 billion in chip subsidies are seen as barely sufficient to motivate a relocation of top chipmakers out of China and into the US, analysts said.

The relocation plans go way beyond making a gesture toward the US, according to the insider, noting that funds, technologies, talent and industrial environment would be among the factors to consider when mulling relocating.

Taiwan Semiconductor Manufacturing Co, the world's largest contract chipmaker, has the largest part of its capacity located on the island of Taiwan, while Samsung's most advanced capacity is based on its home turf in South Korea, the insider went on to say, emphasizing that "the US can't fix the shortage issue just on its own."