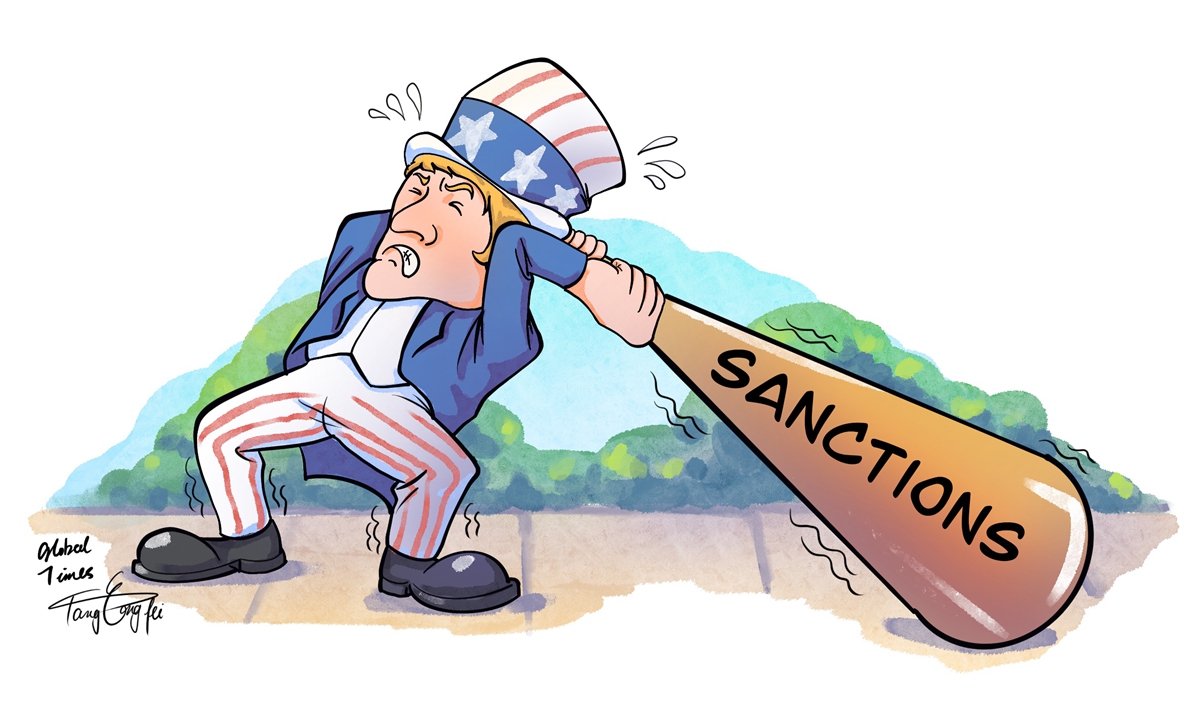

Illustration: Tang Tengfei/Global Times

The US, relying on the dollar's international reserve currency status as well as the attractiveness of its market size, has been wielding its cudgel of economic and financial sanctions for many years, placing many countries, entities and individuals under its coercive sanctions regime.

Lately, the world has witnessed the Biden administration, leading its hardcore allies in Europe and Asia-Pacific, rushed to put a plethora of harsh sanctions on Russia over the conflict in Ukraine. The purpose of these sweeping sanctions is to stifle or destroy Russia's economy, and possibly induce a color revolution in Moscow.

In addition to punishing Russia, the US government in the past decades has broadly expanded the use of its economic sanctioning tools, ruthlessly applying them and ramping them up against many other countries such as Cuba, Venezuela, North Korea, Iran and Syria.

Smaller nations are more vulnerable to the sanctions due to their weak economies. But Russia, endowed with the world's largest landmass that is rich in fossil fuel and mineral deposits, abundant wood, grass, water and agricultural resources, as well as a fairly developed industrial base, is expected to fare better.

The US has two dozen sanctioning tool kits administered by different government agencies including the departments of state, treasury, defense, commerce and the trade representative's office. They all serve a major purpose that is to punish America's foes, advance American foreign policy goals, and secure US' centrism and its hegemonic position in the world.

Of the US sanctions regime, the Office of Foreign Assets Control (OFAC) under the Department of Treasury, and the Bureau of Industry and Security (BIS), under the Department of Commerce, are the most notorious. Russia is now facing a "cyclopaedic-style" sanctioning, with the freezing of Russia's all US-dollar denominated assets and gold reserves abroad being the most morbid - which, imposed by OFAC, are threatening Moscow's ability to service its foreign debts. The US government has also instructed many American multinational companies to leave Russia.

On Thursday, supported by US President Biden, the House of Representatives voted to end normal trade relations with Russia and Belarus, a step which will result in higher tariff rates on imports from the two countries.

Following the US government, the UK, Canada, Australia, the EU, Japan and South Korea have also moved to impose similar sanctioning measures on Russia, which, in the eyes of many independent observers of geopolitics, acted like a herd of boars swooping at a bear. Some European countries, like Germany and France, which depend on Russian supply of natural gas, oil and coal to providing winter heating and daily industrial-use energy, are also asked to set a deadline of upending energy imports from Russia.

And, other countries that hope to continue their normal trade exchange and economic cooperation with Russia, such as China and India, are being pecked. Washington has threatened to introduce sanctions on India just for New Delhi's considering a rupee-ruble exchange to purchase Russia-produced oil at a discount.

Alas, isn't the legitimate right of India, a sovereign nation and a rapidly emerging market with 1.4 billion people, to maintain normal trade with another country being threatened by Washington? The US government may behave condescendingly before its smaller allies, but apparently it seems India is unwilling to be dictated.

The previous Trump administration, indulged in its demonic Sinophobia and treating China as a strategic rival of the US, launched a relentless trade and technology war against China. The US government has placed many Chinese high-tech companies on the BIS' entity list, cutting off crucial supplies to Chinese firms, but during the past 2-3 years, China's pace of innovations has not stopped, but actually quickened, thanks to the government's vigorous input of funds and human resources into the sector.

Now, the world has seen China leapfrogging into 5G, mobile cashless payment, economic digitalization, NEV manufacturing, aerospace, industrial robotics and artificial intelligence. Last year, China's imports and exports topped $6 trillion, an unprecedented record for a single country that puts China's market attractiveness on full display.

By all metrics, the US' economic sanctions should be viewed as a double-edged sword, one that can help Washington achieve policy goals in the short term, but if used recklessly, may put the US' economic and financial leverages at severe peril.

And, there are far-ranging consequences to stem from the US' and its allies' sanctioning of Russia. First, these countries will face a drastic shortage of energy supplies and petrol, as natural gas prices have already skyrocketed. Inflation in the US is likely to edge even higher by a double-digit surge in the coming months and its economic growth will drop to around 2 percent. The EU could fare worse. Lately, British Prime Minister Boris Johnson, as emissary of the US, visited Saudi Arabia and UAE to deliver a plea from the West to pump more oil, but to no avail.

Second, these Western sanctions on Russia will, in the long run, divide and fragment the global economy, forcing many countries in the world to shift away from the US-centric economic and financial system. If the US could remove Russian banks from the SWIFT payment system and freeze US-dollar assets of Russia and its nationals, many other countries and rich individuals and entrepreneurs are shaken as they will be forced to look for alternatives to SWIFT and the US dollar.

Therefore, the saying that sanctions are often ill conceived and rarely successful is not disinformation.

The author is an editor with the Global Times. bizopinion@globaltimes.com.cn