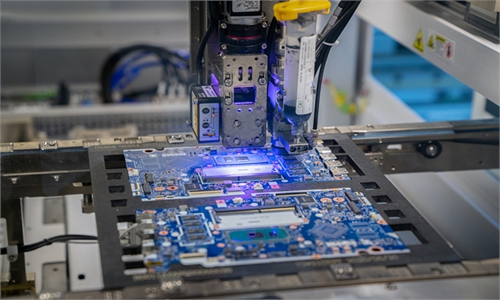

Workers manufacture display panels on an assembly line in Huainan High-Tech Industrial Development Zone in East China's Anhui Province, on April 24, 2022. Photo: VCG

As South Korean media lament another of the country's prized claims is losing to China, industry experts said Chinese companies have closed the gap with South Korean rivals in the past decade, while they emphasized that cooperation is still needed to push the industry forward.

According to South Korea's etnews.com, China took over the No. 1 spot in the display market last year, which South Korea has led for many years.

The news outlets proclaimed that South Korea's title of "the strongest country in display market" was lost after 17 years and that it would not be possible for South Korea to reclaim the No. 1 spot if it cannot find a way to ramp up investment in next-generation displays such as organic light emitting diodes (OLED).

The year 2021 was a milestone for China's display panel industry. Chinese display panel makers, led by companies such as BOE Technology Group Co, Shenzhen China Star Optoelectronics Technology Co, Tianma, and Visionox, accounted a combined 40.4 percent of global market share in turnover, outstripping South Korea's 36.3 percent, data from Beijing-based market research provider Sigmaintell revealed.

It is the first time that Chinese companies held a larger market share that their South Korean rivals, mainly Samsung Display and LG Display, as in 2020, South Korean companies led with 39.8 percent of market share, 4.8 percentage points higher than China.

Industry experts said the country's advance benefited from both scale of operation and structural improvement, notably with BOE's advantages in high-end flexible OLED.

A different set of data published by market research firm Omdia showed the same pattern. China recorded $64.8 billion in sales including liquid crystal display (LCD) and OLED in the global display market in 2021. China overtook South Korea's No. 1 spot with a market share of 41.5 percent while South Korea's market share fell to 33.2 percent.

Li Yaqin, general manager of Sigmaintell, said one reason for China to take over South Korea in terms of turnover were the massive price hikes seen throughout 2021, with 60 to 100 percent year-on-year increases seen in prices across different product categories. "That makes 2021 a watershed year, after China outpaced South Korea in shipments."

On March 30, BOE, the world's largest flat-panel display manufacturer, said its total revenue stood at 219.31 billion yuan ($33.57 billion) in 2021, up 61.79 percent from a yearly basis, while its net profit surged 412.96 percent year-on-year to hit 25.83 billion yuan.

The company attributed the rapid growth to improved demand and supply, technological advances and its products being successfully scaled up throughout the value chain.

Race to lead

Market competition in display panel, an indispensable part for consumer electronics, is fierce. And the competing relations between Chinese and South Korean companies exist in display panels for smartphones, televisions, monitors, among other product segments.

Display panel are comparable to today's high-end semiconductors, for years the production of display panels had been monopolized by foreign companies. But after a decade of strenuous work to catchup, experts said that Chinese players now dominate today's display panel manufacturing and the proliferation of display panel technology benefited global consumers by reducing the cost of a wide range of downstream electronic components and has in recent years caused domestic upstream business such as material-supplying company to flourish.

In terms of LCD, Chinese companies have long surpassed their South Korean counterparts in shipments, and in recent years Chinese companies also invested heavily in advanced production lines for small-size OLED screens that is used in smartphones.

The only market segment owned by South Korean companies left unchallenged by Chinese makers are large-size OLED screens used in TV sets.

Len Lee, chief analyst of display industry of ijiwei.com, said Chinese companies have been playing catch-up during the past decade and the report by South Korean media nevertheless showed a transformation process in which the Chinese players move from that of a runner-up to that of a front runner.

Etnews suggested South Koran companies reduce OLED panel prices by mass producing OLED, which requires substantial investment in production capacity, only then can South Korea replace the LCD market led by China. The battlefield of choice for South Korean firms would be in large TV panel market, in which they still enjoy large technological gap with China.

Even as South Korean companies seek to entrench their lead position in large-size OLED, their efforts may not turn out to be as effective as imagined, Lee said, as large OLED may not prove to be a worthy barrier behind which South Korean companies could fall back upon as it does not have unique functions that could not be fulfilled by LCD.

A concept photo of devices with foldable and flexible screens Photo: VCG

Although seen as a state-of-the-art technology, large-size OLED occupy only a tiny portion of the global display market.

In 2021, shipments of large-size OLED display panels were just 6.7 million units while in the same period the shipments of LCD reached 210 million units.

"Back in the days of LCD phasing out cathode ray tube and plasma display panel, LCD could fulfill unique functions the other two types could not. That is something we don't see in OLED. The things OLED can do, LCD can also do and are being constantly perfected," Lee said. "That means fall back behind the OLED castles may not be enough to fend off challenges lurched out by Chinese players."

China has also started to narrow the gap with Korea in OLED industry. BOE and other companies have commercialized OLED for small and medium-sized displays such as for mobiles and laptops. Along with South Korean brands, BOE also supplies Apple.

Sigmaintell's Li said although Chinese companies outpaced South Korean rivals in turnover in 2021, whether they could hold on to their combined lead this year is a question open to debate as the industry might face a slowdown after the volatile prices last year, and a decline in sales will dent turnover.

Li predicted that 2022 will be a year that tests display panel makers' resilience, with weak players yielding market share as the landscape shifts.

Lee said as the display panel industry moves forward, Chinese companies are betting big on research & development in new emerging display technologies such as mini-LED and micro-LED.

"In these cutting-edge fields of competition, the South Korean advantage is even smaller and companies are competing head-to-head to gain the position of the leader," Lee said. "This is the current stage of China-South Korean in the display sector, with Chinese companies already outperformance their global rivals in certain fields."

South Korean companies would be increasingly willing to export their advanced technology once they realized they are losing market shares, according to Lee.