Cranes are seen at a construction site of a housing complex in Beijing on Thursday. Photo: VCG

China's central bank and banking and insurance regulator on Sunday moved to lower interest rate floors on mortgages for first-time homebuyers by 20 basis points (bps) off the benchmark loan prime rate (LPR), culminating a flurry of housing market-reviving moves across the country as part of a broader pro-growth push.The differentiated move is intended to support inelastic housing demand, while curbing property speculation, experts said, reckoning the structural policy easing will stabilize the housing market. They also expected more measures to boost domestic demand as the country emphasizes capitalizing on the internal circulation of the economy amid global geopolitical uncertainty.

Apart from the 20 bps cut in the lower bound range of mortgage rates for first-time homebuyers, interest rate floors on mortgage lending for second-time homebuyers remain unchanged, read the momentous announcement on the website of the People's Bank of China (PBC), the country's central bank.

The PBC described the fresh move as a revised housing credit policy differentiation, as the country reiterates its stance that housing is for living, not speculation, and eyes fostering a steady and soundly developing real estate market.

On the basis of an unified national interest rate floor, regional branches of the PBC and the China Banking and Insurance Regulatory Commission would guide local self-regulatory mechanisms for market interest pricing to set their lowest rates on mortgage lending for first and second-time homebuyers, in accordance with local housing market realities and local government fine-tuning needs, per the statement.

The housing policy tweak is mostly a structural effort to rein in speculative bets while meeting residents' inelastic demand and improving their housing conditions, Dong Dengxin, director of the Finance and Securities Institute of the Wuhan University of Science and Technology, told the Global Times on Sunday.

The decision sends "a clear policy signal to stabilize the housing market and the economy" at large, Dong remarked.

The announcement indicates the authorities' resolve to turn around a lackluster property market, as a large downward revision of as much as 20 bps off the five-year LPR — a reference rate for mortgages loans — is set to guide banks toward offering lower-rate mortgages for first-time homebuyers, Yan Yuejin, research director at Shanghai-based E-house China R&D Institute, told the Global Times on Sunday.

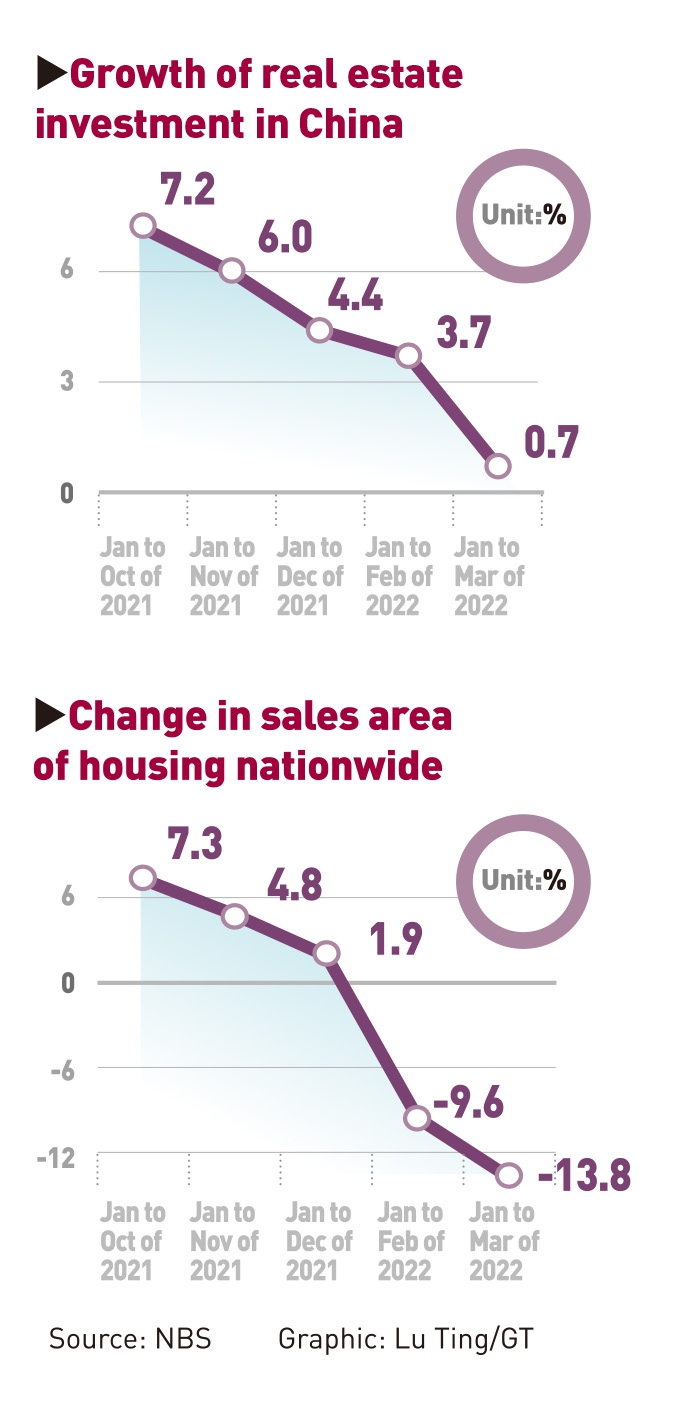

Graphic:GT

The country's one-year LPR was held steady at 3.7 percent in April, while the five-year LPR was unchanged at 4.6 percent.

The previous changes were in January, when the PBC cut the one-year LPR by 10 bps from 3.8 percent. Meanwhile, the five-year LPR was lowered by 5 bps from 4.65 percent, the first reduction since April 2020.

The fresh announcement means mortgage rates could hit 4.4 percent at the lowest level, "a fairly favorable rate," according to Yan, noting that actual mortgage rates available for qualified homebuyers still vary among regions.

As of the end of the first quarter, outstanding individual mortgages were up 8.9 percent year-on-year to 38.84 trillion yuan ($5.72 trillion), the PBC disclosed in its quarterly monetary policy report earlier this month.

The interest rate on newly extended individual mortgages stood at 5.42 percent in March, down 17 bps from the beginning of the year, PBC numbers showed.

If the actual mortgage rate could reach 5.22 percent, a 20 bps cut from the March level, a 30-year mortgage of 5 million yuan would be entitled to a reduced repayment of upwards of 220,000 yuan, according to Yan's calculations.

Prior to the national housing policy change on Sunday, local governments across the country had moved to ease curbs on home purchases or lower down payments on mortgages.

The latest example was Dongguan in South China's Guangdong Province, which vowed on Saturday to relax home purchase restrictions for local families with two or three children.

The ramped-up policy support came amid subdued home purchases, which mirror a broad-based consumption sluggishness as the economy confronts the domestic resurgence of Omicron as well as complex geopolitical tensions and a US-led cycle of drastic rate hikes.

In April, mortgages contracted by 60.5 billion yuan, according to PBC data on Friday. Consumption lending, excluding mortgages, shrank 104.4 billion yuan in April.

As Dong pointed out, more policy support is expected in the foreseeable future to stimulate overall consumption, as the country eyes strengthening the internal circulation of its economy in the face of geopolitical conflicts, among other external uncertainties.

A stepped-up push for domestic consumption as well as a greater focus on investment-motivated growth will be on the front burner of policymaking, Dong emphasized, downplaying the effect of trade on revving up growth for the remainder of the year.