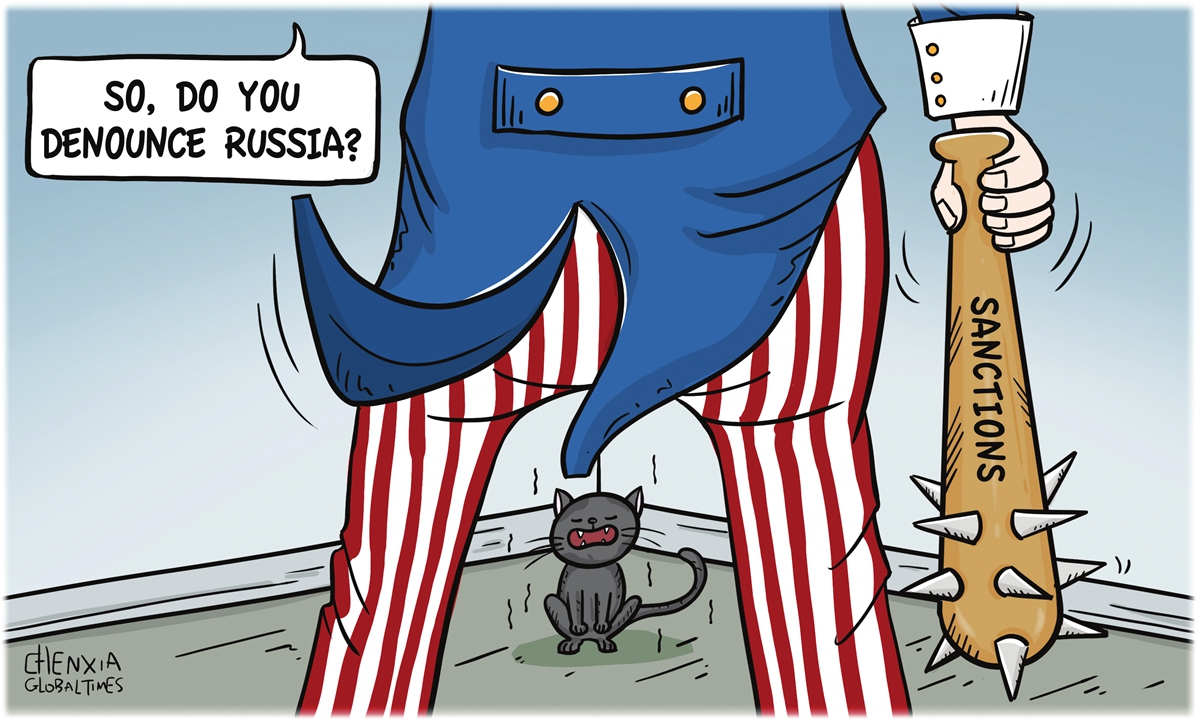

Illustration: Chen Xia/GT

US Treasury Secretary Janet Yellen said recently that it "would not be legal now" for the US to seize Russian government assets to pay for Ukraine reconstruction. However, Yellen's words are, perhaps, not the end of an eye-catching controversy about whether to seize Russian assets; it could be the beginning of a new discussion about how to legally seize those assets.

According to a Voice of America (VOA) report on April 29, The Biden administration is asking Congress for additional legal authority to make it easier for the US government to seize Russian government and "oligarch" assets and transfer the proceeds to Ukraine. The news came after some European politicians suggested their countries could use seized Russian assets to rebuild a devastated Ukraine.

Yellen was quoted as saying that it's very natural "we will look to Russia to help pay at least a portion of the price," but it doesn't seem she wants frozen Russian assets to play a role in Ukraine reconstruction. According to Reuters, US Treasury officials have expressed concerns about setting precedents and eroding other countries' confidence in holding their central bank assets in the US. We believe Yellen is very aware of the severity of the problem. It seems there is a deliberate "good cop, bad cop" strategy in place - the White House plays an active role in calling for seizing Russian assets, in a bid to comfort its allies in Europe, while Yellen tries to comfort the market with a rational voice that helps to persuade investors it's still safe to hold their assets in the US.

Their little trick is crystal clear for international investors and should be condemned. As a result of unilateral sanctions, the US has frozen tens of billions worth of assets belonging to Russians and their government. If foreign assets - public and private - can be frozen in a split second by a reserve-currency country with selfish political interests, politicians should not even waste their time to claim that it's safe for people to hold their assets in the country. US credibility in the economic world was undermined by its decision to freeze Russian assets via unilateral sanctions. Even if the US transfers the proceeds to Ukraine, freezing the assets has been enough to make people lose trust in the country.

This adds to the evidence that the US is no longer a safe place to store reserves. The US has global financial hegemony, but such hegemony is two-way. The US needs to provide services to the world, and depends on the world's support. If the US abuses its position to use sanctions as a geopolitical tool against rivals, it will be the death knell for its financial hegemony. Sanctions on Russia's financial system, such as the freezing of the central bank's reserves, will probably become a turning-point for US financial hegemony.

A large portion of US Treasury bonds are foreign-owned. As more countries reduce their holdings of US Treasury bonds, it's understandable that Yellen wants to alleviate tensions caused by a collapse in the US' reputation, but her efforts are doomed to fail. With unilateral sanctions, the US is bringing the world back to the era of a lawless jungle. Now, more people are worried about the security of their assets in the US. If the US goes a step further in seizing foreign assets, US credibility will be completely broken.

It is difficult for the US to come up with unilateral sanctions that only harm Russia, or harm Russia more than the US. Thus, Washington needs to think about what to do next. The world is also witnessing a profound shake-up of its traditional patterns as countries think about how to avoid the spillover effects of US unilateral sanctions.

The author is a reporter with the Global Times. bizopinion@globaltimes.com.cn