Experimental monkeys become hot commodity in China despite soaring prices as domestic innovative drug R&D projects grow

Lack of animals may affect drug, vaccine development: expert

Artificial breeding of monkeys in an animal breeding center in East China's Anhui Province. Photo: cnsphoto

In the late 1980s, monkeys were both frightening and indispensable in the discovery of Ebola and the fight against the virus.Frightening because the virus first appeared in experimental monkeys, followed by outbreaks of infection and death; indispensable because the monkeys became a firewall for humans in the process of understanding the virus and developing vaccines and drugs.

In the long journey of the birth of new drugs, monkeys always play an important role.

At present, as domestic R&D projects linked to innovative drugs continue to increase, monkeys on farms have again become a prized possession for Contract Research Organizations (CROs), drug companies as well as vaccine developers despite soaring prices.

Skyrocketing prices

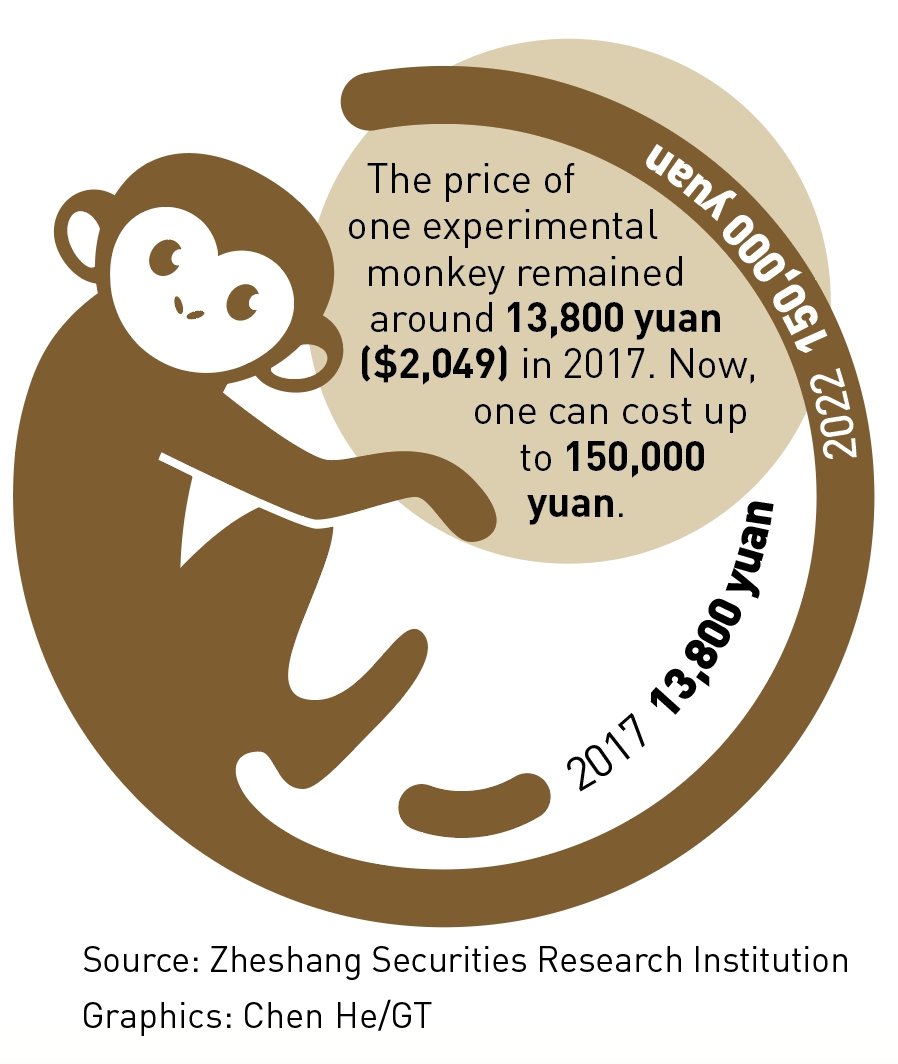

In the past five years, the prices of experimental monkeys have increased about eight times in China.

According to a research report from the Zheshang Securities Research Institute, the prices of experimental monkeys were still hovering at around 13,800 yuan ($2,048) per animal in 2017.

In January this year, the Chinese Government Procurement website released an announcement for the procurement of experimental monkeys for the National Institutes for Food and Drug Control, showing that the budget for 30 experimental monkeys totaled 3.66 million yuan, equal to a unit price of 122,000 yuan per primate.

"The actual market prices are now much higher than 120,000 yuan per animal, and have risen to over 150,000 yuan and even 180,000 yuan each monkey on average," Jiang Chunlai, a professor from the Jilin University's School of Life Sciences, told the Global Times on Monday.

Experts noted that the high prices of experimental monkeys are due to more new drugs being developed domestically, as the country has increased its support for innovative drug research and development, which has created large demand for laboratory animals in the domestic market.

A staff member from a life sciences company in Guiyang, Southwest China's Guizhou Province, told the Global Times that experimenting with monkeys is the most expensive type of biological experiment, and that animals are generally used in drug experiments.

Industry participants noted that in many high-end medical development projects, such as the development of vaccines, monkeys are the only species that can be used to assess the safety of a new product.

"Especially since the outbreak of the COVID-19, many medical companies have sped up the development of anti-COVID-19 drugs and vaccines, which require a large number of experimental monkeys," Jiang noted.

Actually, a number of CROs have taken the lead in the battle to securing more monkeys. It has become a consensus in the industry that "grabbing monkeys means grabbing customer orders."

WuXi AppTec, which provides R&D and manufacturing services for the global pharmaceutical and healthcare industry, has been one of the fastest movers in the market.

In November 2019, a subsidiary of the company acquired 100 percent of the equity of Guangdong Blooming-spring Biological Technology Development Company, which owned more than 20,000 experimental monkeys, SinoLink Securities said.

After the acquisition, WuXi AppTec has become one of the largest experimental monkey breeding enterprises in China.

The 2022 annual report published by Joinn Laboratories showed that the company had started the construction of a large animal breeding base in Wuzhou, South China's Guangxi Zhuang Autonomous Region and completed the construction of a quarantine farm with a proposed breeding capacity of over 15,000 large animals.

Supply shortages

It is estimated that about 70 percent of biological drugs will use experimental monkeys for preclinical testing. Toxicology experiments require about 40 monkeys, and drug metabolism tests need another 20. Therefore, a normal preclinical study of a new drug requires at least 60 experimental monkeys.

"The bulk of experimental monkeys are domestically produced," the employee from the Guiyang-based company said, as Chinese drug authority's ban on the import of experimental primates due to bio-safety concerns.

Jiang also noted that the foreign trade of experimental primates has been prohibited in China during the pandemic, which has further limited supply.

According to a report by News China released in April 2021, China has more than 240,000 experimental monkeys available. Excluding young monkeys, breeding monkeys and other monkeys, there are about only 30,000 eligible for testing.

According to the National Medical Products Administration, in 2021, the number of approved new drug varieties classified as investigational new drugs (IND) reached 831. Excluding several imported drugs and preclinical studies without territorial requirements, data showed that the number of domestic experimental monkeys used last year totaled 28,000.

However, since animal experiments have specific requirements for animal age (generally requiring three years of growth before they can be applied to experiments), combined with their long breeding cycle and low output rate, current market supply is failing to keep up with booming demand, industry experts said.

The biggest impact on drug R&D caused by the shortage is that the costs become higher and cycles become longer, experts noted. For example, a new drug experiment for a certain type of disease is approaching the final step before completing preclinical study, but if there is no experimental monkeys, it will greatly affect the registration time of the drug and delay the advancement of further clinical studies.

"The supply shortage may have impact on those companies who want to develop new drugs and vaccines," Jiang said.