China-US Photo: GT

A spokesperson for China's Foreign Ministry on Tuesday blasted a US Congress bill that aims to restrict investments into China's tech sector as undermining international trade order and global supply chains, saying the move won't stop China's development as it was intended.

The US will "very likely" pass a bill that aims to bar billions of dollars worth of investment in China's high-tech sectors, including semiconductors and artificial intelligence (AI), extending the US' push for a tech decoupling from China, according to media reports and analysts.

However, by proposing misplaced curbs on normal trade and business ties with China, the US politicians will not succeed in blocking China's development. Rather, they will be surrounding the US with walls and and costing the US itself opportunities to grow, Chinese Foreign Ministry spokesperson Wang Wenbin said at a regular press briefing on Tuesday.

Wang Wenbin, spokesperson for China's Ministry of Foreign Affairs. Photo: VCG

"The Chinese side opposes the US practice of using national security as a catch-all pretext to ramp up unjustified investment review. This practice creates difficulties and obstacles for companies from China, the US and all other countries to engage in normal trade and investment cooperation. Such practices are detrimental to international trade order and trading rules and could seriously threaten the stability of global industrial and supply chains," Wang said.

The US Congress is pressing ahead with legislation that limits investment in countries like China, which are seen as adversaries to protect US technologies and rebuild critical supply chains, the Wall Street Journal reported on Tuesday.

It said the measure would require US companies and investors to disclose certain new outbound investments and authorize the executive branch to form a new interagency panel to review and block investments on national security grounds. The sectors and technologies covered include semiconductors, large-capacity batteries, AI and quantum computing.

"There is almost no doubt that the bill will eventually be passed, as most US bills that are anti-China or aimed at containing China's development have been passed," He Weiwen, a senior research fellow from the Chongyang Institute for Financial Studies at the Renmin University, told the Global Times on Tuesday.

He said that the bill, if it does pass, would have a negative impact on US investment in China, with US companies feeling more pain.

"US companies require substantial investment in research and development (R&D) to maintain an edge in the global tech competition. In this regard, China, a huge market with 1.4 billion people, is of growing importance for multinationals," He said.

Wang stressed on Tuesday that opening-up and economic integration is an irreversible historical trend, while attempting to build walls and decouple is trying to reverse the wheels of history.

"China is a large market with the most vitality and potential. China's determination to expand high-level opening-up will not change, with its doors opening wider and wider. Investing in China is investing in the future," he said.

In addition to the latest move to limit investment in China, the US has barred its tech companies from selling software and components to Chinese companies, including Huawei and SMIC.

In November, the Biden administration halted Intel's plan to expand production of silicon wafers in Chengdu, Southwest China's Sichuan Province, over so-called security concerns, Bloomberg reported at the time.

However, in spite of some US politicians' persistent calls for China-US tech decoupling and for reshoring of supply chains, the flow of US investment into China remains stable.

In the first five months, China's actual use of foreign capital stood at $87.77 billion, up 22.6 percent year-on-year. Over the period, direct investment from the US grew by 27.1 percent, data from China's Ministry of Commerce showed on Tuesday.

According to an annual white paper released by the American Chamber of Commerce in China in May, 83 percent of its member companies that were surveyed were not considering relocating manufacturing or sourcing outside of China, though about 58 percent of the US companies reported being directly affected by issues in the China-US relationship.

The chamber reiterated in the white paper that it remained opposed to any effort at outright decoupling of the US-China relationship. "The costs of decoupling from losing trade and foreign investment benefits for both countries would be significant and are unlikely to generate clear winners," it said.

Cao Heping, an economist at Peking University, said that in the long run, the US can't impede China's stronger innovation momentum and domestic replacement.

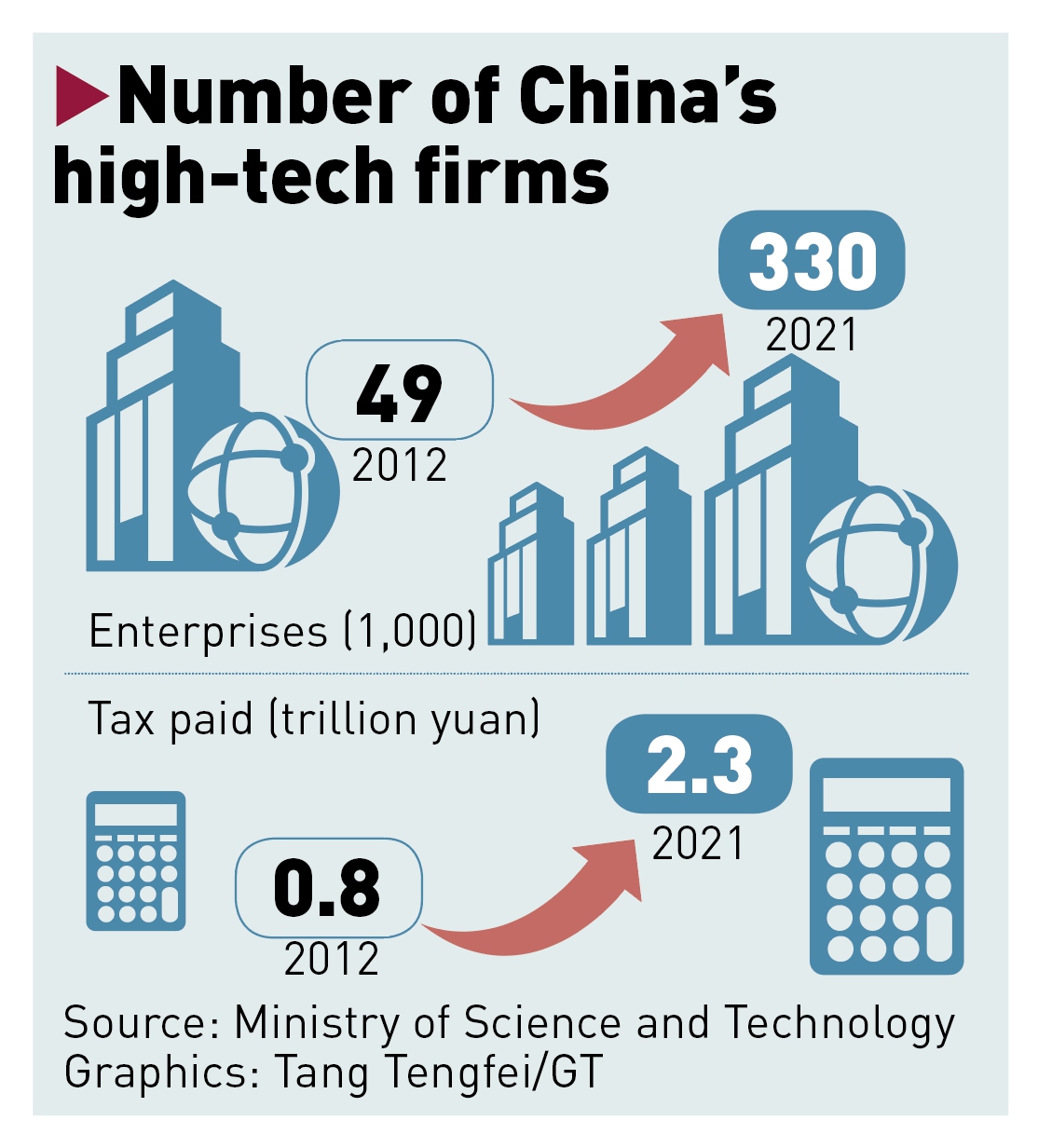

China adheres to a strategy of innovation-driven development and takes self-reliance in science and technology as the strategic support for national development. Its total spending on R&D amounted to about 2.79 trillion yuan ($370.76 billion) in 2021, up 14.2 percent year-on-year, according to data from the National Bureau of Statistics.

Number of China's high-tech firms 2012-2021 Graphic: GT

"Rather than sustaining an endless tech war against China - which will only hurt others without necessarily benefiting oneself - the US should strengthen cooperation with China in seeking new growth points in the digital economy era," Cao told the Global Times.