File photo shows the exterior view of Shanghai Stock Exchange at Pudong New Area in Shanghai, east China. (Xinhua)

Challenged by a thorny economic situation but backed by supportive policies, China's private enterprises raised funds of more than 200 billion yuan ($29.82 billion) in the country's exchange bond market in the first half of 2022, even though the number of bonds issued by firms had decreased by 14 percent, according to latest data on Monday.

Although the data point to a dwindling passion among domestic private companies to raise money via issuing bonds, judging by a 14 percent decrease in the number of bonds they issued, experts still believe that bond issuance will play an increasingly important role in Chinese private companies' fundraising channels, not only because of encouragement from the government, but also because of liquidity advantages compared with other fundraising means.

According to a Securities Daily report on Monday, China's exchange market issued 2.58 trillion yuan of bonds in the first half of this year (excluding convertible bonds), of which 1.88 trillion yuan was corporate bonds and 204.2 billion yuan was local government bonds.

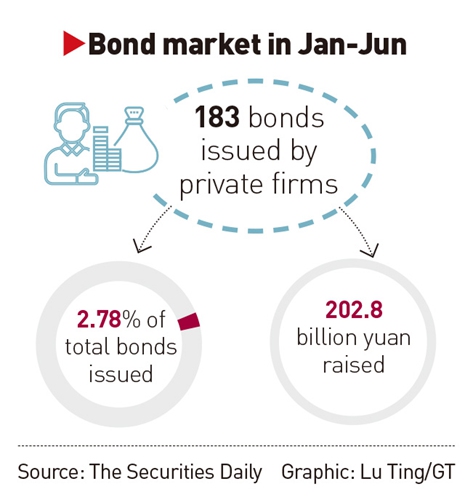

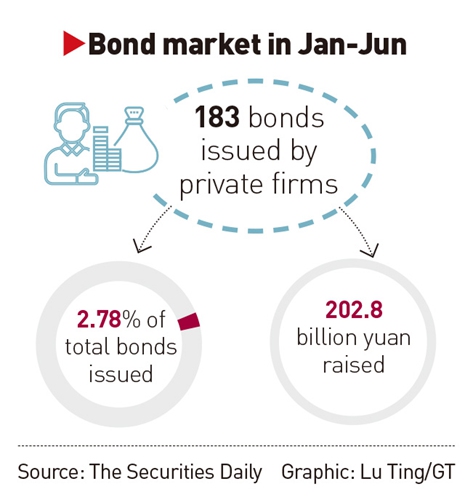

In particular, private companies issued 183 bonds in the first six months this year, accounting for 2.78 percent of the total bonds issued. In comparison, private enterprises issued 213 bonds in the first half of 2021, accounting for 3.2 percent of entire bond issuance, data released by financial data provider Wind showed.

In total, Chinese private companies raised 202.8 billion yuan through issues of corporate bonds and asset-backed securities on domestic exchanges, the Securities Daily report noted.

Xi Junyang, a professor at Shanghai University of Finance and Economics, said that the dwindling number of bonds issued by private companies is likely due to the increased risks of private corporate bonds, as shown by multiple defaults since last year.

"Compared with bonds issued by state-owned companies or governments, the risk of private companies being unable to repay their bonds is much higher, as shown by the rising number of default cases. As a result, investors don't dare buy private corporate bonds, and securities firms are reluctant to underwrite them too," Xi told the Global Times on Monday.

Besides defaults, other factors such as COVID-19-triggered economic fluctuations and the rise of rate securities issuance has also given rise to the situation, Feng Jianlin, a research fellow at economic research and consulting firm Beijing Fost Economic Consulting Company, told the Global Times on Monday. Rate securities mostly consisted of government bonds, local government bonds, policy financial debt and central bank bills.

According to data revealed in a report published by Zhongtai Securities, 35 Chinese private companies defaulted on 97 credit debts that amounted to 95.5 billion yuan in 2021, up 19 percent compared with the default volume in 2020.

Tian Yun, a veteran macroeconomic observer, told the Global Times that private companies' defaulting is a normal situation in an economic downward cycle. "It is also a mechanism for alternative circulation in a market economy, which is not so worrisome in itself. What we should worry is the accompanying financial risks they bring about," he said.

In general, experts are still optimistic that bond issues will become an increasingly important fundraising channel for private firms, not only because of policy support, but because investors will gradually recognize the advantages of fund raising through bond issuance.

Xi said that although bond issuance is still a very "auxiliary" fundraising method for private companies compared with bank loans, the popularity of such channels should increase in the future, as the liquidity of bonds is much better compared with traditional loans.

"When investors gradually recognize this advantage, demands for bonds will increase, which will further press down the costs of fundraising through bonds," Xi said.

On the other hand, the government is also rolling out policies to encourage private company bonds. For example, the China Securities Regulatory Commission (CSRC) announced plans in March to roll out a basket of measures to support private companies to raise funds through bonds, such as allowing private firms in high-tech and strategic emerging industries to issue technology and innovation corporate bonds.

Under the CSRC's guidance, domestic exchanges also rolled out a special plan to support private company's bond issuing. Backed by the plan, a total of eight domestic companies had raised 6.6 billion yuan via bonds by the end of June, the Securities Daily report noted.

Feng said that the effects of government support policies toward the debt market "need time for observation," but with the economy continuing its recovery and the slowdown in rate bonds issuance, the private company bond issuance situation should improve in the second half of this year.

He also suggested that the government should continue to send out signals of firmly supporting private companies' development, while financial regulatory departments should guide rating agencies to lessen the focus on the ownership of companies that issue bonds.

Tian said the efficiency of China's debt restructuring or company bankruptcy is still weak compared with many economies, and he called on regulators to improve this market mechanism to accelerate the process of debt restructuring at legislative and institutional capital levels.