Chinese experts refute Western media hype over Henan banks, saying such cases are isolated

Agricultural technicians carry out the yield measurement of wheat at Xialou Village of Yaodian Township in Dengzhou, central China's Henan Province, on May 24, 2022.(Photo: Xinhua)

Chinese experts on Tuesday refuted recent Western media hype over problems with four rural banks in Central China's Henan Province that have sparked widespread attention as well as swift regulatory actions, noting that the cases are "isolated" and do not represent any nationwide systemic risk and China has the capability to prevent major financial risks after years of efforts to set up a multiple-layered financial risk aversion mechanism.

In the latest development regarding troubles at the four rural banks in Henan, the local banking and insurance industry regulator and the province's financial affairs supervision bureau said on Monday that they will advance deposits for certain depositors who have problems withdrawing money from the banks. Authorities in East China's Anhui Province also announced plans to make reimbursements to depositors on Tuesday.

The latest official moves came as investigations into the cases are still underway and authorities have previously said that a local business group, Henan New Wealth Group, was found to have illegally manipulated the online systems of the banks, with some suspects having already been arrested.

However, despite swift actions from local authorities to resolve the cases, many Western media outlets have seized the news to claim that such incidents could spread across China, especially amid downward economic pressure. A CNN report, for example, cited an expert as saying that such incidents could become more frequent and occur on a larger scale with an economic slowdown and other problems.

Chinese financial industry analysts dismissed such claims as cliché attempts by Western media outlets to smear the Chinese economy, especially when many Western countries are facing economic crises.

"It has been a consistent goal of some Western countries to crack down on China's economy, though the crackdown measures are in different forms at different times," Dong Shaopeng, an expert advisor at the China Securities Regulatory Commission, told the Global Times on Tuesday, noting slandering the Chinese economy is also a form of crackdown.

Dong said that when those countries' economies are not doing well, the crackdown measures are not as harsh as before, but they will still take every opportunity to carry out the strategy of suppressing China, using channels like public opinion or long-arm jurisdiction.

As to the case in Henan, experts said that the latest moves by local authorities are conducive to resolve the cases effectively and ensuring social stability.

According to the announcement on Monday, Henan authorities will give principal disbursements in batches to off-balance-sheet business customers at the four local village banks. Money will first be paid to customers whose deposits do not exceed 50,000 yuan ($7,435), while further verification procedures will continue. The case is reported to involve about 40 billion yuan of deposits from nearly 400,000 people.

Weng Guanxing, a lawyer from Shanghai-based law firm Wintell & Co, told the Global Times on Tuesday that the source of such prior disbursements could probably be constituted of illicit money collected from the detained suspects, cash funded by the rest of the shareholders and funds for social stability raised by local governments.

Henan's police said on Sunday that a criminal group had taken control of the four village banks through Henan New Fortune Group, which is a shareholder of the village banks, and violated regulations by illegally transferring capital, changing data and other misdeeds.

An expert told the Global Times on Tuesday that the Henan case involves intentional crimes instead of normal operating risks, and is a very rare case among rural banks.

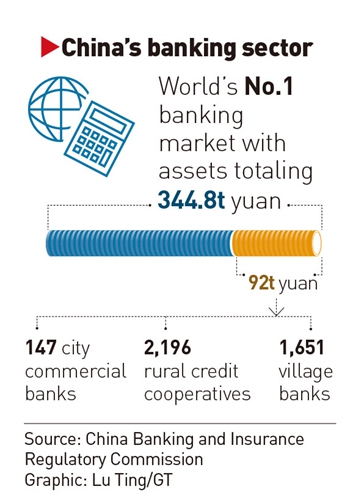

Dong Dengxin, director of the Finance and Securities Institute of the Wuhan University of Science and Technology, told the Global Times that small banks have more risks compared with larger ones, such as difficulty in establishing a good risk-control system with limited employees as well as larger bad loan risks as they have to deal with smaller borrowers who are more likely to default on loans. However, the percentage of small banks defaulting is still very limited in China, he stressed.

Official data from the first quarter of this year also showed that China's banking and insurance sectors are capable of handling risks, according to the Xinhua News Agency. The overall non-performing loan ratio of China's banks stood at 1.79 percent, slightly down from the beginning of this year, the report added.

"Risks and lurking violations still exist… but China has already built a mechanism to defuse potential financial [risks], such as setting up financial stability funds at different layers; therefore, large-scale systemic risks are almost impossible," Dong Shaopeng said.